The exchange rate dark horse this year is...

Jennifer Johnson - 597

If last year's exchange rate market was dominated by the US Dollar, then the Pound is definitely this year's biggest dark horse in the exchange rate market --

- At the start of the year 2024, the pound quickly rushed back and stabilized at the "9.0" turning point...

- From January to March, the pound oscillated upwards above 9.0

- March 6, the United Kingdom released the 2024 spring budget, and the pound continued to go up wildly!

- March 8, the pound against the yuan exchange rate hit a new record high since last August -- [1 pound: 9.2595 yuan].

Behind this smooth rise of pound, I wonder how many international students who are ready to pay their tuition fees to UK have broken down and cried...

Friends of Panda Remit also exclaim: So powerful is the strength of an experienced financial player!

Source: Sina Finance

In addition, according to data from more than 140 foreign exchange rates around the world tracked by Bloomberg, the British Pound has beaten 92% of global currencies so far this year -- a well-deserved dark horse!

Source: Bloomberg

What is the reason for the strong performance of the pound this year? Panda will give you analysis ~

The expectation on British interest rate cut is weakened

March 6, the United Kingdom released the 2024 spring budget.

British Chancellor of the Exchequer Jeremy Hunt announced tax cuts and fiscal stimulus policy higher than market expectations, which may boost the economic outlook -- help families by "permanent tax cuts", in addition, they’ll further cut public spending as another way to cut taxes.

Source: https://www.pwc.co.uk/

The British media pointed out that this series of policies may trigger a rebound in inflation, which will further push up prices and make it difficult for the Bank of England to cut interest rates as much as the market had expected this year.

Previously, it was widely expected that the Bank of England would start to cut interest rates in May this year, with a total of six interest rate cuts of 25 basis points each time.

Now the market expects that the Bank of England will not cut interest rates for the first time until August, and it will only cut interest rates three times in a high probability. In contrast, the European Central Bank and the Federal Reserve are expected to usher in the turning point of monetary policy in June or earlier.

Britain's economy is picking up

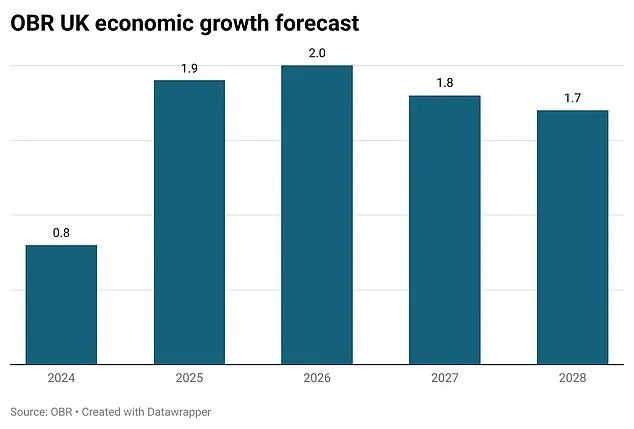

At the same time, according to the latest forecast of the Office for Budget Responsibility (OBR): "The British economy is expected to grow by 0.8% in 2024, and the growth rate next year is expected to reach 1.9%".

The data is 0.5% higher than the autumn forecast, which is optimistic and supports the appreciation of the pound.

In addition, statistics released by the Office for National Statistics (ONS) on March 13 showed that in January this year, the UK's Gross Domestic Product (GDP) grew by 0.2% on a year-on-year basis, with the main drivers being retail trade and construction, and consumer spending playing an important role in boosting the economy.

Athanasios Vamvakidis, head of G-10 currency strategy of Bank of America, said: "Last year, the UK economy was a poor mix of growth and inflation among the major economies. Now it seems to be recovering while inflation is falling."

The rebound in the U.K. economy is also reflected in the movement of the pound.

Even though the pound has fallen back in the last week, in the short term, it is still at a high level. This time of year is now the perfect opportunity for those working and living in the UK to send money back home! If you have a need to send money back to your home country, seize the opportunity!

Panda Remit, the choice of millions of users worldwide, provides safer, more convenient, more reliable and more affordable cross-border remittance services.

It now covers more than 50 countries/regions and dozens of currencies, and supports more than 500 banks and major wallets such as Alipay, WeChat and PayPal.

Panda Remit can meet your multiple remittance needs, including global remittance, large-value remittance, remitting RMB from China and tuition payment.

Panda Remit offers the industry's best exchange rates and lowest fees to ensure the safety of your funds, and have been certified by PCI DSS. With our global presence and regulatory compliance, you can enjoy a convenient service 24/7 during the remittance process.

Visit Panda Remit website/APP to enjoy the new experience of global remittance, more money arriving at faster speed!