A Beginner Guide to Taxation in Australia

Jennifer Johnson - 2023-11-29 09:57:58.0 706

Australia's tax system is sophisticated and complex. When living, working, or doing business in Australia, it is essential to understand basic tax knowledge, comply with the Australian tax system, and proactively file and pay taxes legally. This article will introduce basic tax knowledge in Australia and help you integrate into Australian life more smoothly!

Australian Taxation System

The Australian Taxation Office (ATO) is the core department of Australia's tax management system, providing a wide range of tax services and management to ensure that the Australian government has sufficient funds to support the development of the country and its citizens.

Its main responsibilities include managing tax returns for individuals and institutions, collecting and monitoring tax data, guiding the public in complying with tax regulations, combating tax evasion, and promoting tax economic and financial efficiency. In addition, the ATO is also responsible for regulating areas such as charities, retirement funds, and artworks to ensure compliance with tax regulations.

Australian Tax Filing

01 Tax Residency

According to Australian tax laws, anyone who is an Australian tax resident, regardless of whether their income is sourced within or outside Australia, is required to file income tax with the Australian Taxation Office (ATO).

In general, individuals who reside in Australia or stay in Australia for 183 days or more may be considered Australian tax residents and have an obligation to pay taxes.

Additionally, the ATO considers various factors when assessing an individual's tax residency, such as the location of their main activities, place of residence, duration of stay, and intention to reside in Australia permanently.

It's worth noting that international students are also tax residents. When applying for a tax file number, there is an option asking whether you are a "Resident on Tax Purpose." If you meet the criteria, you should select "Yes."

Note: Non-tax residents also need to declare Australian-sourced income, such as rental income from properties purchased in Australia by overseas investors.

02 Applying for Tax File Number

If you are immigrating to Australia for living, you should apply for an individual tax file number (TFN) as soon as possible. The TFN is a unique identification number assigned by the tax office to manage individual taxation.

The TFN is strictly confidential information and should not be disclosed to others except for important institutions like banks and the government!

If you are running a business, you will need to register for an Australian Business Number (ABN). The ABN is an 11-digit unique number used to identify businesses to the government and society, and it is necessary for conducting business activities in Australia.

03 Tax Obligations

Both residents and businesses have tax obligations, including timely tax filing, payment of the assessed tax amount, maintaining accurate financial records, and cooperating with audits and investigations by the ATO. Residents and businesses need to keep relevant financial documents such as income proofs, deduction proofs, and bank statements for review by the ATO.

04 Tax Year

According to Australian tax regulations, individuals and companies need to file and pay taxes on time. The Australian financial year runs from July 1st to June 30th, and the tax filing period is from July 1st to October 31st each year.

Australian tax residents must declare their income for the past financial year to the ATO by October 31st and complete their individual tax returns. The tax filing deadlines for companies depend on their financial year. Failure to comply with tax filing and payment deadlines may result in fines and other legal consequences. If you want to entrust an accountant to file taxes, the deadline can be extended to March 31st of the following year.

05 Tax Filing Methods

During the tax filing period, taxpayers need to submit an annual income tax return, listing their income, deductions, offsets, and other information. The annual tax return can also be filed electronically.

Electronic filing can be done using the online E-tax system, which is a free electronic tax filing system available on the ATO website 24/7.

You can download and use E-tax by searching for it on the ATO official website. The biggest advantage of E-tax is that you can immediately see how much tax refund you are eligible for or how much additional tax you need to pay, but it requires basic tax knowledge.

06 Overseas Remittances

In simple terms, as long as the income does not come from your work, business, or investments, it is not subject to taxation.

If your overseas parents or relatives remit money to you for tuition fees, living expenses, or buying a car or house, whether it is a gift or a loan, it does not count as income and therefore is not subject to taxation. However, it is recommended to keep the relevant remittance receipts in case of future inspections. Large sums of money transferred from different accounts in a short period are likely to be scrutinized by the system.

According to the ATO, if there are significant overseas remittances into your bank account and you fail to report them on time, you will receive a notice from the ATO, requiring you to provide reasonable explanations within 28 days. If not provided within the prescribed time limit, these remittance amounts will be recognized as personal income, and in addition to paying taxes, you will also face penalties for late interest and dereliction of duty.

Proof that the remittance received is directly sent to you by relatives, the following documents are required:

- Remitter's bank statement: Clearly showing that the funds are transferred from your relative's account, and the timing and amount match the time and amount of the remittance you received.

- Proof of relationship with an English translation notarized document: If it is remittance from parents, the household register book along with a notarized translation of the household register book is sufficient. In other cases, it needs to be issued by the government agency in the relative's place of residence and translated by a translator with a level 3 translation qualification.

- Personal statement from the relative: The statement should mainly explain that the nature of the remittance is a gift or interest-free loan to you, signed by the relative, and an effective translation document should be issued by a translator in Australia with a level 3 translation qualification.

In summary, overseas remittances must be made through legal channels, and relevant remittance certificates should be kept properly. In this regard, Panda Remit, as a leader in the cross-border remittance industry, provides users with secure, reliable, and worry-free remittance services. Not only are there no cumbersome forms and lengthy waiting times, but the entire remittance process can also be tracked in real time. In addition, with a professional and compliant remittance system, competitive exchange rates, and low remittance fees, using Panda Remit ensures that more money arrives faster!

Australian Tax Types

01 Personal Income Tax

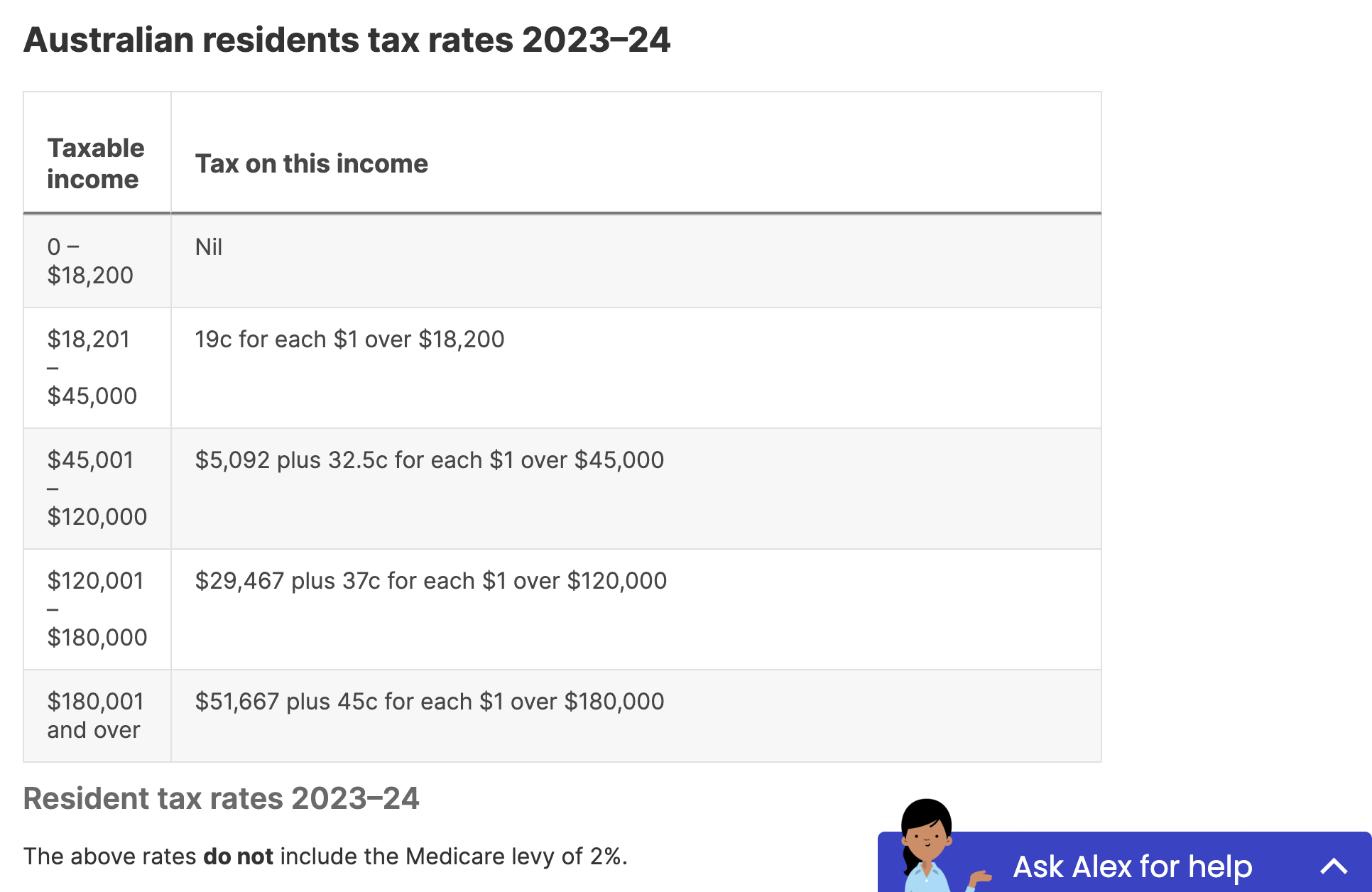

Personal income tax is calculated based on an individual's income level and is the most common type of tax in Australia. Key points for personal income tax reporting include income declaration, deductions, tax rate calculation, and tax return forms.

Sources of personal income include wages, interest, dividends, rental income from properties, etc. Deductions can reduce the taxable amount, such as medical expenses, charitable donations, education expenses, etc. Australia uses a progressive tax rate table to calculate the payable tax amount. The tax rate table is usually determined in the annual budget. Individuals are responsible for self-declaration and payment of income tax. The tax rates for the 2023-24 financial year are shown in the following figure:

02 Company Tax

Company tax applies to the taxable profits of companies registered in Australia, which is the company's income minus legitimate deductions. The company tax rate is usually determined in the annual budget. Currently, the standard company tax rate is 30%. If the company is a base rate entity for the income year 2017-18 and onwards, it can enjoy a lower company tax rate.

03 GST: Goods and Services Tax

Goods and Services Tax (GST) is an indirect tax collected by businesses and commercial entities when selling goods and providing services and is paid to the ATO by these businesses and commercial entities. GST applies to most goods and services transactions within Australia.

Currently, the GST rate is 10%, which means that consumers need to pay 10% of the price of goods or services as GST when making purchases. Businesses and commercial entities need to collect and retain the GST portion from the sales and then regularly remit it to the ATO.

The purpose of GST is to tax consumption and achieve fairness and distribution of taxation. Through the collection of GST, the government can obtain tax revenue from the consumption behavior of consumers and businesses, which is used for public services and infrastructure construction, etc.

*Note that not all goods and services are subject to GST. Some goods and services may be exempt or zero-rated (GST-free sales). In addition, businesses and commercial entities need to register and obtain an Australian Business Number (ABN) to collect and remit GST from consumers.

04 Capital Gains Tax

Capital gains tax applies to the profits obtained by individuals or businesses from the sale of assets. It is calculated based on the amount of asset appreciation and the length of asset holding. Different types of assets may enjoy different capital gains tax reductions and concessions. For detailed information, please visit the ATO website: https://www.ato.gov.au/individuals-and-families/investments-and-assets/capital-gains-tax/what-is-capital-gains-tax/

Note: The above tax types are core components of the Australian tax system. Understanding and complying with relevant tax laws and reporting requirements are crucial to ensure tax compliance. If there are special circumstances or a need for further understanding of a particular tax type, it is recommended to consult a professional tax advisor or seek assistance from the Australian Taxation Office.

Important Points to Note

During the tax filing process in Australia, there are some important points to pay special attention to, including the following aspects:

1. Familiarize yourself with tax policies

Tax policies and tax rate tables usually change annually. Therefore, it is crucial to be familiar with the latest Australian tax policies and regulations before filing taxes. Stay updated with the guides and announcements released by the tax authorities to grasp tax concessions and exemptions is essential.

2. Prepare and retain accurate financial records

During the tax filing process, individuals and businesses should properly store and organize financial records, such as income receipts, invoices, and expense vouchers. These records are of significant reference value for tax reporting and financial analysis. Ensuring the accuracy and completeness of financial records can help you calculate the correct amount of tax payable and serve as important evidence during tax authority audits.

3. Ensure timely filing and payment of taxes

As per the regulations of the ATO, individuals and businesses are required to file and pay taxes within the specified timeframe. Late filing and payment may result in fines and interest charges, so it is essential to ensure the timely fulfillment of tax obligations.

4. Utilize applicable tax deductions and benefits

Australia's tax system offers various tax deductions and benefits, such as retirement savings plans and property investment tax deductions. During the tax filing process, familiarize yourself with and lawfully utilize the applicable tax deductions and benefits to reduce the amount of tax payable.

5. Seek advice from professional tax advisors

If you are confused about the tax filing procedures or have specific circumstances, it is recommended to consult a professional tax advisor. They can provide personalized tax advice and guidance, ensuring compliance with tax law requirements and optimizing tax planning to the maximum extent.

In summary, understanding the basic tax knowledge in Australia is crucial for individuals and businesses. Being aware of the tax year, types of taxes, and tax filing considerations can help individuals and businesses comply with tax regulations, ensuring the accuracy and timeliness of tax reporting. If needed, it is advisable to consult the Australian Taxation Office or seek more detailed and specific tax guidance from professional tax advisors.

If you have any remittance needs, click to make remittances:

About Us - Panda Remit

Panda Remit is a cross-border remittance online platform, which is committed to providing global users with safer, more convenient, reliable, and affordable online cross-border remittance services. With a user-friendly interface and advanced security features, Panda Remit is the best solution for anyone looking for a hassle-free way to make global remittance.

Panda Remit has the following features:

1. High safety degree - One of the key features of Panda Remit is its advanced security measures

All transactions are encrypted and monitored 24/7 to ensure the safety of your funds. What's more, Panda Remit uses state-of-the-art fraud detection technology to prevent unauthorized access from your account.

2. Convenient transfer environment - Panda Remit is equipped with a currency calculator

The platform is available on Panda Remit's official website or Panda Remit app so that you can easily access your account and make transactions on the go. Users can transfer money in a variety of currencies, including US dollars, euros, HK dollars, pound, yen, etc,. Furthermore, it is also worth noting that Panda Remit provides 24/7 Chinese customer service, providing a familiar and intimate environment for overseas Chinese.

3. Simple operation process - Panda Remit has a user-friendly interface that makes it easy to navigate and use

Moreover, whether you need to pay bills or send money to friends and family in other countries, you just need to simply follow the operation tutorial provided by Panda Remit to create an account, link your bank account or credit card, and then you're ready to transfer money globally. With just a few clicks, you can successfully send money to anyone, anywhere in the world you want.

4. Instant transfer - Panda Remit provides a quicker way to transfer money globally

Panda Remit is not only secure and convenient, but it is also fast. It allows for instant transfers between Panda Remit users, eliminating the need for waiting periods or processing times as much as possible. This feature is especially beneficial for people or businesses that require quick and efficient cross-border remittance.

5. Low handling fee - Panda Remit offers a range of exchange rate benefits to users

Panda Remit also offers competitive prices compared to traditional remittance methods and other apps of the same kind. Thus, users can enjoy low transaction fees and competitive exchange rates and get high amounts received when transferring money globally, which makes Panda Remit a cost-effective solution for individuals and businesses alike. Plus, the system would give coupons to first-time users.

In conclusion, Panda Remit provides a simpler and more efficient online global remittance way that offers a range of features and benefits to users. Nowadays, Panda Remit has opened global remittance services for more than 30 countries or regions worldwide and helped users save nearly 100 million dollars in fees, which is deeply recognized and trusted by millions of users around the world.

Panda Remit is the perfect solution for you to make cross-border remittances.

Please visit the Panda Remit official website or download the app, Panda Remit, for more detailed information.