Apps to help you make remittances from USA to China

Jennifer Johnson - 2024-04-02 11:22:37.0 1666

Panda Remit (熊猫速汇)

Panda Remit was founded in 2018, headquartered in Singapore, holding MSO license. Since its establishment, Panda Remit has always been committed to changing the traditional way of remittance, providing global users with safe, fast, convenient international remittance services with fair prices, and establishing a new digital network.

With its professional ability and rich experience in the international payment field, Panda Remit has so far obtained several rounds of financing from Sequoia Capital, Lightspeed Capital and Next Capital, etc.

In 2020, Panda Remit became a strategic partner with Alipay, and became the only remittance company selected by Mastercard2020 to join the Start Path program.

Exchange Rate:

1 USD = 7.3197CNY

(Changes in real time, for reference only)

Money Receiving methods:

Bank card, Alipay, Weixin

Payment Methods:

Visa/MasterCard debit card, ACH payment

Arrival speed:

2 minutes at the earliest.

Amount limit:

Minimum $100 and maximum $2999 in a single transaction, but no limit on the number of transfers.

Handling Fee:

Zero fee for new users’ first order

Existing users: $6.99/transfer (no hidden or extra fees)

Wise (formerly TransferWise)

Founded in 2011, Wise is a technology company headquartered in London, UK that specializes in cross-border money transfers and successfully listed on the London Stock Exchange in 2021, with a current market capitalization of around $5 billion. As of 2023, Wise's three main products are Wise Account, Wise Business and Wise Platform.

Exchange rate:

1 USD = 7.2302 CNY

(Changes in real time, for reference only)

Money Receiving method:

Bank account

Payment Methods:

ACH, wire transfer, debit card, credit card

Arrival speed:

Depends on the country where the money is sent and received and the payment method, usually instant.

Amount limit:

50,000 RMB (about $7300) for a single transfer.

Handling fee:

A small fixed fee of 4.22 USD + 0.65% of the amount that you exchange is required to send money from the US to China Mainland.

Take 1000 USD for example:

Bank account (ACH) - 13.29 USD

Wire transfer - 15.49 USD fee

Debit card - 27.20 USD fee

Credit card - 59.19 USD fee

Disadvantage:

Higher fees

Remitly

Founded in 2011, Remitly is an online money transfer service company based in Seattle US that currently provides cross-border money transfer services to more than 150 countries/regions. In September 2021, Remitly went public (RELY) for trading on the Nasdaq exchange, and currently has a market capitalization of around $5 billion.

Exchange rate:

1 USD = 7.2143 CNY

(Changes in real time, for reference only)

Money Receiving methods:

Weixin, Alipay, UnionPay Card

Payment Methods:

Bank account, Visa/Mastercard debit or credit card

Arrival speed:

Economy (Ordinary remittance): payment by bank account, usually takes 5~7 working days for the money to arrive

Express (expedited remittance): payment by debit/credit card, money arrives in a few minutes at the earliest.

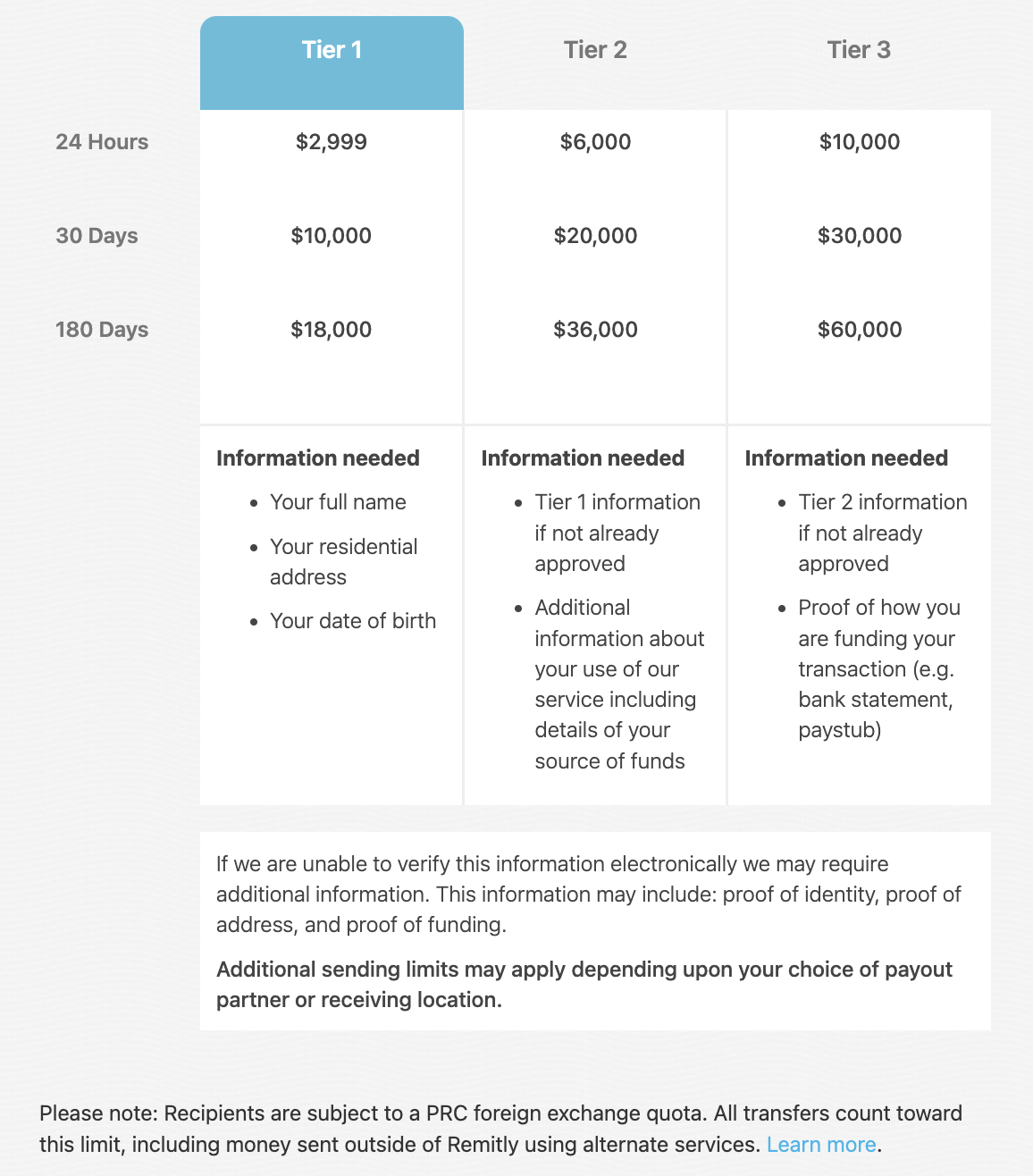

Amount limit:

Remittance limit:

Money Receiving Limits:

For remittances to China, different money receiving methods have corresponding limits

Alipay: ¥50000 per transfer

Bank Deposit: ¥21000 per remittance

Weixin: ¥30000 per remittance

Handling fee:

New users: no handling fee for the first order

Existing users:

US$2.99 for remittance amount below US$1,000

No handling fee for remittance amount of US$1,000 or more.

Disadvantage:

Poor exchange rate

Paysend

Founded in April 2017 in London, UK, Paysend is the first new generation UK fintech company to launch the world's first cross-border remittance technology from [Card-to-Card], dedicated to securely enabling users to quickly complete international transfers between bank cards and e-wallets across the globe.

Exchange rate:

1 USD = 7.1266 CNY

(Changes in real time, for reference only)

Money Receiving methods:

UnionPay Card, Weixin Wallet, Alipay

Payment Methods:

MasterCard, Visa, UnionPay Card

Arrival speed:

Officially, it claims that 90% of remittance orders are guaranteed to reach the recipient's bank account within 15 seconds.

However, the exact arrival time will be related to the sender's payment method, the recipient's money receiving method and international holidays and other factors.

Amount limit:

Each Paysend order to send RMB to Weixin is limited within 30,000 RMB;

Each Paysend order to send RMB to Alipay is limited within 50,000 RMB;

Each Paysend order to send RMB to China UnionPay Card is limited within 30,000 RMB;

Each recipient can accept up to US$50,000 in foreign currency per year.

To increase the limit, you need to provide appropriate identification documents, proof of address or proof of income in the app, and Paysend will complete the review within three workdays after receiving your application.

Handling fee:

"Card-to-Card technology offers a fixed fee for cross-border money transfers: only $2 when sending from the US.

Disadvantage:

Exchange rates are slightly lower than the market average

Instarem

Founded in 2014 by Indian entrepreneur Prajit Nanu and headquartered in Singapore, Instarem is a cross-border payment service provider that now has branches in 11 countries.

Exchange rate:

1 USD = 7.1847 CNY (could be better for the first transaction of new users)

(Changes in real time, for reference only)

Money Receiving methods:

Alipay, bank card, Instarem account

Payment methods:

ACH, debit card, credit card, wire transfer, Instarem account

Arrival speed:

Transfers to Instarem accounts are usually in real-time.

Other methods usually take 2 business days (longer for some countries and money receiving methods)

Amount limit:

ACH: $3000

Wire Transfer: no limit

Instarem account: no limit

Debit Card: $2500

Credit Card: $2500

Handling Fee:

New users: no handling fee for the first transfer

Existing users: 0.25%-1% of the remittance amount

*Handling fee varies depending on the amount, payment method and receiving country.

Disadvantages:

Slower arrival speed

Poor exchange rate

Panda Remit, the choice of millions of users worldwide, provides safer, more convenient, more reliable and more affordable cross-border remittance services.

It now covers more than 50 countries/regions and dozens of currencies, and supports more than 500 banks and major wallets such as Alipay, WeChat and PayPal.

Panda Remit can meet your multiple remittance needs, including global remittance, large-value remittance, remitting RMB from China and tuition payment.

Panda Remit offers the industry's best exchange rates and lowest fees to ensure the safety of your funds, and have been certified by PCI DSS. With our global presence and regulatory compliance, you can enjoy a convenient service 24/7 during the remittance process.

Visit Panda Remit website/APP to enjoy the new experience of global remittance, more money arriving at faster speed!