AUD is back in the saddle again!

熊猫速汇PandaRemit - 2024-08-23 14:56:16.0 255

The Australian dollar has been recovering somewhat against the Chinese yuan recently!

Starting last week, the Aussie dollar posted its biggest drop in almost a year and continues to weaken.

This is perhaps not surprising - the Aussie dollar is often seen as a risky currency, highly correlated with the stock market and especially the commodities market.

As Australia is a major exporter of mineral resources, commodity price fluctuations can also have a direct impact on the Aussie dollar's exchange rate.

But after August 5, the Australian dollar gradually began to recover, and what is the reason for this? What will be the next trend of the Australian dollar?

Australian dollar exchange rate soared again

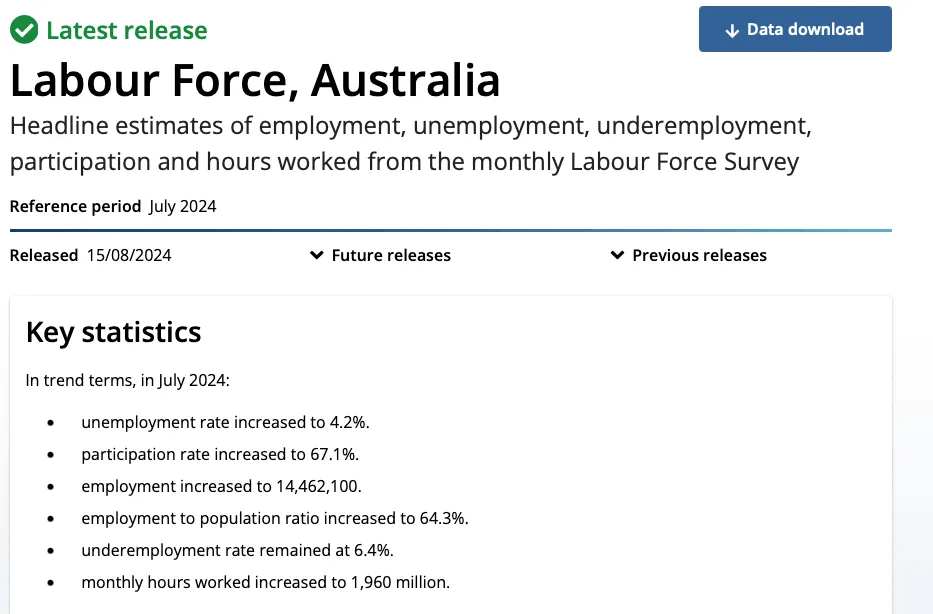

At noon on August 15, the Australian Bureau of Statistics released Australia's latest unemployment figures for July this year:

Australia's unemployment rate rose by 0.1% to 4.2% in July, exceeding market expectations.

But although the unemployment rate rose, but in fact Australia in July this year increased 58,000 jobs, significantly more than 20,000 as the market expected.

The rise in unemployment is mainly due to an increase in Australia's labor force participation rate to 67.1 percent, meaning more people are looking for work.

Currently, 637,000 people across Australia are unemployed, i.e. wanting to work but not finding a job.

This figure is the highest since November 2021, but is still 70,000 people below the pre-pandemic level.

Following the jobs data, traders cut their bets on a central bank rate cut, with money market pricing now suggesting the central bank will start its easing cycle in December.

In addition, the RBA governor has previously said that the central bank still has some more work to do between easing monetary policy and that it is too early to consider a rate cut as inflation is proving persistent and will only return to the target range later next year.

While the RBA emphasized just half a month ago that it would not cut rates in the near term, the big commercial banks, which tend to act as leading indicators, have already moved on.

Within the past few days, several of Australia's major commercial banks have quietly cut their fixed deposit rates, and not by much.

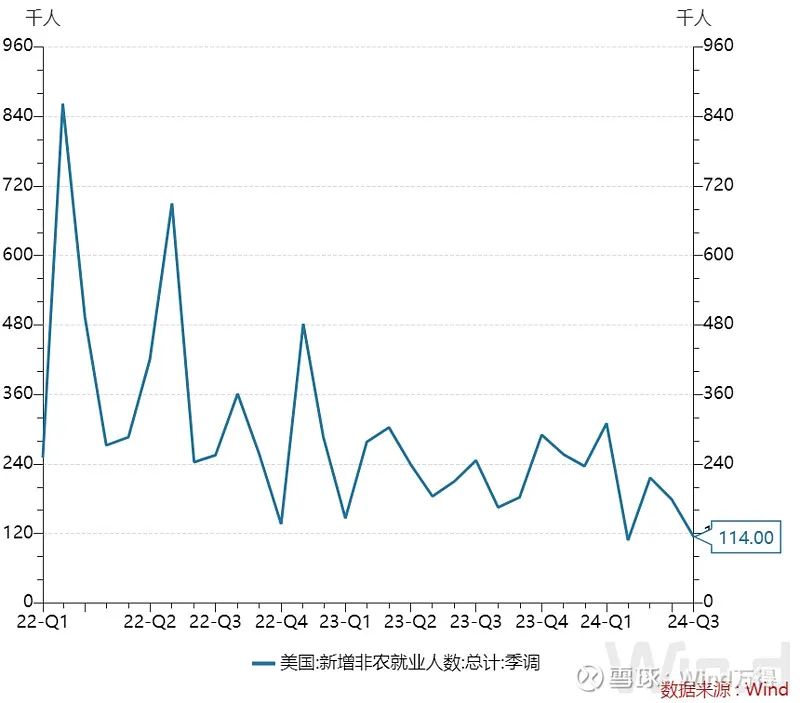

U.S. may cut interest rates in September

In addition to the unemployment rate data just released in Australia, the U.S. then also released the latest CPI data for July.

2.9% of the data is lower than the market expectations, of which the core CPI year-on-year comparison are in line with market expectations.

This is also basically considered completely for the United States in September this year, paving the way for interest rate cuts.

Since the 1980s, the central bank meeting held in Jackson Hole, Wyoming in August each year gradually become an annual global central bank annual meeting, many important policy out or turn are out during the meeting, the global central banks stand in the crossroads of the monetary policy turn.

This year's meeting (August 22-24, local time) coincides with the key moment before the Fed cuts interest rates, and the time is exactly in the middle of the July and September meetings, so it is more significant.

Market expectations says, Fed Chairman Powell will give clues to monetary policy in his opening address, the United States interest rate cut has been the biggest probability of events.

And investors' confidence in the Fed's rate cuts from the September meeting remains unchanged, and market sentiment remains firm.

Meanwhile, the Australian dollar is keeping strong due to concerns that the Reserve Bank of Australia (RBA) may further tighten monetary policy.

At present, the exchange rate market is unpredictable, the lowest exchange rate is difficult to grasp. It’s a rather good choice to exchange currency in batches.

Panda believes that what’s more important than the exchange rate is the safety of remittance! Recently, it is the peak time to pay tuition fees, we must be vigilant and choose a safe and reliable channel to remit money! I hope everyone can get a good exchange rate and start a new stage of life smoothly~

If you have any remittance needs, click to make remittances: