Is the Australian dollar about to rise?

熊猫速汇PandaRemit - 602

Looking back at last month, the Australian dollar was falling all the way, and everyone was wondering why it kept falling. Well, this time it took everyone by surprise!

It turns out that the Australian dollar was secretly preparing a big move, and now it is on a strong upward trend! What's the reason behind this "surge"? Let me explain it to you.

The RBA may continue to raise interest rates

On the morning of November 21st, the Reserve Bank of Australia (RBA) released the minutes of its November interest rate decision meeting, which sent an important signal: if inflation data exceeds expectations, the RBA will raise interest rates again in the coming months.

According to the Australian Financial Review, Australia's overall inflation rate ranks first among developed economies, and the RBA may raise interest rates further to ease the pressure of rising prices.

Many friends may wonder how raising interest rates can alleviate the pressure of rising prices. Generally, when bank interest rates increase, it encourages more people to save money, which can reduce consumer demand. If there is less money circulating in the market, prices will not be driven up higher and higher. Therefore, raising interest rates can actually relieve inflation to some extent.

So why does raising interest rates promote the appreciation of the Australian dollar? Let's use an example to help you understand: if the RBA raises interest rates, it will attract more foreign capital inflows, which will help economic growth and naturally promote the appreciation of the Australian dollar.

However, although the Australian dollar is more "valuable" and the purchasing power of Australian residents has "increased," they are still powerless when facing high inflation. They can only silently bear high interest rates, high mortgage rates, high housing prices, and high prices.

The depreciation of the USD is pushing the AUD higher

Since November, the US dollar index has fallen sharply, from a high of around 107 to around 103. What is the reason?

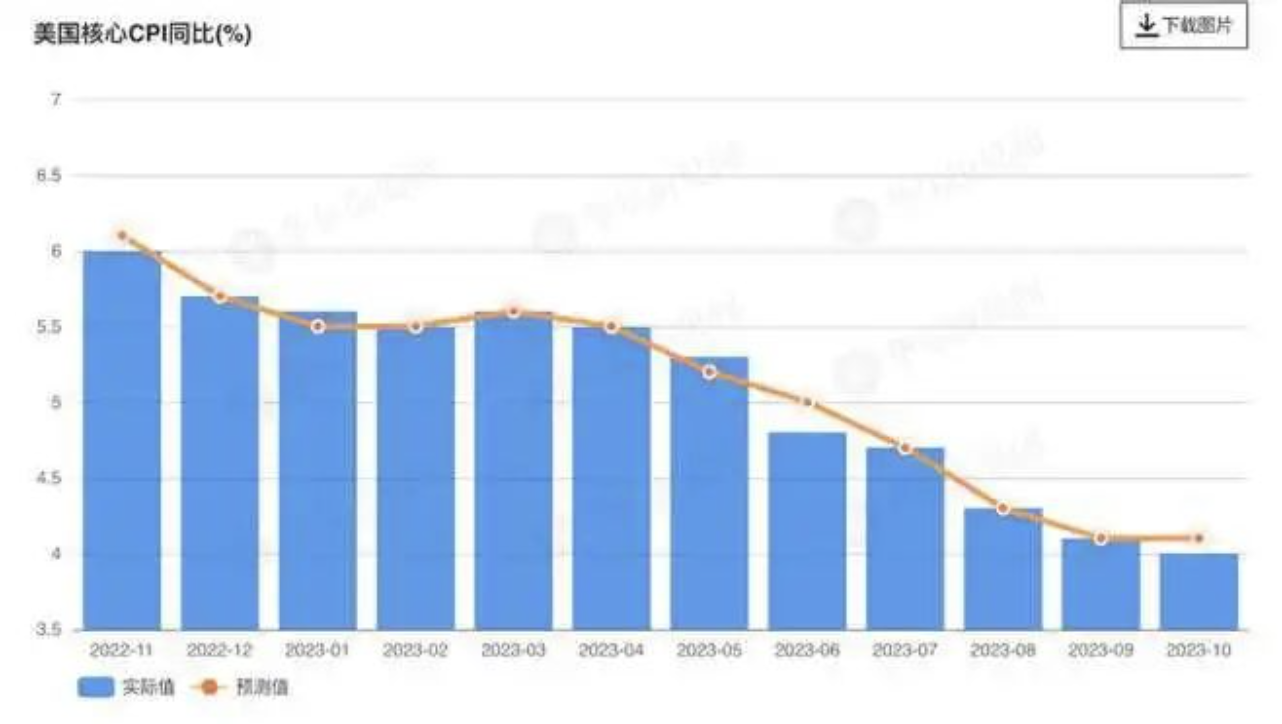

According to the latest data released by the US Bureau of Labor Statistics, the US Consumer Price Index (CPI) in October increased by 3.2% compared to the same period last year, which is lower than the market's expectation of 3.3%. At the same time, US manufacturing and industrial output have weakened, the job market has cooled down, and various indicators indicate that the US economy is slowing down.

Source: https://wallstreetcn.com/

The unexpected drop in inflation in the United States has strengthened market expectations for the Federal Reserve to stop raising interest rates, exerting downward pressure on the US dollar and accelerating its depreciation.

If the Reserve Bank of Australia continues to raise interest rates while the Federal Reserve lowers interest rates as expected, the interest rate differential between the two will further narrow, and the financial market will naturally focus more on the Australian dollar, undoubtedly creating valuable conditions for the appreciation of the Australian dollar and pushing it higher.

Strong demand for commodities supports the strength of the AUD

As we all know, Australia has extremely rich iron ore resources and is one of the world's largest exporters of iron ore. Since August this year, iron ore prices have risen by more than 20%, fluctuating around $130 per tonne.

At the same time, the supply chain of the iron ore market is relatively tight, and major port inventories have reached the lowest level since 2015. The imbalance between supply and demand naturally pushes up the price of iron ore.

The Australian Minister for Trade and Tourism has stated that China is Australia's largest trading partner and the main destination for Australian export products. With the frequent introduction of stimulus policies in the Chinese real estate market, the production demand for the basic raw material of real estate construction in China, steel, has also increased, and the import of iron ore is indispensable. This has to some extent pushed up the price of iron ore, living up to the saying "easy to rise, difficult to fall."

In summary, policy stimulus and tight supply support the rising prices of iron ore, which in turn supports the strength of the Australian dollar.

This time, we don't know how long the Australian dollar will continue to rise. For international students planning to study in Australia starting in February, you can pay attention to the exchange rates in the near future and try to avoid the peak period of paying tuition fees, as the rates are usually higher during that time. You can occasionally visit the Panda Remit official website to check the real-time exchange rates, seize the opportunity, and exchange currencies in a timely manner.

If you have any remittance needs, click to make remittances: