Are FX Rates Greener after Lunar New Year?

熊猫速汇PandaRemit - 403

Family members and friends are all back at work at last! We had a good time at the dinner table, the wine table, the mahjong table, and finally back to the office desk...

The Spring Festival holiday just ended was a happy picture of new year celebrating -- cross-border trips are flooded, tickets to popular scenic spots are sold out, and the movie box office sets a new record. ......

Compared with the thriving atmosphere of the new year, the FX rate market since the beginning of the year 2024 has been a little bit lukewarm, how is the situation? Quickly come to see it together with Panda Remit!

Japanese yen: Nosediving!

At the start of 2024, the yen initiated "a plunge" mode, stumbled back to around 100:4.78, which means that the yen fell back to the lowest point of the range in recent years...

In the whole of 2023 yen almost was always in a downtrend, and finally had a good rebound at the end of 2023. Not yet stabilized at 5.0, it started a new round of plummet at the beginning of 2024, which makes people wonder whether the rebound is to fall better?

Source: Sina Finace

After checking many sources, Panda Remit found that the yen fell for the following two main reasons:

According to Japanese TV, Japan's GDP fell 1.1% in the fourth quarter on quarter-on-quarter basis, and its nominal GDP fell from the world's third place to the world's fourth place, overtaken by Germany.

On February 13, the U.S. Department of Labor released inflation data that exceeded expectations, lowering market expectations that the Federal Reserve will cut interest rates earlier.

This can be a real double blow to the yen exchange rate at home and abroad! However, for those who are ready to go to Japan to travel, work or study, now is a good time to get some yen. People with need for foreign exchange should take the chance!

Australian dollar: Stopped falling?

Speaking of the blow in the start of the year, Australian dollar tells almost the same story of yen!

The yen and the Australian dollar are like two tragic brothers in the exchange rate market in 2023, and still hasn’t given people any surprise in 2024, both writing a script of a "plummeting opening", both suffering from internal and external problems!

On February 13, the U.S. CPI rose more than expected. When data was released, the Australian dollar against the yuan plunged from the highest 1:4.706 to 1:4.642.

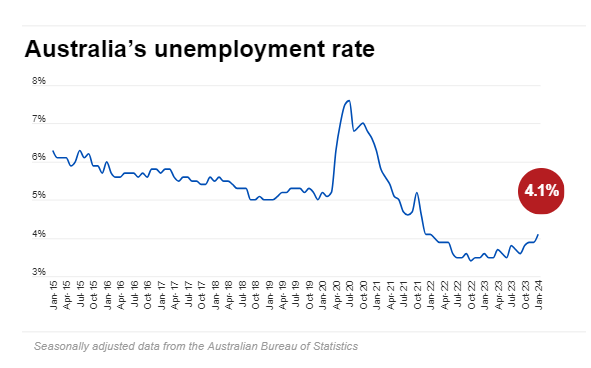

On February 15, data released by the Australian Bureau of Statistics showed that the seasonally adjusted unemployment rate across Australia rose to 4.1% in January from 3.9% in the previous month, reaching the highest level in two years!

Source: ABC News

But considering the last two days, the Australian dollar seems to have the sign of stopping falling. No matter what, the exchange rate is difficult to predict, and friends with need to get some Australian dollars should seize the opportunity!

Source: Sina Finace

HKD: Slightly up

Sometimes only after seeing ups and downs can people feel the happiness of a smooth ride, especially a smooth rise!

As Hong Kong China adopts the linked exchange rate system, the movement of the HKD is closely related to the US dollar, making them seem almost the same from the exchange rate graph!

HKD’s impressive performance in 2023 has made many friends in need slap their thighs and regret not starting earlier. HKD rate really proved that some excellent rate will no longer come back once missed...

And since the beginning of 2024, HKD has kept making silent effort to rise a little bit every day. In the background of the upward movement of the US dollar index during the Chinese New Year holiday, the HKD also maintains a slight increase.

Source: Sina Finace

US Dollar: Closing in on "7.2"

The strength of the US Dollar was evident in 2023, and although it slipped at the end of the year, it still held on to the "7.0" turning point.

Into 2024, the strong momentum of US dollar is not reduced!

The US dollar index rose sharply in February, led by US Non-farm Payrolls.

Last week, the U.S. January CPI and PPI data are stronger than market expectations, and the market reaction after the release of the data is strong, US dollar exchange rate surging higher.

From a short-term perspective, US dollar FX rate is still expected to continue the strong trend further upward, approaching 7.2.

Source: Sina Finace

The euro: The rise is blocked

After reaching a high position of 8.1138 in July 2023, the euro exchange rate fell all the way down and hasn’t yet come back to its peak.

In 2024, against the backdrop of contracting external demand, monetary tightening and withdrawal of fiscal support, the EU cut its euro zone growth forecast from 1.2% to 0.8%, reflecting the weakness of the euro zone economy, which has clearly stalled, making it difficult for the euro exchange rate to rise.

Source: Sina Finace

GBP: Holding the ground of "9.0"

The Pound was also on a downward trend after its high point of 9.4105 in July 2023.

After falling below 9.0 at the end of September 2023, the pound exchange rate, after months of struggle, finally got back above 9.0 in the opening of 2024!

On February 14th, the latest data from Office of National Statistics showed that inflation in the UK stabilized at 4% in January, rising at the same rate as in December last year, with a lower-than-expected rise in inflation leading the market to increase bets on a rate cut from the Bank of England.

The pound also weakened slightly after the data was released...

Source: Sina Finace

New Zealand Dollar: Still falling?

The New Zealand Dollar exchange rate market in 2023 has been a very turbulent and uneventful year. In the lack of economic recovery and the strength of the U.S. dollar, the New Zealand dollar fell hard.

RBNZ governor Adrian Orr pointed out in the latest speech on February 16th, that the reduction of core inflation still has more work to be done, but he also recognized the risk of excessive tightening. As a result, the market reduced the possibility of an interest increase by the New Zealand Federal Reserve this month, and reduced bets on interest increase this year to less than 50%.

Source: Sina Finace

As of now, FX rates of various markets in 2024 as a whole have not ushered in a great start, but for those who want to go abroad to work and study or send money to friends and relatives abroad, now is a good time not to be missed. Don’t miss it again!