Ria Money Transfer vs Revolut: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-13 11:27:49.0 25

Cross-border money transfers have become increasingly important in 2025 as individuals and businesses seek affordable, fast, and transparent solutions. Common pain points include high fees, slow delivery, hidden charges, and inconsistent user experiences. Ria Money Transfer and Revolut are two prominent providers addressing these needs in different ways. Additionally, Panda Remit has emerged as a strong alternative for users seeking competitive rates and quick online transfers.

For background on international money transfers, see this Investopedia guide.

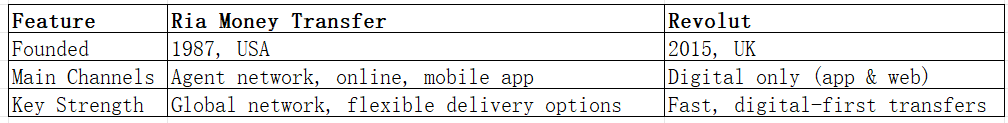

Ria Money Transfer vs Revolut – Overview

Ria Money Transfer, founded in 1987 in the United States, operates a large global agent network alongside online and mobile transfer options. It caters primarily to retail users who value both in-person and digital services.

Revolut, established in 2015 in the UK, is a digital-first platform offering multi-currency accounts, instant transfers, and card-based payments. It appeals to tech-savvy users who prioritize convenience, speed, and transparency.

Similarities:

-

Both provide international money transfers

-

Mobile apps for Android and iOS

-

Support debit card and bank account funding

Differences:

-

Ria offers physical agent locations; Revolut is fully digital

-

Revolut emphasizes instant transfers and app integrations; Ria focuses on broad coverage and flexible payout options

-

Ria supports cash pickups; Revolut focuses on digital payments

Panda Remit remains a competitive option, offering fast online transfers and low fees.

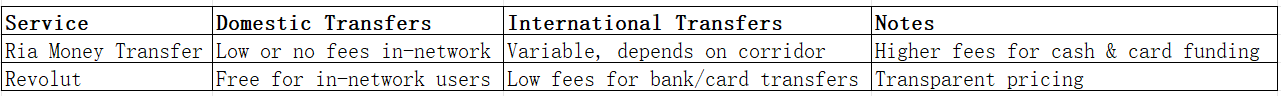

Ria Money Transfer vs Revolut: Fees and Costs

Ria applies variable fees depending on destination, payout method, and payment type, with higher fees for cash or card-funded transfers.

Revolut offers lower fees for many digital transfers, often included within subscription tiers or standard accounts. Its fee transparency makes it easier to understand overall costs.

For more detailed fee comparisons, see NerdWallet’s money transfer guide.

Panda Remit offers competitive fees without the need for physical branches.

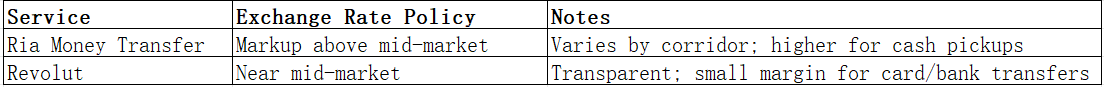

Ria Money Transfer vs Revolut: Exchange Rates

Exchange rates affect how much recipients actually receive. Ria usually applies a markup above mid-market rates depending on corridor and payout method.

Revolut offers close-to-market rates, especially during weekdays, providing better transparency and predictable transfer costs.

Panda Remit also maintains competitive exchange rates for frequent users.

Ria Money Transfer vs Revolut: Speed and Convenience

Ria offers various transfer methods including cash pickup, bank deposit, and mobile wallet delivery. Transfer times range from minutes (cash pickup) to 1–3 business days (bank transfers).

Revolut emphasizes instant or near-instant digital transfers, especially card-to-card or account-to-account, providing excellent convenience for tech-savvy users.

For more on transfer speeds, see Remittance Speed Guide.

Panda Remit is also recognized for fast, fully online transfers.

Ria Money Transfer vs Revolut: Safety and Security

Both Ria and Revolut are regulated in multiple jurisdictions. Ria is overseen by U.S. and international financial authorities, while Revolut is regulated by the UK’s Financial Conduct Authority (FCA). Both use strong encryption and anti-fraud measures to ensure safe transfers.

Panda Remit is a licensed provider with modern security features for online transfers.

Ria Money Transfer vs Revolut: Global Coverage

Ria provides one of the largest global payout networks, covering hundreds of countries with diverse delivery options, including cash pickup and mobile wallets.

Revolut supports many countries digitally, with multi-currency accounts and instant transfers but limited physical agent access.

Refer to the World Bank Remittance Data for global coverage statistics.

Ria Money Transfer vs Revolut: Which One is Better?

Ria and Revolut both have distinct strengths. Ria is ideal for users seeking extensive coverage and flexible payout methods. Revolut is suited for users who prioritize low fees, instant transfers, and fully digital experiences.

Panda Remit may offer additional advantages for users looking for competitive rates, speed, and simple online transfers.

Conclusion

Choosing between Ria Money Transfer vs Revolut depends on individual needs. For broad coverage and physical agent support, Ria remains a strong option. For fast, low-cost, and digital-first transfers, Revolut is an excellent choice.

Panda Remit also provides a compelling alternative, with competitive exchange rates, low fees, multiple online payment methods (POLi, PayID, bank card, e-transfer), and rapid online processing.

For further comparisons, visit NerdWallet or explore Panda Remit’s official website.