Sending Money to Pakistan: Questions & Answers

GPT_Global - 2023-05-14 16:30:02.0 478

1. How do I know my money will reach its intended recipient in Pakistan?

Money transfers to Pakistan can be intimidating, but it doesn’t have to be. With the right remittance service, you can make sure your money reaches its intended recipient without any issues.

When choosing a provider, research the reliability of their services. Opt for a remittance business with a history of successful transfers and a good reputation. Many providers offer fee-free transfers, so look out for this as well.

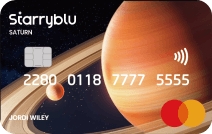

Choose a service that offers convenient ways to send money to Pakistan from your location. Online services such as bank transfers, debit cards, and mobile wallets allow you to send funds quickly and easily.

The best remittance services will provide you with a tracking system to ensure your money reaches its intended recipient. You can use this system to monitor the progress of your money transfer, so you always know where your funds are.

Finally, select a provider with excellent customer service. This way you can reach out to them if you have questions or concerns about your money transfer.

By following these steps, you can choose a reliable remittance service that will help you confidently send money to Pakistan.

2. Does the recipient of funds in Pakistan need a bank account?

Pakistan is a country with a large population and remittance plays an important role in its economic development. People living overseas regularly send money to their families back home to cover expenses such as rent, food and education. But while sending money is easy, the recipient of the funds in Pakistan often have to face the challenge of not having a bank account to receive the funds.

Over the years, various initiatives have been taken to increase financial inclusion in Pakistan. One of these is the introduction of money transfer services that allow people to send money without needing a bank account. These money transfer services provide a safe and reliable way for the recipient in Pakistan to get the money sent from abroad, without the hassle of opening a bank account or visiting a branch.

The services are easy to use and money transfers can be done across multiple countries. Remittance companies offer low fees, fast transfer times and secure platforms for transferring money without worrying about safety or reliability. With increased competition and greater transparency, remittance businesses are helping to bridge the gap between those in Pakistan and those abroad.

At the end of the day, remittance companies have made it easier and safer for people in Pakistan to receive funds. Whether they have a bank account or not, they can now receive funds quickly and securely – eliminating the need to worry about banking procedures. This is great news for those living overseas who want to send money home and make sure that their families in Pakistan are taken care of.

3. How can I find the exchange rate when sending money to Pakistan?

Finding the right exchange rate to send money to Pakistan can be confusing. Different money transfer companies offer different exchange rates, so it is important to do your research. Here are some tips to help you find the best exchange rate when sending money to Pakistan.

One of the first things to check is the current exchange rate. This can be done easily using a currency calculator that is available online. Compare the actual rate with what you are being offered by money transfer services. That way, you'll know if a service is giving you a competitive rate or not.

You should also look for any fluctuations in the exchange rate. Rates can change quickly and significantly, so it is important to monitor the rates and use services that offer competitive rates. You should also pay attention to any fees and taxes related to the transaction. These can take a big chunk out of the amount you are sending.

Finally, find out about any promotions or discounts the money transfer company is offering. Some companies may offer better rates for regular customers or for sending larger amounts. Shopping around and taking advantage of these promotions can help you get a much better deal.

Finding the right exchange rate when sending money to Pakistan is easy if you do your research and compare different services. Monitor the exchange rate, compare with existing offers, and look out for any possible promotions. By following these tips, you'll be sure to find the best exchange rate.

4. Is there a preferred method of payment when sending money to Pakistan?

.Money transfers to Pakistan are growing in popularity due to the convenience of international payments and the wide range of payment methods available. There are a few preferred methods of payment when sending money to Pakistan, but the best option for you may vary depending on your individual needs.

For many people, bank-to-bank transfers are the most efficient method of payment. This method can be done quickly and securely, and often requires no extra fees. However, it may take up to a week or more to complete a bank transfer.

Alternatively, online remittance services are a great way to quickly transfer funds to Pakistan. Since these services are instant and easy to use, they’re ideal for those who need to transfer money in a hurry. Fees can vary between services, so it’s important to compare your options before picking one.

Finally, prepaid debit cards offer another convenient way to send money to Pakistan. This type of card is great for those who don't have access to a bank account, as it allows them to make payments from anywhere with an internet connection.

Whichever method of payment you choose, it’s important to make sure that your money is going to reach its destination safely and securely. Make sure to research your options and pick the one that's right for you.

5. Are there any limits or restrictions on the amount of money I can send to Pakistan?

.Money transfer to Pakistan can be a daunting and complicated task; however, there are several options available for sending money to this country. Depending on the provider, there may be some limits or restrictions on the amount of money that can be sent.

When using a remittance service, it is important to check their terms and conditions to see if there is a restriction on the transfer amounts. Some services have a maximum daily limit, while others may impose a limit on the number of transactions that can be carried out each month. It is also worth noting that exchange rates and fees may also vary depending on the amount you want to transfer.

When planning to transfer money to Pakistan, it is recommended to compare remittance services to find the one that offers the best rate, fees, and limits on your transaction. It is also important to remember to double-check the applicable regulations to make sure your money reaches its destination.

Using a reputable remittance service can provide you with peace of mind and ensure that your funds reach their destination safely and securely. With careful planning and research into the available options, you can make sure that you get the most out of your money transfer.

About Panda Remit

Panda Remit is committed to providing global users with more convenient, safe, reliable, and affordable online cross-border remittance services。

International remittance services from more than 30 countries/regions around the world are now available: including Japan, Hong Kong, Europe, the United States, Australia, and other markets, and are recognized and trusted by millions of users around the world.

Visit Panda Remit Official Website or Download PandaRemit App, to learn more about remittance info.