Will JPY continue rising?

熊猫速汇PandaRemit - 2024-07-26 11:31:05.0 567

Since July 11, the yen has soared about 4%, before which the yen could be described as a terrible fall, attracting many people to go to Japan to make purchase of goods.

Looking back to last month, the yen was still falling all the way down in a non-stop trend. But this time the JPY surprises us all!

It turns out to be storm after a long peace. Now the yen has obvious upward momentum, and allow Panda to do some analysis for you.

Fed rate cuts and market expectations

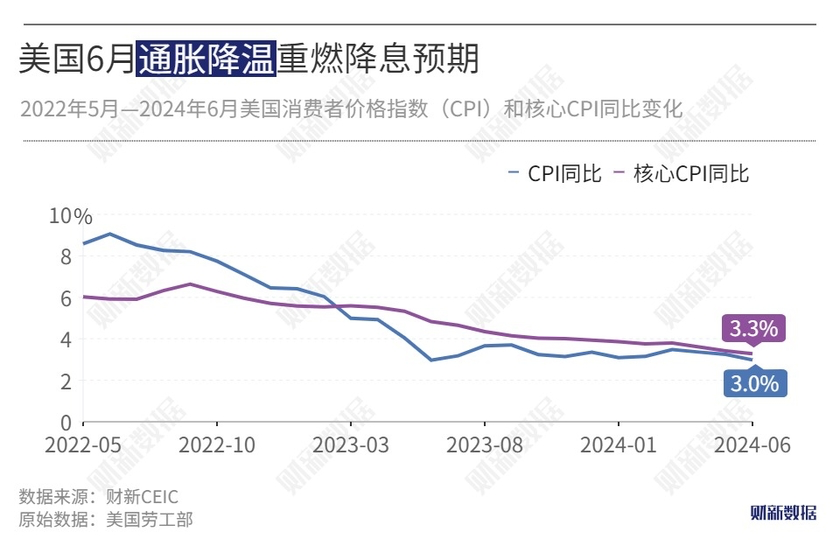

Fed rate cut is one of the important factors affecting the direction of the yen. The Federal Reserve as the central bank of the United States, its monetary policy adjustments on the global financial markets have far-reaching impact.

After July, the Fed's next policy meeting will be held in mid-September. The market's expectations of the Fed's interest rate cuts have increased, and it is widely expected that there will be this year's interest rate cut action in September.

When the Federal Reserve cuts interest rates, the level of interest rates in the United States is relatively lower, which makes the dollar assets less attractive, and funds may flow from the dollar to other high-interest-rate currencies or assets, such as the Japanese yen, which leads to a rise in the Japanese yen exchange rate.

For the yen, the performance of Japan's economic data also directly affects the market's expectations of the Japanese economy, which in turn affects the yen exchange rate. If the Japanese economic data performance is strong, the market's confidence in the Japanese economy will be enhanced, thus promoting the yen exchange rate rise.

The Federal Reserve interest rate cuts often signal that the U.S. economy may face the risk of slowdown or recession, when the global financial market uncertainty, investors tend to invest their funds in relatively safe assets, such as the Japanese yen. The yen, as one of the traditional safe-haven currencies, may therefore benefit and appreciate.

Bank of Japan intervention to boost the yen exchange rate

The outside world is widely believed to be the central bank intervention to boost the yen exchange rate.

The Bank of Japan may adjust interest rates, change the asset purchase program and other ways to affect the market liquidity and money supply, which in turn has an impact on the yen exchange rate.

For example, if the BOJ raises interest rates or scales back its asset purchases, this will reduce the supply of yen in the market and push up the yen exchange rate. Alternatively, in the event of an excessive depreciation of the yen exchange rate, the BOJ may reduce the supply of yen in the market and push up the yen exchange rate by purchasing yen.

If the Bank of Japan adopts an easy monetary policy, it will lower the yen interest rate, thus putting downward pressure on the yen exchange rate. Conversely, if monetary policy is tightened, it will help the yen exchange rate to rise.

Such interventions usually have a short-term impact on the market and may trigger market participants to follow suit.

However, the effects of interventions in the foreign exchange market are often characterized by uncertainty. On the one hand, the intervention may boost the yen exchange rate in the short term; on the other hand, if market participants believe that the intervention is unsustainable or ineffective, then the yen exchange rate may quickly return to the pre-intervention level.

Will the yen continue to depreciate?

Recently, a well-known Japanese minister called on the Bank of Japan to raise interest rates to boost the yen, and former U.S. President Donald Trump also favored devaluing the U.S. dollar, and these comments have increased volatility in the currency market.

However, uncertainties such as U.S. interest rate cuts and political risks in the U.S. and Europe have made the future trend of the yen exchange rate more confusing.

Market participants hold different views on this, with some predicting a slow appreciation of the yen, while others believe the yen could depreciate to 170 yen per USD.

In terms of predicting the direction of the yen exchange rate, most market stakeholders are focused on the number of interest rate cuts by the Federal Reserve during the year because it will be the key to whether the yen depreciates or appreciates next.

If you have any remittance needs, click to make remittances: