Year-End Remittance Scams Are Becoming Increasingly Sophisticated! PandaRemit Safeguards Your Funds

GPT_Global - 2023-12-21 17:25:31.0 897

As 2023 is drawing to a close, scammers are ramping up their efforts to meet their "year-end targets."

This year, international remittance fraud cases have been rampant, with numerous remittance companies experiencing major issues. After working hard all year, it's crucial for everyone to be extra vigilant and protect their hard-earned money!

PandaRemit hereby solemnly declares: We actively respond to national policies and cooperate with regulatory authorities in various countries/regions to jointly combat financial fraud!

To this end, PandaRemit has compiled typical scam tactics seen this year, hoping to raise awareness and caution to prevent falling into these traps!

Hong Kong: A "Clever Scam" Duping Two at Once

In June this year, someone in Hong Kong was scammed out of 100,000 due to private currency exchange!

A brief overview of the scammer's "ingenious" operation:

The scammer added two netizens, A and B, from different WeChat groups as friends and arranged a time and place for offline money exchange.

Netizen B gave cash to netizen A, who then transferred money to netizen B, but netizen B never received the funds.

This operation resulted in both netizens A and B becoming victims—netizen A transferred money into the scammer's account, leading to netizen B not receiving any money.

During this process, both parties thought they were being scammed by each other, not realizing the existence of a third-party scammer. Even the police couldn't help but marvel at the sophistication of this scam.

USA: Private Currency Exchange, Almost Cost a Life!

In October, according to U.S. media reports, two Chinese men in Long Island City, Queens, New York, were ambushed during a currency exchange, beaten, and robbed of $34,000.

Here's what happened:

The two Chinese men initially saw someone offering currency exchange in a WeChat group. Wanting to exchange their U.S. dollars for Chinese yuan, they agreed on a time and place to meet online.

As they were about to exchange currency face-to-face, two other men suddenly appeared from behind and attacked them: first striking the victims on the head and then stealing their backpack containing $34,000.

The Chinese man who came to exchange currency also ran away...

Investigations revealed that the Chinese man who came to exchange currency and the two robbers were in cahoots. They had planned this act to rob the victims, and the currency exchange message on WeChat was a lure.

The Chinese Embassy in the U.S. also recently issued a notice, warning Chinese citizens to beware of scam traps!

Australia:

"Reliable Currency Exchange" on Xiaohongshu? Not So Reliable!

In Australia, many students use Xiaohongshu, a platform known for "a hundred thousand how-tos." Surprisingly, there's a "reliable currency exchange" service on it.

After adding "reliable currency exchange" on WeChat, netizen a transferred tens of thousands of yuan but never received any Australian dollars.

The so-called reliable currency exchange is a scam that lures victims with "favorable exchange rates." Once they receive the money, they make excuses, disappear, or even forge bank transfer records and payment vouchers.

In November, the Chinese Consulate General in Perth also posted this news on its official WeChat account, warning Chinese citizens and students in Western Australia to beware of "currency exchange" scams. The suspects often lurk in WeChat groups, Moments, Xiaohongshu, and other online platforms, making it difficult to distinguish between genuine and fraudulent offers. They establish contact with victims by adding them as friends.

Changjiang Currency Exchange: Account Frozen, Family Investigated!

In October this year, "Changjiang Currency Exchange," self-proclaimed as "Australia's No. 1 Currency Exchange Platform," was thoroughly investigated by Australian police, with all 12 of its stores in Australia being shut down! The Australian police stated that the company helped illegal clients launder money through its massive fund flows, taking a 10% profit.

Over the past three years, "Changjiang Currency Exchange" has processed a total of 10.1 billion Australian dollars in transactions, mixing funds from both legal and illegal clients, with legal funds accounting for 98%.

Although illegal funds only accounted for 2%, their total amount reached about 229 million Australian dollars.

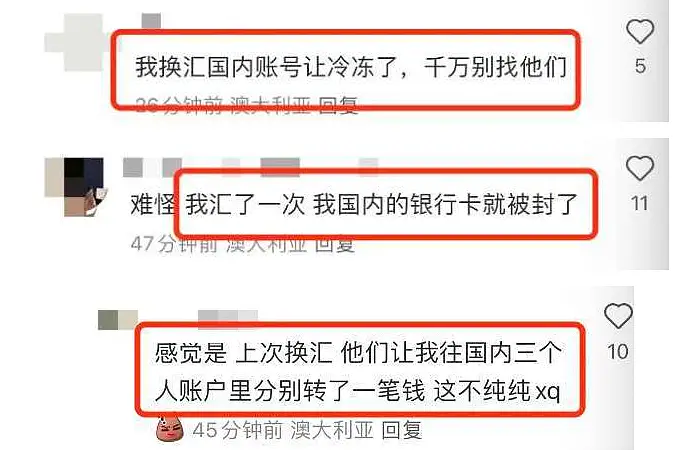

Social media users have also reported that using Changjiang Currency Exchange led to their accounts being frozen.

Source: Xiaohongshu

Singapore: Legal Remittance Frozen?

Similarly, in October, many Chinese in Singapore who used remittance companies or merchants to send their hard-earned money back to China found their remittance funds frozen upon arrival due to suspected money laundering. The reason was that the third-party bank accounts used by the remittance companies were allegedly involved in illegal activities.

It is understood that the number of affected Chinese has exceeded 1,000, with a total frozen amount exceeding 30 million yuan. Every weekend, a large number of affected remitters visit the remittance companies seeking solutions, but to no avail.

This has also caught the attention of the Chinese Embassy in Singapore, which issued a notice regarding this matter:

Scammers are constantly devising new tactics. In addition to avoiding risky practices like private currency exchange, choosing a legal, compliant, and secure remittance company is of utmost importance!

"Public Office for Private Gain"? All Scams!

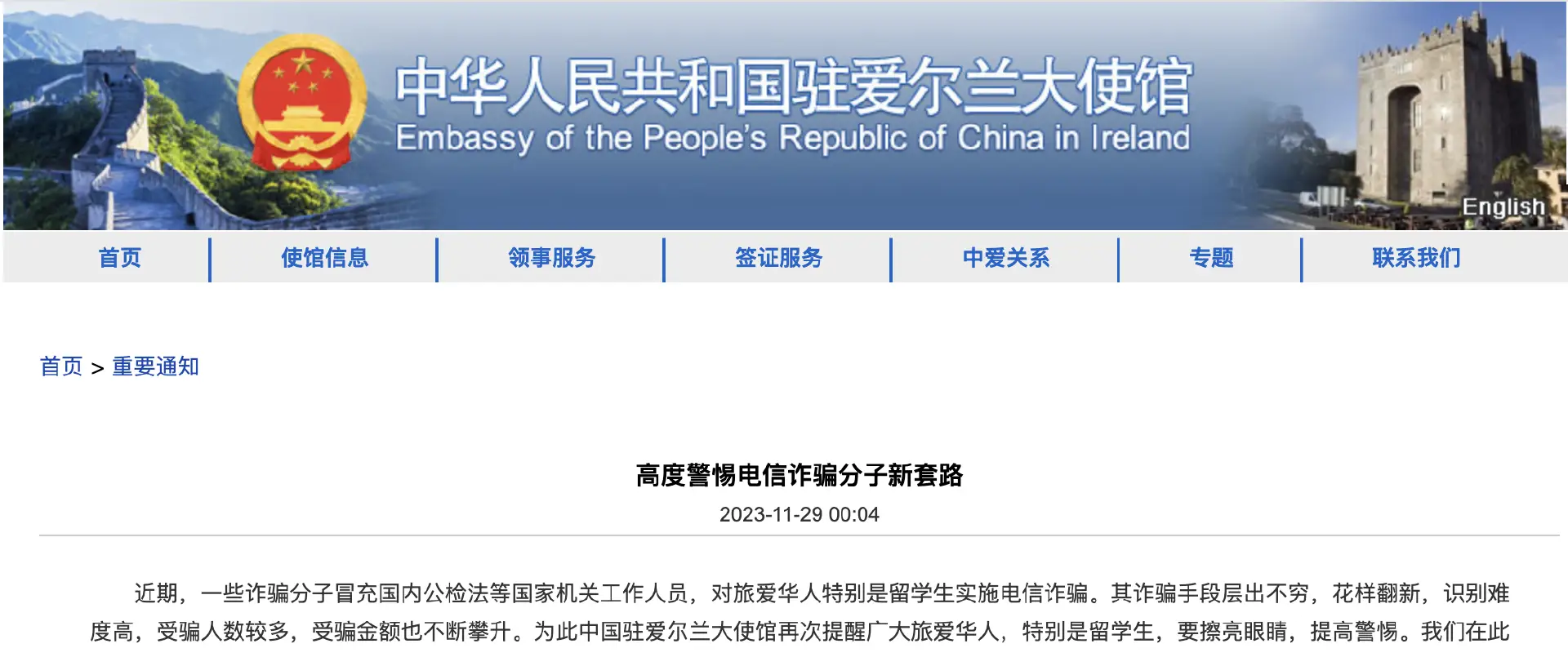

Coincidentally, embassies in multiple countries have issued notices warning Chinese citizens to be highly vigilant against new tactics used by telecommunication fraudsters.

Currently, scam tactics are diverse, including but not limited to impersonating public security, procuratorate, customs, embassy staff, courier companies, landlords, etc. The content of the scams involves virtual kidnapping, illegal currency exchange, online transactions, etc.

Victim A received a call from a so-called "Anti-Fraud Bureau Director," who continuously brainwashed them. The scammer used props like "police badges" to coerce and trap A, making them firmly believe in the scammer's "government official" identity.

After gaining A's trust, the scammer lured A to leave Ireland for a third country under the guise of cooperating with a "secret mission." During this time, A was instructed to turn off communication tools and hand over social media accounts. This tactic made it difficult for the police to locate A, increasing the difficulty of solving the case and achieving the goal of defrauding money. Under the scammer's persuasion, A repeatedly asked their parents for large sums of money under various pretexts, such as further training and Bitcoin trading.

Safeguarding Your Remittance Security Is PandaRemit's Lifelong Pursuit

Legally Compliant Process

PandaRemit has obtained PCI DSS certification, passing nearly 300 audit criteria across six major areas and 12 standards, including network security, application and system security. This means the company's payment capability and technology have reached international leading levels;

As an international company, PandaRemit's remittance business spans the globe. In different countries/regions, PandaRemit has obtained the corresponding remittance licenses through regulatory compliance, strictly adhering to international remittance business rules to ensure each transaction is legal and compliant.

For specific license information, please visit (https://www.pandaremit.com/zh/compliance).

Endorsement by Authoritative Institutions

With its professional capabilities and extensive experience in the international payment field, PandaRemit has received multiple rounds of financing from Sequoia Capital, Lightspeed Capital, and Jia Cheng Capital,

The renowned Chinese law firm King & Wood Mallesons provides legal services to PandaRemit. King & Wood Mallesons has issued a compliance legal opinion letter for PandaRemit's China business, ensuring each remittance complies with regulatory requirements.

Dual Encryption Protection

PandaRemit uses Symantec security solutions, featuring industry-standard data protection with no vulnerabilities.

PandaRemit also strictly adheres to local regulations regarding user data confidentiality, ensuring the maximum security of remitter information. All private data submitted by users are processed through Norton Secure Site SSL and Https dual encryption, constantly safeguarding your information security.

Multiple Identity Verifications

PandaRemit conducts strict identity verification during account opening and remittance processes.

During account opening, in addition to information review and facial recognition, a dedicated customer service representative will confirm the identity over the phone, ensuring the customer is the actual person opening the account to prevent misuse of personal information;

When logging into the account, PandaRemit protects account security through "setting a password" and "binding a mobile number";

During the remittance process, PandaRemit also performs multiple information verification checks to ensure only authorized users can conduct remittance operations.

Reminder: PandaRemit staff will never ask for verification codes in any way. Please do not share verification codes with others.

Real-Time Risk Monitoring

PandaRemit has established a comprehensive risk monitoring system, conducting strict risk control management, encrypting and monitoring all transactions around the clock. It can real-time monitor remittance behavior, promptly detect abnormal transactions, and take appropriate measures;

Once the backend detects an abnormal transaction, PandaRemit will lock the transaction and verify the situation with the person involved over the phone, fully ensuring the security of user funds.

Transparent and Visualized Progress

PandaRemit's remittance process is entirely online, supporting real-time tracking of remittance progress.

- The entire remittance process is visualized and trackable, allowing users to check the remittance status in real-time on the mobile app;

- Users can also inquire about remittance progress through online customer service;

- Timely notifications of transaction completion are sent via SMS/email/WeChat.

About Us - Panda Remit

Panda Remit is a cross-border remittance online platform, which is committed to providing global users with safer, more convenient, reliable, and affordable online cross-border remittance services. With a user-friendly interface and advanced security features, Panda Remit is the best solution for anyone looking for a hassle-free way to make global remittance.

Panda Remit has the following features:

1. High safety degree - One of the key features of Panda Remit is its advanced security measures

All transactions are encrypted and monitored 24/7 to ensure the safety of your funds. What's more, Panda Remit uses state-of-the-art fraud detection technology to prevent unauthorized access from your account.

2. Convenient transfer environment - Panda Remit is equipped with a currency calculator

The platform is available on Panda Remit's official website or Panda Remit app so that you can easily access your account and make transactions on the go. Users can transfer money in a variety of currencies, including US dollars, euros, HK dollars, pound, yen, etc,. Furthermore, it is also worth noting that Panda Remit provides 24/7 Chinese customer service, providing a familiar and intimate environment for overseas Chinese.

3. Simple operation process - Panda Remit has a user-friendly interface that makes it easy to navigate and use

Moreover, whether you need to pay bills or send money to friends and family in other countries, you just need to simply follow the operation tutorial provided by Panda Remit to create an account, link your bank account or credit card, and then you're ready to transfer money globally. With just a few clicks, you can successfully send money to anyone, anywhere in the world you want.

4. Instant transfer - Panda Remit provides a quicker way to transfer money globally

Panda Remit is not only secure and convenient, but it is also fast. It allows for instant transfers between Panda Remit users, eliminating the need for waiting periods or processing times as much as possible. This feature is especially beneficial for people or businesses that require quick and efficient cross-border remittance.

5. Low handling fee - Panda Remit offers a range of exchange rate benefits to users

Panda Remit also offers competitive prices compared to traditional remittance methods and other apps of the same kind. Thus, users can enjoy low transaction fees and competitive exchange rates and get high amounts received when transferring money globally, which makes Panda Remit a cost-effective solution for individuals and businesses alike. Plus, the system would give coupons to first-time users.

In conclusion, Panda Remit provides a simpler and more efficient online global remittance way that offers a range of features and benefits to users. Nowadays, Panda Remit has opened global remittance services for more than 30 countries or regions worldwide and helped users save nearly 100 million dollars in fees, which is deeply recognized and trusted by millions of users around the world.

Panda Remit is the perfect solution for you to make cross-border remittances.

Please visit the Panda Remit official website or download the app, Panda Remit, for more detailed information.

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from WOTRANSFER PTE. LTD. or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date.

If you have any remittance needs, click to make remittances: