Will SGD rise?

熊猫速汇PandaRemit - 2024-04-19 10:52:04.0 662

Recently, the Singapore dollar exchange rate fluctuates a little crazy. A few days ago, taking April 12 for example, the Singapore dollar against the Chinese yuan exchange rate was under 5.33 for the first time since June 2023, but on April 15 SGD began to appear back up. In this regard, students who are going to study in Singapore said -

It’s so sad I didn’t get more SGD before!

But next, the exchange rate of SGD to CNY fell unexpectedly instead, from 5.38 to 5.29.

What's going on? Will the exchange rate go up again?

Our hearts are all thumping as the SGD exchange rate fluctuates, because Singapore is the first choice of Chinese people to go abroad, whether it is to go abroad to work, travel, study, or sojourn.

So why all the fluctuations?

Allow Panda to look into the recent Singapore dollar situation for you

MAS has maintained monetary policy for four consecutive times

Inflation in Singapore has been severe in the past two years, and one of the effective ways to deal with inflation is to let the currency appreciate.

As a result, the Singapore Dollar to RMB exchange rate has been rising. In April 2022, the Singapore Dollar to Renminbi exchange rate was still 4.66, and in April 2024, it came to 5.34 already.

In the past two years alone, the SGD/RMB rate has risen by 14%!

And recently, the Monetary Authority of Singapore (MAS) also said that it is keeping its monetary policy unchanged to allow the SGD to continue to appreciate.

In its tri-monthly Monetary Policy Statement, the MAS announced that the range, width, axis and slope of fluctuations in the Singapore Dollar Nominal Effective Exchange Rate (S$NEER) remain unchanged.

The authorities expect the local economy to strengthen further and achieve broader growth this year.

The current rate of appreciation of the SGD is helping to contain imported inflation and domestic cost pressures enough to ensure price stability in the medium term.

Core inflation is likely to remain high in the early part of the year, but will generally moderate and decline in the fourth quarter, with a further downturn in 2025, so that current monetary policy remains appropriate.

The impact of this, though, is this:

Good news for working people - the same amount of SGD for more yuan, which is simply a pay raise in disguise;

Bad news for international students - tuition fees and living expenses are relatively increased, gonna spend careful with every penny now!

Singapore recently extended the ban

With the implementation of the China-Singapore visa-free policy, Singapore has become a popular tourist destination for more and more Chinese tourists.

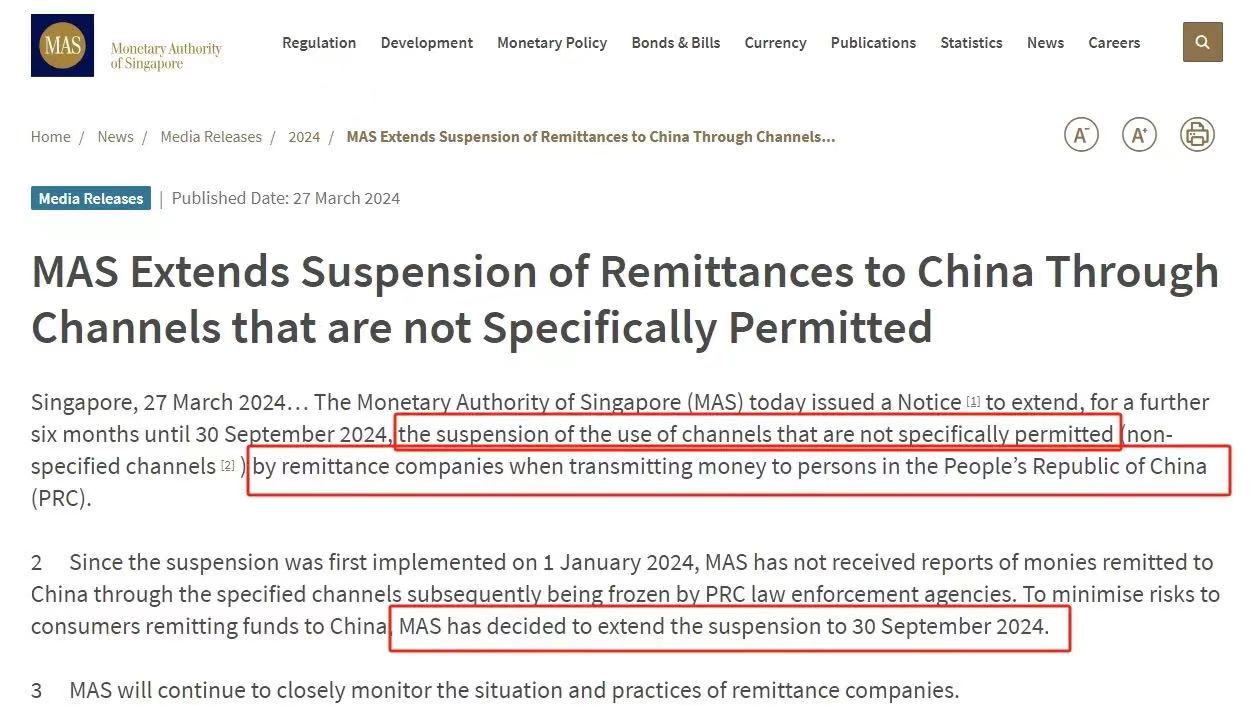

On March 27, MAS said that the ban "Singapore cross-border remittance service companies are not allowed to remit money to China through a third-party agent" would be extended for six months until September 30th.

The reason must have been heard before:

In 2023, a large group of Chinese compatriots sent money back to their home country through money transfer companies in Singapore's Chinatown, which resulted in the freezing of their China bank accounts.

The authorities issued a ban on local remittance companies in order to protect consumers:

Singapore licensed cross-border remittance companies can only handle China-related remittances for customers through designated channels such as banks or payment cards.

Therefore, you must choose a safe and compliant remittance channel. Panda Remit has always been known for its security, convenience and affordability, making it the preferred tool for cross-border remittances.

In the process of cross-border transfer in China Mainland, Panda Remit uses the channel of outward remittance business of Tianjin KCB Bank, one of the first five private banks approved by the China Banking and Insurance Regulatory Commission (CBIRC), and accepts the supervision of the People's Bank of China. Panda Remit always ensures the legitimacy and compliance of its operation, and strictly prevents money laundering from occurring.

In the global anti-money laundering tightening background, it is crucial to enhance the anti-money laundering awareness for both sides’ financial security in the economic exchanges is.

However, in recent years, there have been frequent cases of remittances being frozen in Singapore. Panda is also here to warmly remind everyone: be sure to safeguard your own property!

Finally, Singapore as an international financial center, its exchange rate is affected by the international market, it is recommended that you remain sensitive to market dynamics while making financial operations, so as to better grasp the fluctuation trend of the exchange rate.

If you have the need to get some SGD currency, please aim at the right time.