Best App to Send Money from Singapore to India (2025 Guide)

Benjamin Clark - 2025-10-22 09:35:40.0 13

Introduction

Every year, thousands of people in Singapore send money to India to support family, manage investments, or fund education expenses. With the rise of digital payment technology, transferring money internationally has become easier and faster. People now seek services that offer high exchange rates, low transfer fees, and secure, quick delivery. In this guide, we’ll explore why remittances from Singapore to India are so common and highlight the best money transfer apps in 2025 — including Panda Remit, Wise, and Remitly — to help you find the most efficient option for your needs.

Why Many People in Singapore Send Money to India

Singapore is home to a large Indian expatriate community working in various industries such as technology, healthcare, and construction. Many of them regularly remit part of their income to family members in India to cover living expenses, education, or investments.

In addition, business owners often transfer funds to India for trade payments or service outsourcing. With Singapore’s strong economy and efficient banking infrastructure, cross-border transfers have become a regular financial activity.

Using digital remittance platforms instead of traditional bank transfers has gained popularity because of the faster processing time, lower costs, and better exchange rates they offer.

What to Look for in a Money Transfer App

When choosing the best app to send money from Singapore to India, consider the following key factors:

1. Exchange Rate

Even a slight difference in the exchange rate can make a big impact on the total amount your recipient receives. Look for platforms that offer competitive real-time rates with minimal markup.

2. Transfer Fees

Fees vary by provider and transfer method. Some charge a flat rate, while others use a percentage of the total transfer amount. Always compare the total cost (exchange rate + fee) rather than focusing on one factor alone.

3. Transfer Speed

Depending on the app, your transfer may take anywhere from a few minutes to several business days. Panda Remit and Remitly typically offer faster delivery compared to traditional banks.

4. Ease of Use

A user-friendly interface, smooth setup, and instant notifications make the experience more efficient and stress-free.

5. Security and Regulation

Choose apps that comply with the Monetary Authority of Singapore (MAS) and use advanced encryption to safeguard your money and data.

Best Apps to Send Money from Singapore to India (2025 Update)

Here are some of the most reliable and popular money transfer services for sending funds from Singapore to India in 2025.

Wise (wise.com)

Wise is well-known for its transparency and real mid-market exchange rates. It displays all fees upfront, allowing users to know exactly how much will be received in India.

Pros:

-

Transparent mid-market rates

-

No hidden fees

-

Regulated by MAS

Cons:

-

Fees can be higher for large transfers

-

Transfers may take 1–2 business days

Remitly (remitly.com)

Remitly provides two transfer options — Express for instant delivery (at a higher fee) and Economy for slower but cheaper transfers. It’s a great option for regular family remittances.

Pros:

-

Flexible transfer speed options

-

Competitive fees

-

24/7 customer support

Cons:

-

Transfer limits for new users

-

Exchange rate slightly lower than Wise

Panda Remit (pandaremit.com)

Panda Remit has become one of the most trusted remittance apps in Asia for sending money to India. It offers competitive exchange rates, low fees, and fast transfers, making it ideal for both small and large transactions.

Pros:

-

Competitive rates with low transaction fees

-

Fast and secure delivery

-

Easy-to-use mobile app

Cons:

-

Does not support credit card payments

-

Exact transfer times vary by receiving bank

How to Send Money from Singapore to India Using Panda Remit: Step-by-Step Guide

-

Sign up on pandaremit.com or download the Panda Remit app.

-

Verify your identity by uploading your NRIC/FIN details as required by regulations.

-

Choose India as the destination country.

-

Enter the transfer amount and review the exchange rate and fees.

-

Add recipient details, such as full name and bank account number in India.

-

Confirm and pay via bank transfer or other supported methods.

-

Track your transfer in real-time until the funds arrive.

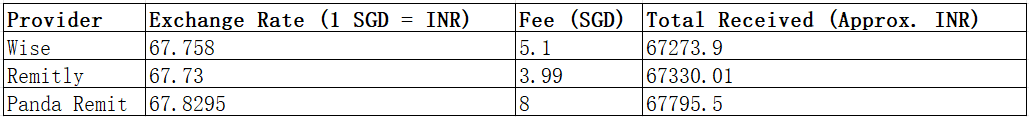

Cost & Exchange Rate Comparison Example (1,000 SGD)

Rates are based on reference data and may vary by time and market condition.

Tips to Get the Best Exchange Rates

-

Compare rates across multiple platforms before confirming your transfer.

-

Transfer on weekdays as exchange rates can fluctuate during weekends and holidays.

-

Avoid paying with credit cards, which usually add higher fees.

-

Subscribe to rate alerts from apps like Panda Remit or Wise to get notified when rates improve.

-

Send larger amounts less frequently to save on cumulative fees.

Common Questions (FAQ)

1. Is Panda Remit safe for international transfers?

Yes. Panda Remit complies with financial regulations and uses secure encryption to protect user data.

2. How long does it take to send money from Singapore to India?

Transfers can be completed within a few hours or up to one business day depending on the provider.

3. Can I use a credit card to transfer money?

No, credit card payments are not supported on Panda Remit for security and compliance reasons.

4. What’s the maximum amount I can transfer?

Transfer limits depend on verification level and Singapore’s regulatory guidelines.

5. Which app has the best overall value?

Panda Remit provides an excellent balance of exchange rate, speed, and low fees, making it one of the best overall options in 2025.

Conclusion

With so many remittance apps available, finding the right one for sending money from Singapore to India depends on your priorities — whether it’s speed, affordability, or convenience. Wise offers full transparency, Remitly provides flexibility, and Panda Remit delivers one of the most balanced options with low fees, competitive rates, and quick delivery. For those looking for a safe, convenient, and cost-effective way to transfer funds in 2025, Panda Remit stands out as one of the best choices.