Travelex Wire vs GCash Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-20 11:28:25.0 15

Sending money abroad has become increasingly common, whether for family support, business transactions, or overseas investments. However, many users still face pain points such as high transfer fees, slow processing times, hidden costs, and complex user experiences.

Two popular platforms in this space are Travelex Wire and GCash Remit. Both offer cross-border money transfer services but differ in pricing, exchange rate policies, speed, and coverage. Alongside these two, Panda Remit (https://www.pandaremit.com) is emerging as a trusted alternative for users looking for competitive rates and efficient transfers.

For general insights on international remittances, check this guide from Investopedia: https://www.investopedia.com/terms/r/remittance.asp

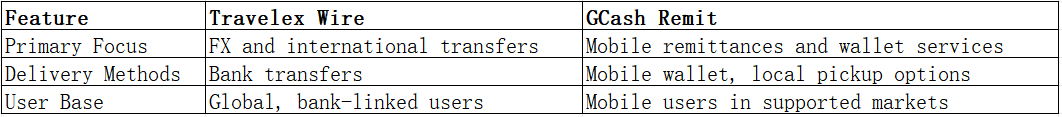

Travelex Wire vs GCash Remit – Overview

Travelex Wire is part of the well-known Travelex Group, offering global remittance solutions built on its extensive foreign exchange network. It focuses on providing users with reliable international money transfers and competitive currency services.

GCash Remit, operated under the GCash brand, provides digital financial services, including international remittances. Its strength lies in mobile integration, allowing users in supported regions to receive money conveniently through their mobile wallets.

Similarities:

-

Both offer international transfer services.

-

Both support mobile app usage for transactions.

-

Both are regulated and operate in multiple currencies.

Differences:

-

Travelex Wire focuses more on traditional bank transfers and currency exchange services.

-

GCash Remit leans towards mobile-first remittances and wallet-based transfers.

-

Their fee structures and supported regions differ.

Panda Remit also serves the international transfer market, offering users another secure and licensed option.

Travelex Wire vs GCash Remit: Fees and Costs

Fees are often one of the biggest deciding factors when choosing a remittance platform.

Travelex Wire typically charges service fees for international transfers that may vary by destination and amount. Additional costs may come from intermediary banks.

GCash Remit applies transaction-based fees, often tied to sending corridors and partner networks. Fees can be competitive for certain destinations, particularly for mobile wallet payouts.

For a detailed breakdown of international money transfer fees, see this NerdWallet comparison: https://www.nerdwallet.com/best/banking/international-money-transfers

Panda Remit is also recognized for its low-cost structure compared to many traditional services.

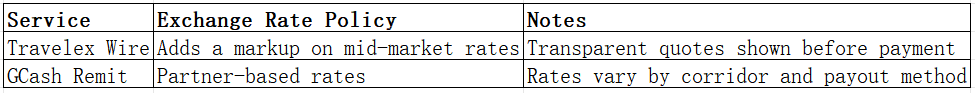

Travelex Wire vs GCash Remit: Exchange Rates

Exchange rate markups can significantly affect the final amount your recipient receives.

Panda Remit often highlights competitive exchange rates as one of its key advantages for users looking to maximize their transfers.

Travelex Wire vs GCash Remit: Speed and Convenience

Travelex Wire generally processes transfers within 1–3 business days, depending on the destination country and receiving bank.

GCash Remit can offer near-instant transfers to mobile wallets in supported markets, making it attractive for users sending to recipients who prefer wallet-based payouts.

For more on remittance delivery times, check this resource: https://remittanceprices.worldbank.org/en

Panda Remit is also known for offering fast transfers, providing a digital-first alternative.

Travelex Wire vs GCash Remit: Safety and Security

Both platforms operate under regulatory oversight and employ encryption to protect user data and funds. Travelex Wire leverages its financial services heritage, while GCash Remit benefits from mobile network integration and user authentication protocols.

Panda Remit is likewise fully licensed in its operating markets, offering a secure option for users seeking reliable transfers.

Travelex Wire vs GCash Remit: Global Coverage

Travelex Wire supports a broad range of countries and currencies, leveraging its foreign exchange network.

GCash Remit focuses on specific corridors that integrate with its mobile ecosystem, mainly targeting users in supported regions.

For a global view of remittance flows and coverage, see the World Bank report: https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues

Travelex Wire vs GCash Remit: Which One is Better?

Both services offer distinct advantages. Travelex Wire appeals to users who prioritize trusted FX services and bank transfers. GCash Remit is ideal for those who want mobile wallet convenience and fast payouts in supported regions.

For some users, Panda Remit may deliver better overall value — particularly in terms of cost-effectiveness and digital transfer convenience — depending on their specific sending and receiving needs.

Conclusion

When comparing Travelex Wire vs GCash Remit, the right choice depends on your transfer priorities:

-

Travelex Wire: Best for traditional bank-linked users needing wide currency coverage.

-

GCash Remit: Great for mobile-savvy users in supported regions who value wallet-based speed.

However, if you're looking for a modern, cost-efficient, and user-friendly option, Panda Remit (https://www.pandaremit.com) stands out as a reliable alternative. It offers:

-

Competitive exchange rates and low transfer fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

Coverage of 40+ currencies

-

Fast, all-online transfer processes

For more insights on choosing the best money transfer platform, visit: https://www.finder.com/international-money-transfers

In 2025, understanding the differences between Travelex Wire vs GCash Remit will help you select the service that best suits your needs — whether that’s traditional reliability, mobile-first convenience, or innovative alternatives like Panda Remit.