Is the Pound about to Have a Bad Day?

熊猫速汇PandaRemit - 2024-05-17 14:09:20.0 475

Recently, the pound to yuan exchange rate gradually calms down from the top point at the beginning of the year.

However, the Pound to RMB exchange rate has also stabilized above 9, with the latest rate at 9.14.

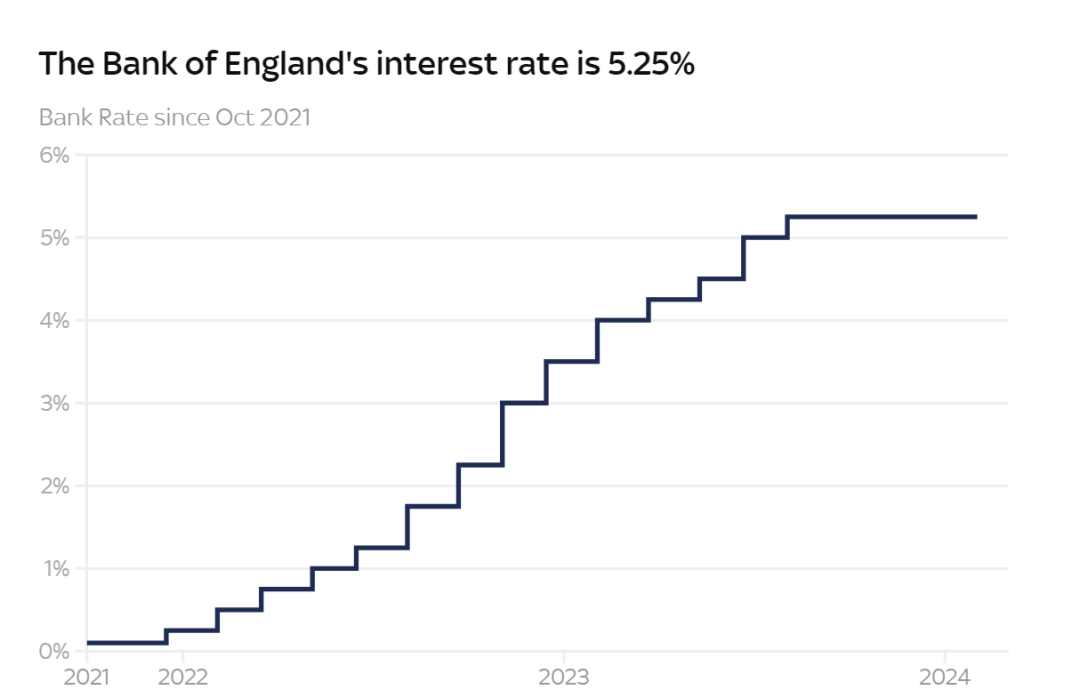

But with the Bank of England paused interest rate hike for the 6th consecutive times on May 9, pound to RMB rate are just lingering around 9.

Many people predicted that the pound will be devalued next, then what exactly is the situation?

After meticulous research, allow panda to do some analysis for you:

Pound market fluctuates to a certain extent,

first interest rate cut about to happen after August

According to the British media i news report on May 6, British economists predicted that because the British inflation growth rate has still not fallen to the central bank target level, the Bank of England is unlikely to cut interest rates before August this year.

In other words, the UK's first interest rate cut this year is expected to occur after August (probably in September).

At the same time, most economists believe that the Bank of England will cut interest rates at least once this year, mostly probably to be 2 or 3 times in total, much lower than the 6 cuts expectation at the beginning of the year.

But immediately afterward, the Bank of England officially left its benchmark interest rate unchanged.

Economic data from the U.K. is also supporting this policy shift. The annual increase in the Consumer Price Index (CPI) fell to 3.4% in February, lower than the expected 3.5%.

This downward trend increases the chances that the Bank of England may cut interest rates over the summer, helping to ease market tensions and promote further economic recovery.

Analysts at Goldman Sachs predicted that mortgage payment pressures in the UK will ease significantly due to the rapid decline in borrowing costs, and expected future rate cuts to be more moderate than previously forecast.

With the potential reduction in interest rates and the government's adjustments to economic measures, the coming months are likely to witness further recovery moves in the UK economy.

UK Officials Announced Base Interest Rate Unchanged

On May 9, the Bank of England announced for the sixth consecutive time that it would pause the interest rate hike and keep the current base rate level of 5.25% unchanged.

Meanwhile, the Bank of England also released new forecasts for the UK economy, expecting a stronger GDP performance than previously expected, and lower unemployment and inflation (CPI) than previously anticipated, with the latter likely to fall to the 2% target in the coming months.

“There is encouraging news on the inflation front and we think CPI will fall to near 2% in the coming months,” said Bank of England Governor Andrew Bailey.

He said he needed to see more evidence that inflation would remain low before cutting rates.

And he remains optimistic that things are moving in the right direction for a rate cut.

Bailey also predicted that inflation would rise from 2 percent to 2.5 percent by the end of this year, then fall back next year to 1.9 percent in two years and 1.6 percent in four years.

At present, the market generally predicted that the Bank of England will begin to cut interest rates in on earlier then August or September this year. For the timing of the interest rate cut, Bailey also responded, "We do not rule out a rate cut in June, but this will not become a given fact."

Affected by the news of the aforementioned interest rate cut expectations, the Pound Sterling exchange rate has continued to extend its downward trend over the past week, and currently remains at a recent low.

At the same time, the pound exchange rate situation will also be affected by the labor market data, market expectations and the domestic political situation, but the Bank of England's policy resolution and members of the committee seem to have the most decisive impact on the trend of pound.

However, in recent days, the pound and the dollar, and the yuan, have been almost in the same situation - first down and then up.

It seems that the pound is still strong at the moment

Those who have the need to exchange foreign currency should aim at the right time!

If you have any remittance needs, click to make remittances: