PaySend vs TorFX: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-10 10:54:42.0 23

Cross-border transfers are increasingly important in today’s global economy. Users often face challenges such as high fees, slow processing, and hidden exchange rate margins. In 2025, PaySend and TorFX are two major players addressing these concerns with competitive features.

PaySend excels at fast, low-cost personal transfers, while TorFX focuses on providing favorable exchange rates for larger transactions and corporate clients. For those seeking a modern, convenient solution, Panda Remit offers an appealing alternative. (Source: Investopedia: International Money Transfer Guide)

PaySend vs TorFX – Overview

PaySend was founded in 2017 in the UK, providing instant transfers to bank cards in over 170 countries. Its platform prioritizes speed and transparency, with a strong mobile app experience, catering mainly to personal remittances.

TorFX, founded in 2004 in the UK, specializes in international currency exchange and larger transfers, often offering better rates for high-value transactions. It serves both personal and business clients across multiple currencies.

Similarities:

-

International money transfer capabilities

-

Transparent exchange rates

-

User-friendly online and app platforms

Differences:

-

PaySend: Ideal for quick, small-to-medium transfers

-

TorFX: Suited for high-value transfers and corporate clients

Panda Remit is another option combining speed and affordability, particularly for everyday transfers.

PaySend vs TorFX: Fees and Costs

PaySend charges a fixed low transfer fee (around $1.50), making it attractive for personal users. Fees are displayed upfront for full transparency.

TorFX typically does not charge a flat fee but applies exchange rate margins, which decrease proportionally with higher transfer amounts. This approach benefits users sending larger sums.

Panda Remit can be a lower-cost option for smaller transactions while maintaining fast processing. (Reference: NerdWallet: Money Transfer Fees Comparison)

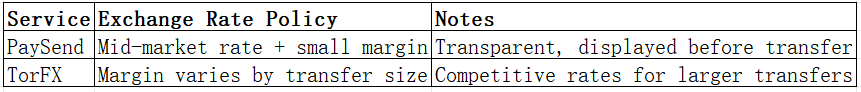

PaySend vs TorFX: Exchange Rates

Both platforms ensure no hidden fees. PaySend suits smaller, rapid transfers, while TorFX rewards bulk remittances. Panda Remit provides consistently competitive rates for everyday use.

PaySend vs TorFX: Speed and Convenience

PaySend enables instant or same-day transfers, with real-time tracking via its app.

TorFX usually completes transfers within 1–2 business days, optimal for planned, larger payments. Its platform is straightforward but less optimized for instant personal transfers.

For users needing fast remittances, Panda Remit offers quick, fully online transfers. (Reference: Monito: Transfer Speed Guide)

PaySend vs TorFX: Safety and Security

Both PaySend and TorFX are regulated financial institutions, using encryption and multi-factor authentication. Transactions are monitored to prevent fraud.

Panda Remit is similarly licensed and secure, ensuring safe international transfers.

PaySend vs TorFX: Global Coverage

PaySend: Transfers to over 170 countries via bank cards and bank accounts.

TorFX: Transfers to 100+ countries, specializing in major currencies.

Both platforms support multiple funding options (bank transfer, debit card). Neither supports credit card transfers or African remittance corridors.

Panda Remit supports 40+ currencies with fast online transfers. (Source: World Bank: Remittance Data)

PaySend vs TorFX: Which One is Better?

-

PaySend: Best for small, fast, personal transfers.

-

TorFX: Best for high-value transfers and business clients.

For everyday users needing speed, low fees, and convenience, Panda Remit provides a competitive alternative.

Conclusion

In the PaySend vs TorFX comparison, PaySend excels in fast, low-cost transfers, while TorFX is advantageous for large-value remittances. Users should choose based on their transfer size and urgency.

Panda Remit offers a compelling option for those seeking high exchange rates, low fees, and flexible payment methods (POLi, PayID, bank card, e-transfer). With coverage of 40+ currencies and fast, fully online transfers, Panda Remit is an excellent alternative for 2025 international money transfers.

(Additional references: NerdWallet Money Transfer Review, Investopedia International Transfer Guide)