Oh my dear AUD...

Jennifer Johnson - 2024-03-27 17:30:04.0 1446

Last week was a week of ups and downs for those who were ready to get some Australian dollars to pay for their tuition.

After all, the trend of the AUD always affects everyone's heart (wallet)...

On Monday to Thursday last week, the Australian dollar showed a downward trend, all the way down, with the lowest point to [4.6818], just as many netizens were waiting until a lower point...

The Australian dollar unexpectedly came to a great turnaround!

By Friday (March 21), the Australian dollar soared as high as [4.7750]!

The record high in nearly two months!

Source: Sina Finance

I have to say, the Australian dollar exchange rate is really a test of human nature, down when some want to wait until even lower, up when some regret not getting enough AUD in time.

So, for what reason did AUD have last week's "roller coaster" trend? Let's hear what Panda has to say in detail

Reasons for the fall

RBA kept high interest rates unchanged

Last Tuesday, the Reserve Bank of Australia decided to keep interest rates at a 12-year high of 4.35% and stopped mentioning the possibility of further rate hikes, suggesting that the monetary tightening cycle is over.

In addition, strong U.S. consumer and producer inflation data fueled expectations that the Federal Reserve would stick to its long term approach of keeping rates going up.

The news triggered a fall in the Australian dollar.

Iron ore prices tumbled

Commodity markets took a turn as the prices of two key Australian exports diverged.

Copper prices surged nearly 6 percent in the last two weeks to an 11-month high of more than $9,000 a ton.

Meanwhile, iron ore plunged by more than 13 percent to below $100 a ton for the first time in seven months.

Australia exported A$124.1 billion of iron ore and A$12.27 billion of copper last fiscal year.

Citi leads a growing number of market commentators predicting that copper's rally will continue into next year due to improving demand for electric vehicles, solar and wind power.

The Australian dollar fell to a near two-week low due to both of these factors.

Source: Sina Finance

The reason of the surge

Fed dovish speech

In the early morning hours of March 21, the Federal Reserve interest rate resolution announced data rates remained unchanged in the range of 5.25% to 5.5%.

The Fed said it still expects to cut interest rates three times this year, 75 basis points cut by the end of 2024, and the expectation on rate cut shows a real concern that inflation will be more difficult to control.

With the risk of Fed tightening removed, and dovish statements, the AUD climbed sharply as the US dollar and US Treasury Bond yields weakened.

Australian data exceeded expectations

Also on March 21, Australia released better-than-expected employment data across the board:

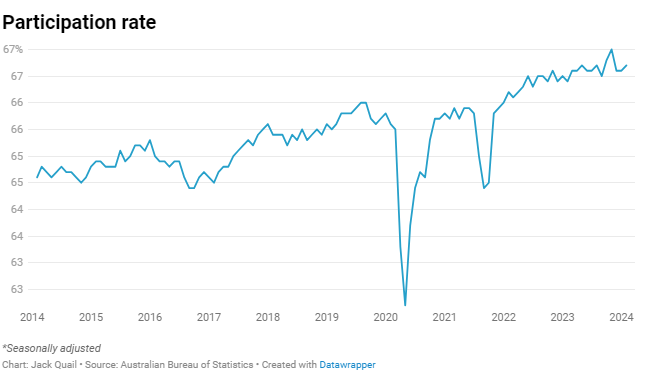

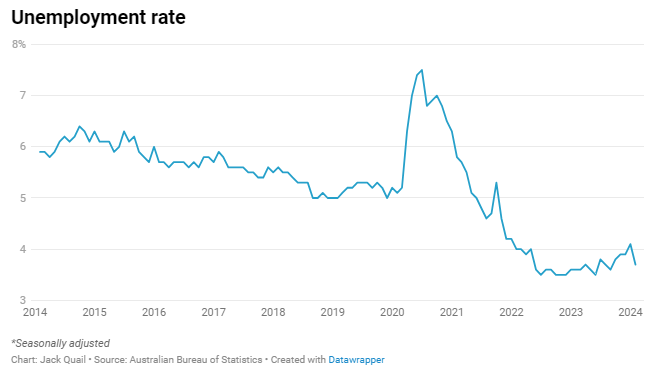

Employment surged by 116,500 in February against an estimate of 40,000, almost tripling the market estimate, which is also the largest increase since the 2021 pandemic lockdown was over.

The unemployment rate fell to 3.7% in February from 4.1% against an estimate of 4.0%; allaying fears that it would rise faster than expected.

Although the employment data is rather volatile each time, it does show that the Australian job market is still relatively resilient.

China-Australia relations continued to heat up

On March 20, Chinese Foreign Minister Wang Yi officially met with Australian Foreign Minister Huang Yingxian.

This is the first time since 2017 that a Chinese foreign minister has visited Australia, which represents a further step in China-Australia relations.

Following the meeting between the two foreign ministers, the Chinese Ministry of Foreign Affairs issued a statement, "Wang Yi and Huang Yingxian have met for the 6th time. Every time they meet, mutual trust between the two sides increases by one level, and China-Australia relations take a step forward."

China is one of Australia's largest export markets, and the warming of China-Australia relations has benefited the Australian economy to some extent.

A number of good news helped the Australian dollar in last Friday's soaring performance!

The exchange rate market is unpredictable, and the lowest exchange rate is difficult to predict. Perhaps getting foreign currencies in batches within a reasonable range is not a bad idea ~

Panda believes that remittance safety is more important than the exchange rate! Recently, it is the peak time to pay tuition, we must be vigilant and choose a safe and reliable channel to remit money! I hope everyone can get a good exchange rate and start the new stage of studying abroad smoothly!