Is It Going to Rise?

熊猫速汇PandaRemit - 2023-12-04 14:44:54.0 392

Looking back last month, the Australian dollar was still falling. Everyone was still wondering why it kept falling? This time it was completely unexpected!

source:Sina Finance

It turned out to be a strategy of muting and amplifying, but now the Australian dollar is gaining momentum! What’s the reason for this small “jump”? Let the Panda Remit speak for you.

The Reserve Bank of Australia may continue to raise interest rates

On the morning of November 21, the Reserve Bank of Australia (RBA) released the minutes of its November interest rate decision meeting. It released an important signal: if the inflation data is higher than expected, the Reserve Bank of Australia will raise interest rates again in the next few months.

The Australian Financial Review reported that Australia's overall inflation rate ranks first among the world's developed economies, and the Reserve Bank of Australia may therefore further raise interest rates to ease the pressure of rising prices.

Many friends may be wondering, how can raising interest rates alleviate the pressure of rising prices? Generally, an increase in bank interest rates can encourage more people to save money and reduce consumer demand. If there is less money circulating in the market, prices will not be driven up higher and higher. Therefore, raising interest rates can actually alleviate inflation to a certain extent.

So why does raising interest rates promote the appreciation of the Australian dollar? Let’s give an example to help everyone understand: If the Reserve Bank of Australia raises interest rates, it will attract more foreign investment, which will help economic growth and naturally promote the appreciation of the Australian dollar.

However, even though the Australian dollar has become more "valuable" and the purchasing power of Australian residents has "increased", they are also helpless in the face of high inflation and can only silently endure high interest rates, high mortgage loans, high housing prices and high commodity prices.

The depreciation of the US dollar boosts the Australian dollar’s sprint

Since November, the U.S. dollar index has fallen sharply, falling from the highest point of 107 to the lowest level around 103. Why?

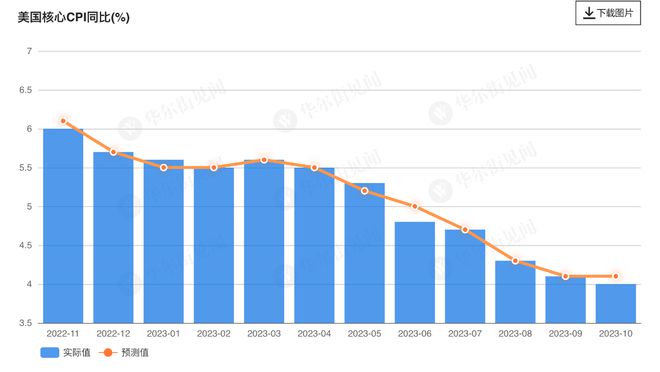

According to the latest data released by the U.S. Bureau of Labor Statistics, the U.S. Consumer Price Index (CPI) increased by 3.2% year-on-year in October, lower than market expectations of 3.3%. At the same time, U.S. manufacturing and industrial output are weak, the job market has cooled, and all signs point to a slowdown in the U.S. economy.

Source: Wall Street News

The unexpected fall in inflation in the United States has rapidly increased market expectations that the Federal Reserve will stop raising interest rates, exerting downward pressure on the U.S. dollar and accelerating its depreciation.

If the Reserve Bank of Australia continues to raise interest rates at this time and the Fed cuts interest rates as expected, with one increase and one decrease, the interest rate gap between the two will further narrow, and the financial market will naturally turn more attention to the Australian dollar, which will undoubtedly once again create valuable conditions for the appreciation of the Australian dollar. Boosting the Australian dollar's sprint.

Commodities support the strength of the Australian dollar

As we all know, Australia is extremely rich in iron ore resources and is one of the world's largest iron ore exporters. Since August this year, iron ore prices have risen by more than 20%, fluctuating around US$130 per ton.

At the same time, the supply chain in the iron ore market is relatively tight, with inventories at major ports hitting the lowest level since the same period in 2015. The imbalance between supply and demand will naturally drive up the price of iron ore.

The Australian Minister of Trade and Tourism once stated that China is Australia's largest trading partner and the main destination for Australian exports. As China's real estate stimulus policies are frequently introduced, the production demand for steel, the basic raw material for China's real estate construction, has also increased. Imported iron ore is definitely indispensable, which has pushed up the price of iron ore to a certain extent. In response to the saying "Easy What goes up is hard to come down.”

In summary, policy stimulus and tight inventory supply have caused iron ore prices to rise steadily, supporting the strength of the Australian dollar. Panda Remit can't help but lament the hard power of this commodity!

We don’t know when the Australian dollar will rise this time. For international students in Australia who choose to enroll in February, you can pay attention to the recent exchange rate and avoid the peak period of studying abroad payment, because it is usually at a high point at that time, and you can only pay the tuition in tears. ! You can check the real-time exchange rate on the Panda Remit Express official website from time to time, seize the opportunity, and exchange currency in time~

If you have any remittance needs, click to make remittances: