Paysend vs Paysera: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-10 15:39:43.0 14

Cross-border money transfers have become an essential service for students, freelancers, and families living abroad. However, users often face high fees, hidden exchange rate margins, and slow delivery times. In this article, we compare Paysend vs Paysera to see which one offers the best balance of cost, speed, and convenience. We also introduce PandaRemit as a reputable alternative for users seeking simple and affordable online remittance solutions. (source)

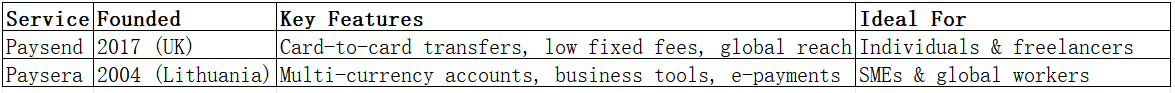

Paysend vs Paysera – Overview

Paysend, founded in 2017 in the UK, provides international money transfers to over 170 countries. It allows users to send money directly to bank accounts, cards, or digital wallets through its app and website.

Paysera, launched in 2004 in Lithuania, is a versatile digital payments platform offering global transfers, multi-currency accounts, and online payment processing for businesses and individuals.

Similarities: Both services provide mobile apps, debit card support, and real-time currency conversion tools.

Differences: Paysend focuses on affordable card-to-card transfers for individuals, while Paysera offers broader financial tools such as business payments and e-commerce integrations.

PandaRemit also operates in the same international remittance space, providing users with competitive rates and a seamless digital experience.

Paysend vs Paysera: Fees and Costs

When comparing Paysend vs Paysera, the fee structure is one of the most important factors. Paysend charges a transparent, low fixed fee per transaction (usually around $2), and users know the total cost upfront. Paysera’s fees vary depending on the destination country, payment method, and account type—sometimes making it more complex to estimate total transfer costs.

Both platforms offer free account creation, but Paysera users may encounter additional charges for business services or specific transfer routes.

According to NerdWallet’s fee guide, Paysend is often cheaper for small personal transfers, while Paysera offers better value for users managing multi-currency balances.

PandaRemit can also be a cost-effective alternative, offering low transfer fees and competitive exchange rates for many popular routes in Asia, Europe, and the Americas.

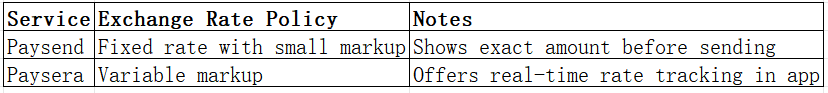

Paysend vs Paysera: Exchange Rates

Exchange rate transparency greatly impacts how much recipients receive. Paysend applies a small markup above the mid-market rate but always shows the total before confirming a transaction. Paysera also uses a slight markup, but it provides more flexibility through multi-currency accounts and live exchange rate tracking.

For users seeking even more competitive exchange rates, PandaRemit often provides closer-to-mid-market rates without hidden charges, although rates depend on the corridor.

Paysend vs Paysera: Speed and Convenience

Both Paysend and Paysera prioritize convenience through their intuitive mobile apps and web interfaces. Paysend transfers are usually completed within minutes for card-to-card payments, while bank transfers may take up to 1–2 business days. Paysera’s transfer times vary more depending on the recipient bank and country, typically ranging from a few minutes to three days.

The Remittance Speed Guide by Wise suggests that instant transfers depend largely on local banking systems and verification processes.

PandaRemit, meanwhile, is recognized for its efficient delivery times and streamlined online process, enabling users to send money abroad quickly without the need for physical branches.

Paysend vs Paysera: Safety and Security

Security is essential when sending money internationally. Both Paysend and Paysera are licensed and regulated by financial authorities in their respective regions. Paysend is authorized by the UK Financial Conduct Authority (FCA), and Paysera operates under the supervision of the Bank of Lithuania.

Each platform uses advanced encryption and multi-factor authentication to protect user data and funds. Paysera additionally offers detailed transaction monitoring for business clients.

PandaRemit also prioritizes safety, being a licensed money transfer provider that employs strict verification and anti-fraud measures to safeguard user transactions.

Paysend vs Paysera: Global Coverage

Paysend supports transfers to over 170 countries, including major destinations in Asia, Europe, and the Americas. Paysera, while covering fewer countries, provides deep integration within the European Economic Area and supports over 30 currencies.

Users can fund transfers using bank accounts, debit cards, or local payment methods. However, neither Paysend nor Paysera supports credit card-based remittances for security and compliance reasons.

According to the World Bank Remittance Data, digital transfer services continue to expand coverage globally as users move away from traditional banking methods.

Paysend vs Paysera: Which One is Better?

Choosing between Paysend vs Paysera depends on your needs:

-

Choose Paysend if you prefer simple, affordable, and fast card-to-card transfers for personal use.

-

Choose Paysera if you need a multi-currency account, business payments, or integration with online stores.

Both services are reliable, secure, and widely used in the international remittance space. However, for users seeking a modern, low-cost digital transfer experience with competitive exchange rates, PandaRemit offers an excellent alternative.

Conclusion

In summary, this Paysend vs Paysera comparison highlights that both platforms deliver strong value in 2025. Paysend excels in speed and simplicity, while Paysera shines in flexibility and multi-currency functionality. Users who prioritize convenience and lower fees may find PandaRemit to be an even better fit.

Why consider PandaRemit:

-

Competitive exchange rates and low transfer fees

-

Multiple payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

Supports over 40 currencies across Asia, Europe, and the Americas

-

Fast and fully online transfers

Learn more at PandaRemit’s official website. For broader remittance insights, refer to resources like NerdWallet’s guide and the World Bank report.