HSBC Hong Kong Bank Account Closure Guide

Jennifer Johnson - 2023-12-05 10:09:36.0 850

HSBC Hong Kong, as an internationally renowned financial institution, offers a wide range of banking services globally. This includes personal savings, investment wealth management, and corporate financial services, demonstrating HSBC's extensive business foundation. However, due to changes in personal needs, relocation, or service adjustments, customers may need to close their accounts at HSBC.

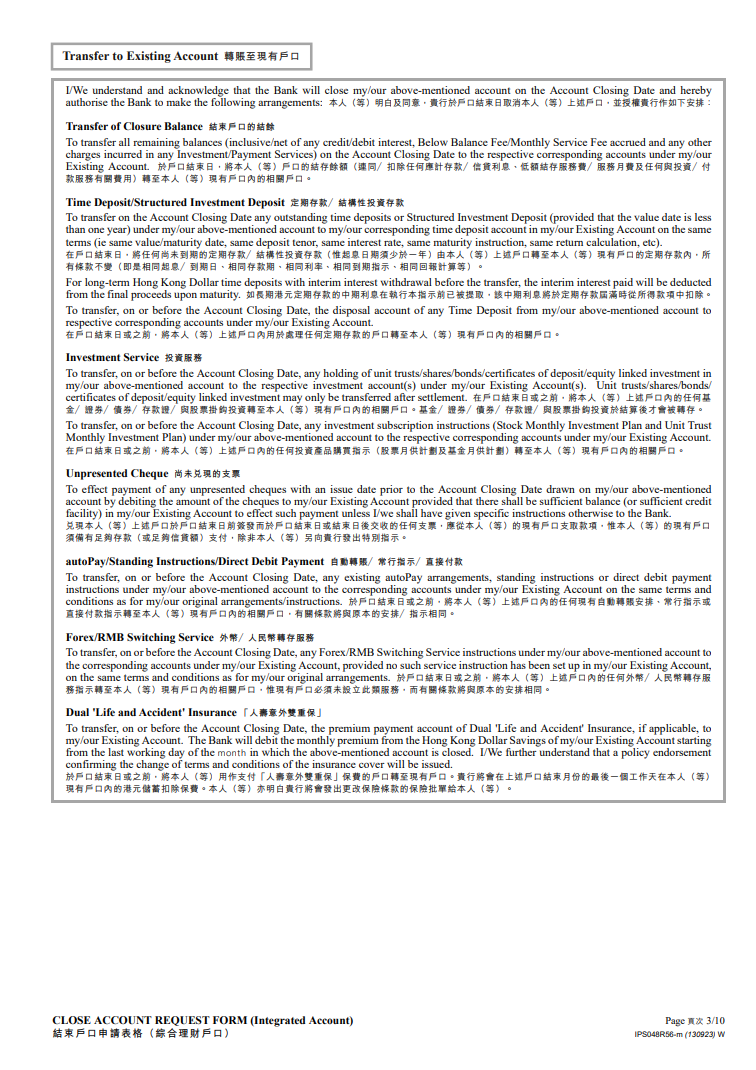

Basic Requirements for Account Closure

- Differences between Personal and Corporate Accounts

Personal accounts typically require the presence of the account holder, while corporate accounts may require the participation of a legal person or authorized representative.

- Essential Identity Proof Documents

Valid identification, such as a Hong Kong Identity Card or passport.

- Account Balance Requirements

Ensure there is no negative balance in the account; some accounts may need to maintain a minimum balance until closure is completed.

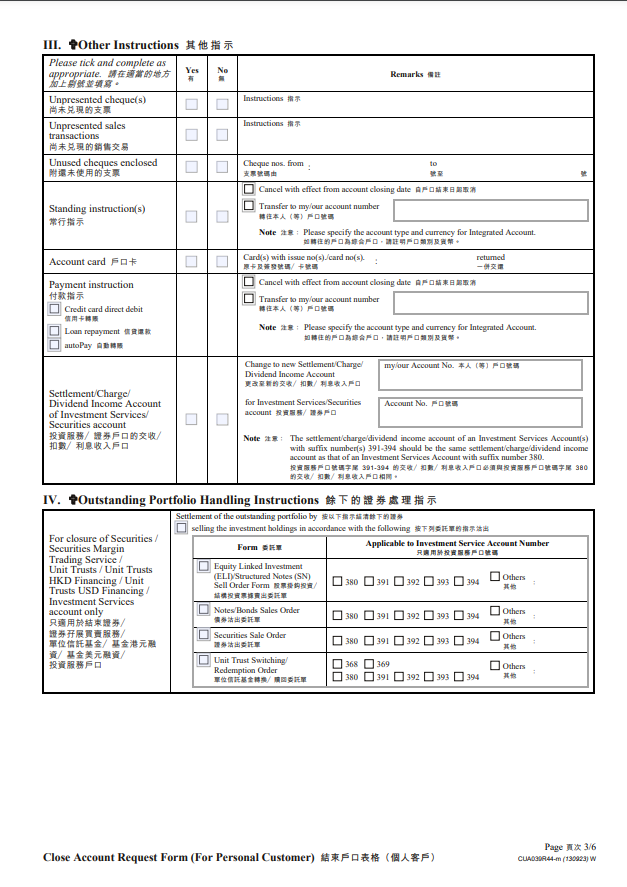

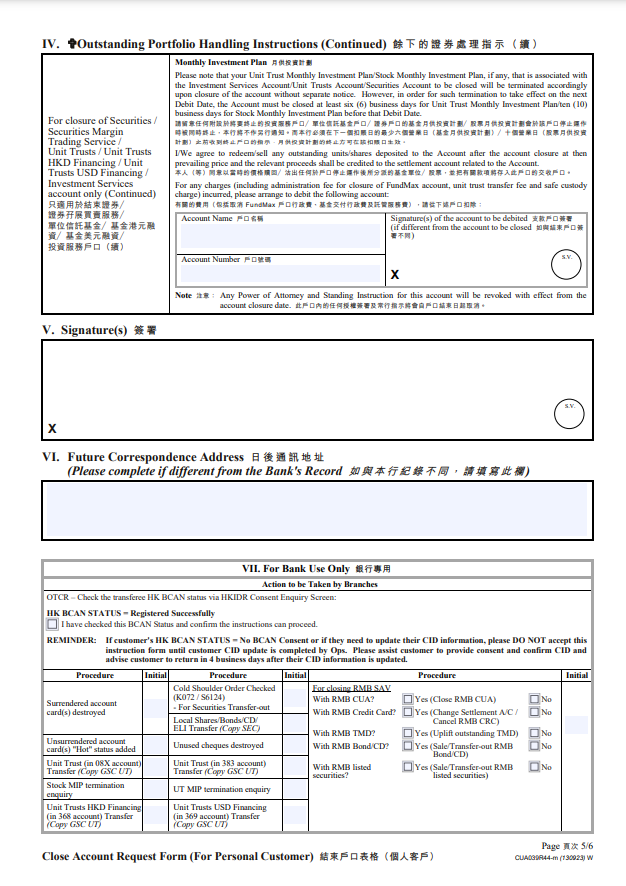

Closure Process for Different Types of Accounts

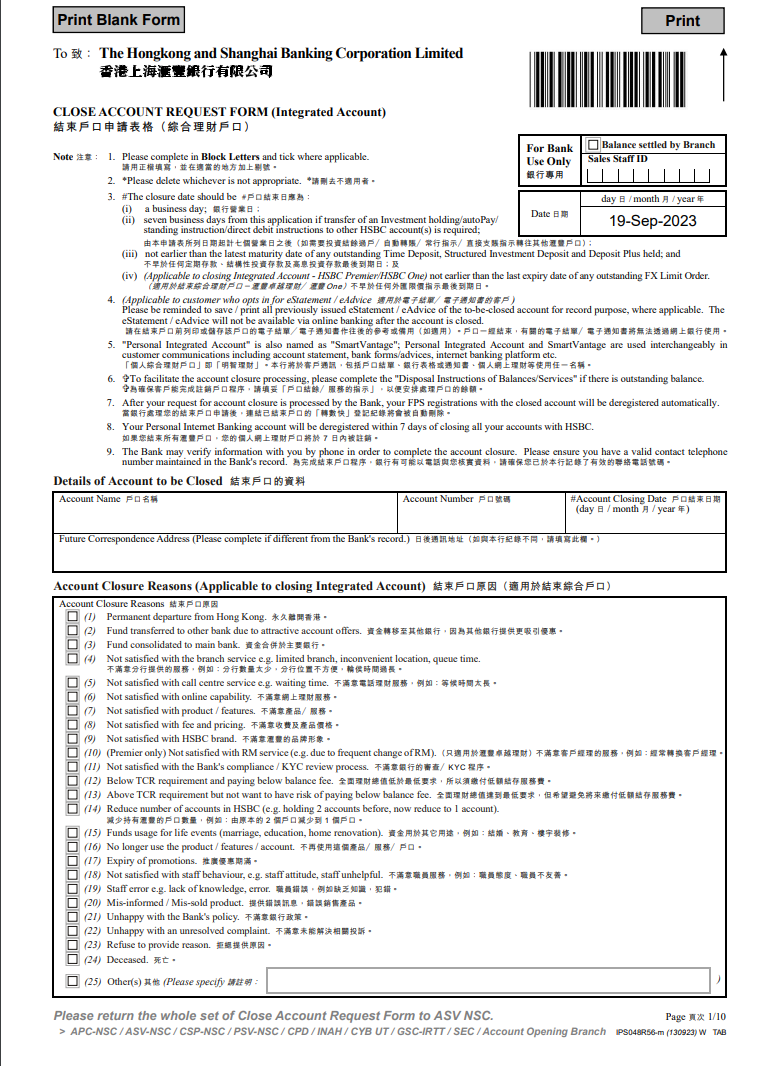

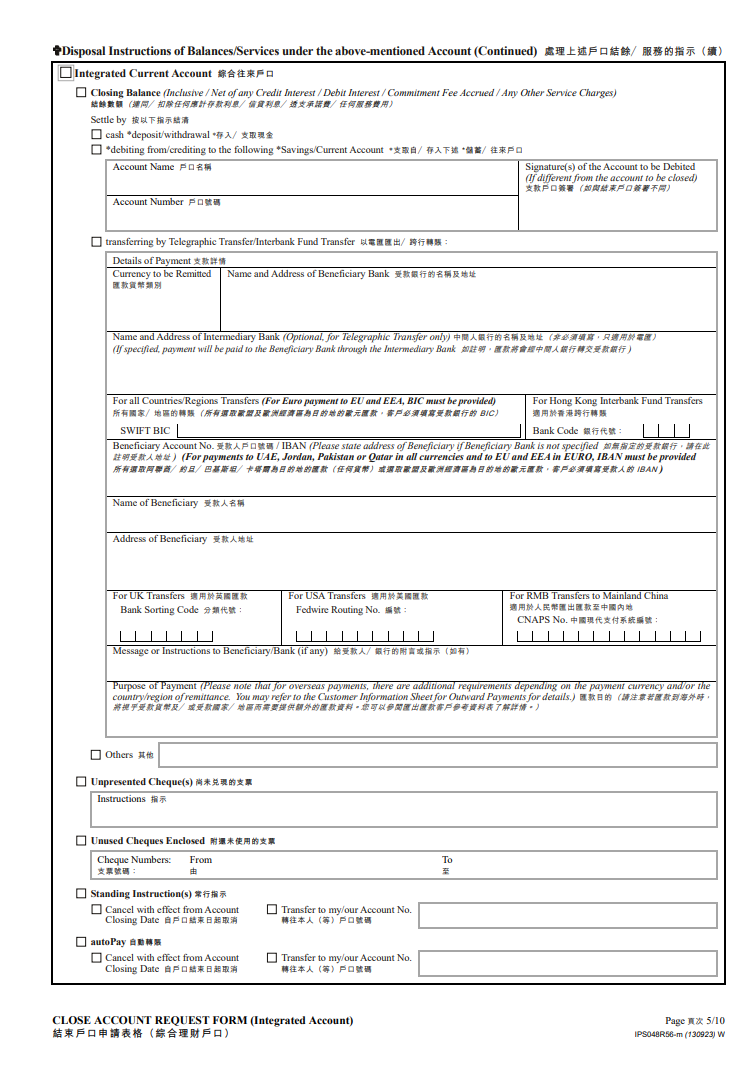

- Current Accounts: Typically involves filling out a specific closure form and ensuring all transactions are completed.

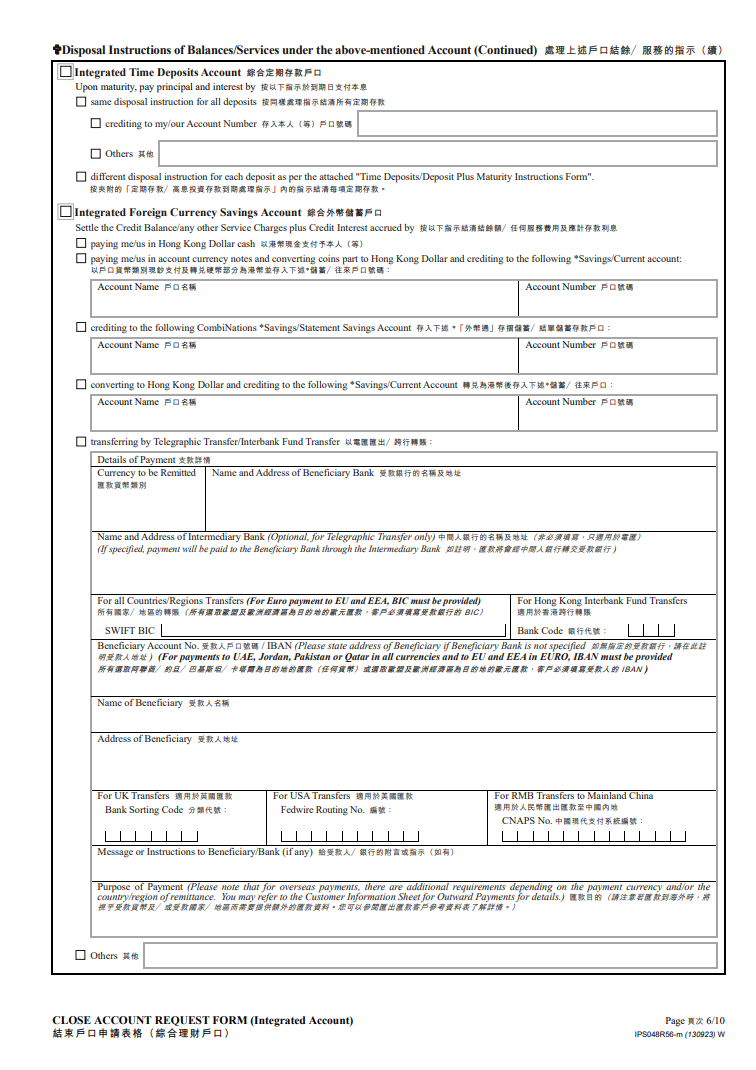

- Time Deposit Accounts: May require waiting for the deposit term to end or paying a penalty for early withdrawal.

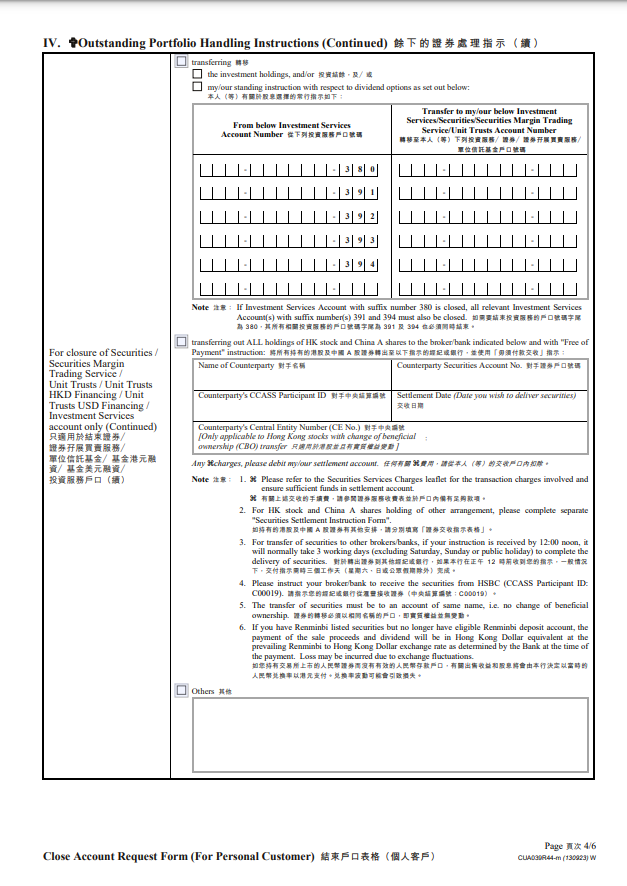

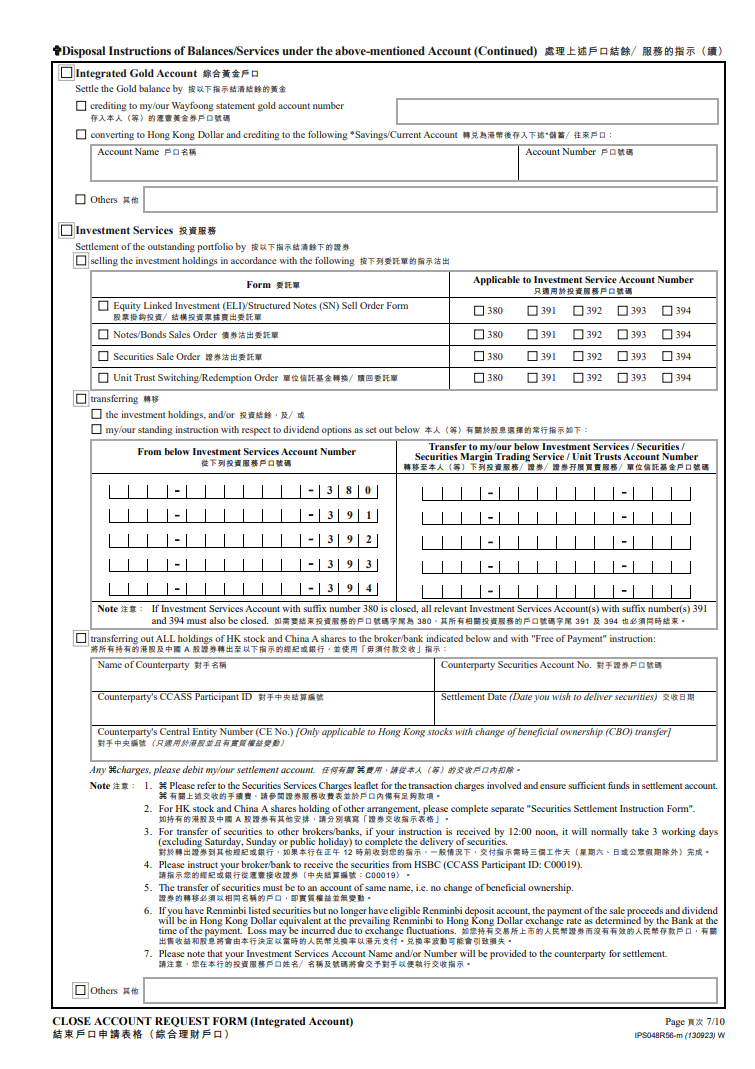

- Investment Accounts: Liquidate all investment products, which may require additional processing time.

- Loan Accounts: Must settle any outstanding loans or transfer them to another bank.

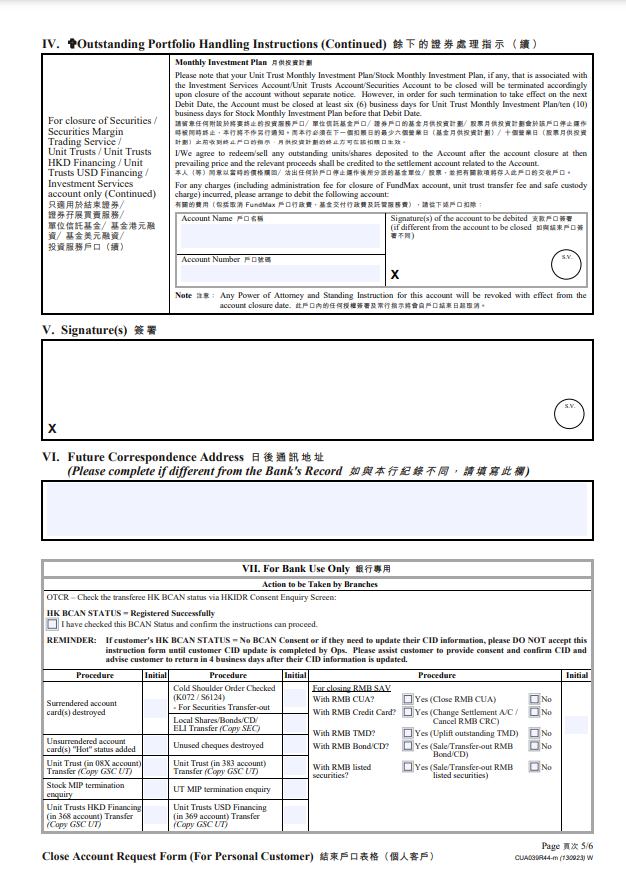

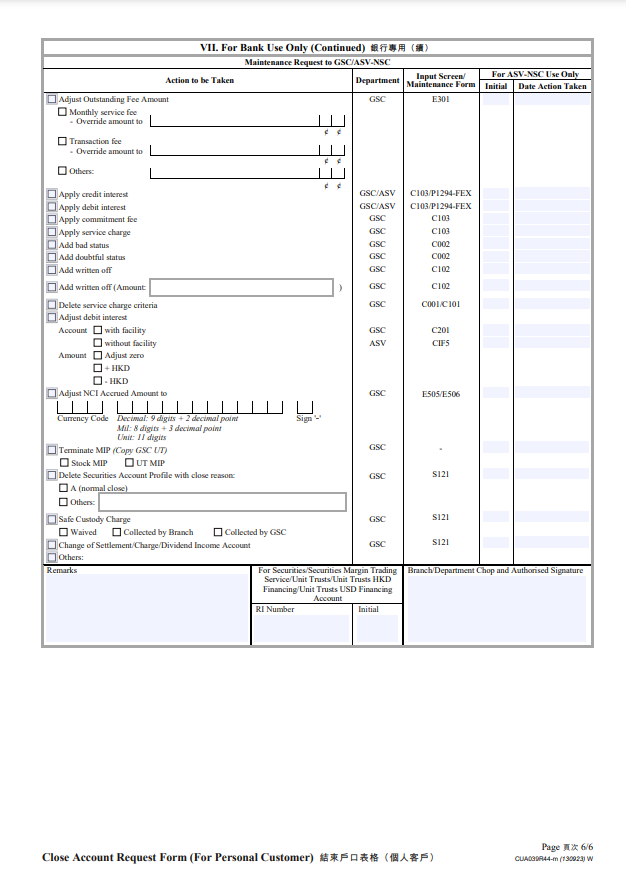

Account Closure Process

HSBC values each customer and strives to meet their banking service needs. However, if a customer decides to close their account, they need to visit a nearby HSBC branch in Hong Kong to complete the necessary procedures. Alternatively, the following forms can be downloaded and mailed to us.

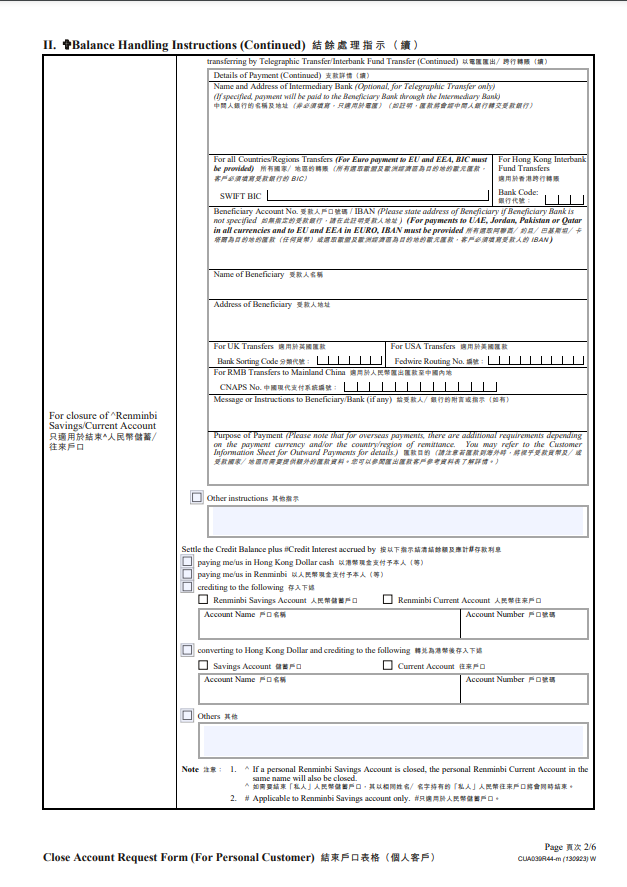

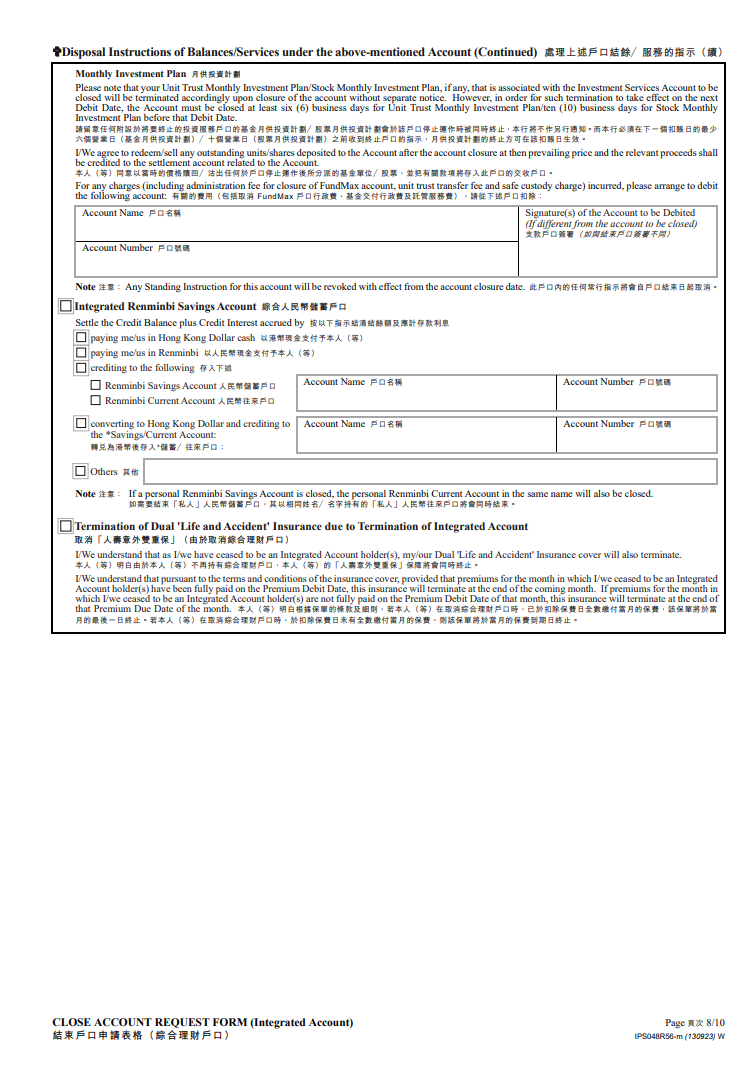

Mailing Forms

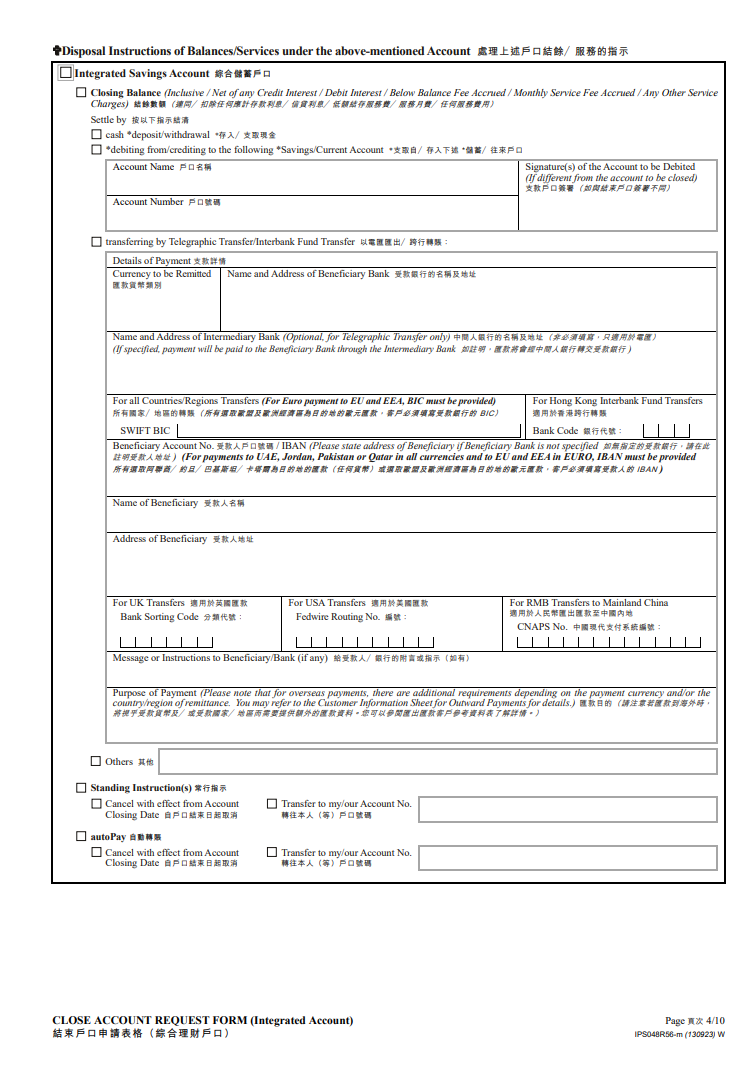

- Comprehensive Wealth Management Account Form

- Other Personal Account Forms

Mailing Address

HSBC Hong Kong Central Post Office P.O. Box 72677 (The Hongkong and Shanghai Banking Corporation Limited)

To Ensure Smooth Closure

- If you plan to mail the account closure forms to us and your account has a balance, ensure you have filled out the "Instructions for handling the balance/service of the above account" section in the form.

- If you are using our safe deposit box service, please arrange to end the service within 3 months after requesting account cancellation.

- HSBC may also contact you by phone to verify information to complete the account cancellation process. Ensure your phone number recorded with the bank is correct. Otherwise, contact HSBC to update your personal information.

- If your signature does not match the one in the bank's records, your account will not be canceled. HSBC will notify you by letter to cancel the account in another way.

Special Circumstances for Account Closure

- Non-Hong Kong Residents: May need to provide additional identity and residence proof.

- Minors' Accounts: Require the consent and participation of a guardian.

- Deceased Account Holder: Requires the provision of the deceased's death certificate and relevant documents from the legal heirs.

Time and Fees for Closure

HSBC processes applications within 3 working days of receipt.

- Closing a comprehensive account with HSBC Hong Kong usually does not incur a fee.

- Current and Savings Accounts: Typically no fee for closure, but fees may apply in cases of inactivity or low balance.

- Time Deposit Accounts: Early termination may incur penalties or fees.

- Investment Accounts: Closure may involve transaction or management fees.

- Business/Corporate Accounts: May have a more complex fee structure, including account management and transaction fees.

Post-Closure Considerations

Bank Account Statements/Notices

Once the account is closed, you will not be able to view electronic statements/notices through online banking. Consider printing or downloading all electronic statements/notices of the account before closure to retain complete records.

After completing the account closure process with HSBC Hong Kong, you might consider how to efficiently and conveniently handle international remittances. At this point, PandaRemit (PandaRemit) offers a worthy option. As a platform specializing in cross-border remittances, PandaRemit is widely praised for its speed and low cost. For more information, visit the PandaRemit official website to explore more remittance solutions and enhance your financial management efficiency and convenience.

If you have any remittance needs, click to make remittances:

About Us - Panda Remit

Panda Remit is a cross-border remittance online platform, which is committed to providing global users with safer, more convenient, reliable, and affordable online cross-border remittance services. With a user-friendly interface and advanced security features, Panda Remit is the best solution for anyone looking for a hassle-free way to make global remittance.

Panda Remit has the following features:

1. High safety degree - One of the key features of Panda Remit is its advanced security measures

All transactions are encrypted and monitored 24/7 to ensure the safety of your funds. What's more, Panda Remit uses state-of-the-art fraud detection technology to prevent unauthorized access from your account.

2. Convenient transfer environment - Panda Remit is equipped with a currency calculator

The platform is available on Panda Remit's official website or Panda Remit app so that you can easily access your account and make transactions on the go. Users can transfer money in a variety of currencies, including US dollars, euros, HK dollars, pound, yen, etc,. Furthermore, it is also worth noting that Panda Remit provides 24/7 Chinese customer service, providing a familiar and intimate environment for overseas Chinese.

3. Simple operation process - Panda Remit has a user-friendly interface that makes it easy to navigate and use

Moreover, whether you need to pay bills or send money to friends and family in other countries, you just need to simply follow the operation tutorial provided by Panda Remit to create an account, link your bank account or credit card, and then you're ready to transfer money globally. With just a few clicks, you can successfully send money to anyone, anywhere in the world you want.

4. Instant transfer - Panda Remit provides a quicker way to transfer money globally

Panda Remit is not only secure and convenient, but it is also fast. It allows for instant transfers between Panda Remit users, eliminating the need for waiting periods or processing times as much as possible. This feature is especially beneficial for people or businesses that require quick and efficient cross-border remittance.

5. Low handling fee - Panda Remit offers a range of exchange rate benefits to users

Panda Remit also offers competitive prices compared to traditional remittance methods and other apps of the same kind. Thus, users can enjoy low transaction fees and competitive exchange rates and get high amounts received when transferring money globally, which makes Panda Remit a cost-effective solution for individuals and businesses alike. Plus, the system would give coupons to first-time users.

In conclusion, Panda Remit provides a simpler and more efficient online global remittance way that offers a range of features and benefits to users. Nowadays, Panda Remit has opened global remittance services for more than 30 countries or regions worldwide and helped users save nearly 100 million dollars in fees, which is deeply recognized and trusted by millions of users around the world.

Panda Remit is the perfect solution for you to make cross-border remittances.

Please visit the Panda Remit official website or download the app, Panda Remit, for more detailed information.

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from WOTRANSFER PTE. LTD. or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date.