CurrencyFair vs Currencies Direct: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 10

Introduction

Sending money internationally can be costly and time-consuming, with hidden fees, slow transfers, and inconsistent exchange rates often frustrating users. CurrencyFair and Currencies Direct are two popular options for transferring funds across borders. CurrencyFair focuses on peer-to-peer transfers to offer competitive rates, while Currencies Direct provides traditional broker services for personal and business clients. For a flexible alternative, Panda Remit offers fast, fully-online transfers covering over 40 currencies. Understanding the strengths and limitations of each service is essential for efficient cross-border payments. Learn more about international money transfers.

CurrencyFair vs Currencies Direct – Overview

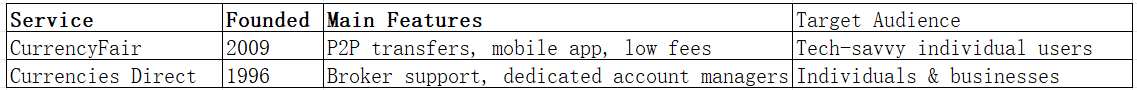

CurrencyFair was founded in 2009, offering peer-to-peer currency exchange and international transfers. Its platform is web- and app-based, supporting a wide user base seeking cost-effective cross-border payments.

Currencies Direct started in 1996, specializing in foreign exchange and international transfers for individuals and businesses. It offers dedicated account managers and online services for both personal and corporate clients.

Similarities:

-

Both provide international money transfer services

-

Mobile app and web platform access

-

Support for multiple payout options including bank transfers

Differences:

-

CurrencyFair uses a peer-to-peer model for lower fees and competitive rates

-

Currencies Direct provides a traditional broker experience with dedicated support

-

CurrencyFair appeals to tech-savvy users; Currencies Direct attracts users needing guidance and larger transfer flexibility

Quick Summary Table:

CurrencyFair vs Currencies Direct: Fees and Costs

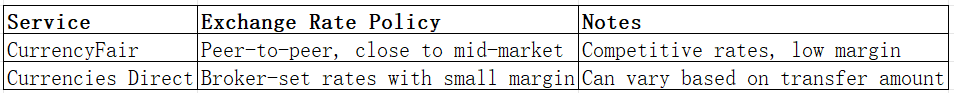

CurrencyFair charges a low, transparent fee per transfer and offers competitive exchange rates due to its peer-to-peer system. Currencies Direct fees vary by transfer amount and currency, with some services incurring additional charges for faster processing. Subscription or account tiers may affect costs for both platforms.

For reference on fee comparison, visit NerdWallet international transfer fees guide.

Panda Remit can be a lower-cost alternative for smaller or regular transfers.

CurrencyFair vs Currencies Direct: Exchange Rates

Exchange rates are a crucial factor in transfer value. CurrencyFair offers rates closer to the mid-market, often beating traditional brokers. Currencies Direct applies its own rate margin depending on the currency pair and transfer amount.

Panda Remit also provides competitive rates for standard currency pairs.

CurrencyFair vs Currencies Direct: Speed and Convenience

CurrencyFair transfers usually take 1–2 business days, with a user-friendly app and online platform. Currencies Direct processing may take 2–5 business days, depending on the currency and destination, but offers direct support and guidance.

For remittance speed insights, see Remittance Guide by World Bank.

Panda Remit is positioned as a fast alternative with fully-online transfers.

CurrencyFair vs Currencies Direct: Safety and Security

Both platforms are regulated and implement encryption for safe transfers. CurrencyFair is licensed in multiple jurisdictions and uses secure authentication. Currencies Direct is FCA-regulated and provides fraud protection. Panda Remit is also licensed and secure, offering peace of mind for online users.

CurrencyFair vs Currencies Direct: Global Coverage

CurrencyFair supports over 150 currency routes with coverage across Europe, Asia, and the Americas. Currencies Direct also offers broad international reach, focusing on personal and business accounts. Payment options include bank transfers for both services.

For detailed remittance coverage, see World Bank remittance coverage report.

CurrencyFair vs Currencies Direct: Which One is Better?

CurrencyFair is ideal for cost-conscious users familiar with online platforms, benefiting from peer-to-peer rates. Currencies Direct suits individuals and businesses requiring dedicated support and flexible transfer amounts. Users looking for fast, all-online transfers may find Panda Remit advantageous for regular cross-border payments.

Conclusion

When comparing CurrencyFair vs Currencies Direct, the choice depends on priorities:

-

CurrencyFair: Lower fees, mid-market rates, tech-friendly

-

Currencies Direct: Dedicated support, reliable broker service

-

Panda Remit: High exchange rates, low fees, flexible payment methods (POLi, PayID, bank card, e-transfer), 40+ currency coverage, fast transfers

For a full-service online alternative, Panda Remit provides convenience and competitive rates. Additional guidance on transfers can be found via Investopedia and NerdWallet. This CurrencyFair vs Currencies Direct comparison helps users choose the most suitable platform for international money transfers in 2025.