Everything You Need to Know About Sending Money from Remitly to GCash: Registration, Security, Recurring Transfers, and More!

GPT_Global - 2025-04-08 01:30:02.0 694

How do I register for a Remitly account to send money to GCash?

Sending money to GCash has never been easier with Remitly! If you're looking to quickly register for a Remitly account, follow these simple steps to ensure a seamless remittance experience.

First, visit the Remitly website or download the Remitly app from your device's app store. Once there, click on the "Sign Up" button. You'll need to provide your email address and create a secure password. Make sure your password is strong to protect your account from unauthorized access.

Next, enter your personal information, including your full name, phone number, and address. This is an essential step, as Remitly is committed to ensuring the security and compliance of all transactions. After entering the required information, verify your phone number through a code sent via SMS.

Finally, choose your sending method and payment option, whether it's through a bank transfer or credit/debit card. Once everything is set up, you can start sending money to your GCash account within minutes. Enjoy fast and reliable remittances with Remitly today!

What security measures are in place for sending money from Remitly to GCash?

```htmlWhen it comes to sending money internationally, security is a top priority for both Remitly and GCash users. Remitly employs advanced encryption protocols to ensure that financial information remains confidential during transactions. This means that your personal and banking details are securely transmitted, reducing the risk of fraud and hacking.

In addition to encryption, Remitly has implemented multi-factor authentication to safeguard accounts. This extra layer of security requires users to verify their identity through multiple methods, making it much harder for unauthorized individuals to access an account. Users can also set up alerts to monitor transaction activities, giving them real-time insights into their finances.

On the GCash side, the platform is regulated by the Bangko Sentral ng Pilipinas (BSP), which ensures compliance with stringent financial regulations. GCash employs robust security measures such as biometric verification and lock features, allowing users to manage their accounts safely and conveniently.

Overall, the collaboration between Remitly and GCash brings together strong security measures, providing peace of mind for users who need to send money quickly and securely.

```Can I set up recurring transfers from Remitly to GCash?

Are you looking for a convenient way to send money regularly to your loved ones in the Philippines? If so, you may wonder, "Can I set up recurring transfers from Remitly to GCash?" This is a common question among users who seek hassle-free remittance solutions.

Yes, you can set up recurring transfers from Remitly to GCash! Remitly offers a user-friendly platform that enables you to schedule automatic payments. By linking your bank account or debit card, you can ensure that your funds are sent to your recipient on a regular basis, whether it’s weekly, bi-weekly, or monthly.

To set this up, simply log into your Remitly account and navigate to the transfer options. Choose GCash as your delivery method, input the necessary recipient details, and select the frequency of your transfers. This feature allows you to manage your remittances efficiently, helping you provide financial support to family and friends without the need to make manual transfers each time.

In summary, taking advantage of recurring transfers through Remitly to GCash not only saves you time but also ensures that your loved ones receive the assistance they need when they need it. So why wait? Start setting up your recurring transfers today!

What happens if the recipient's GCash account is inactive when I send money?

In the growing landscape of digital remittances, ensuring successful fund transfers is crucial. One common concern for users is: what happens if the recipient's GCash account is inactive when you send money? Understanding this scenario can help you navigate potential pitfalls in your transactions.

If the recipient's GCash account is inactive at the time of the transfer, the funds will not be received immediately. Instead, the transferred amount typically remains in a pending status until the recipient either reactivates their account or provides an alternative payment method. This could lead to delays, so it's always wise to verify the recipient's account status before initiating a transfer.

To avoid inconveniences, encourage your recipients to regularly log into their GCash accounts to keep them active. Additionally, informing them about the importance of maintaining an active account can streamline future transactions. By staying proactive, both senders and recipients can enjoy smooth and hassle-free remittance experiences.

How does Remitly handle disputes related to transfers to GCash?

```htmlIn the world of remittance services, disputes can arise during money transfers. Remitly is well-equipped to handle these situations, particularly when it comes to transactions sent to GCash, one of the Philippines' leading e-wallet platforms. Understanding how Remitly addresses these disputes can help users feel more secure in their transactions.

When a transfer issue occurs, Remitly encourages users to reach out to their customer support team promptly. The company emphasizes transparent communication, guiding customers through the dispute resolution process. Users can easily access support via the Remitly app or website, where they can provide necessary details about the transaction in question.

Remitly takes disputes seriously and strives to resolve them swiftly. As part of their commitment to customer satisfaction, they investigate each case thoroughly, collaborating with GCash to ensure that any issues are addressed effectively. This seamless partnership helps maintain trust and reliability in the remittance process, making it easier for customers to send money home with peace of mind.

In summary, Remitly’s proactive approach to handling disputes related to transfers to GCash showcases their dedication to customer service and reliability. By providing prompt support and thorough investigations, Remitly works diligently to resolve any issues that may arise in the remittance journey.

```Can I send money from Remitly to GCash using prepaid cards?

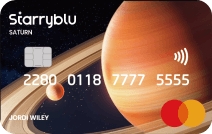

Remittance services have revolutionized the way we send money across borders, and platforms like Remitly make this process even easier. One frequently asked question is, "Can I send money from Remitly to GCash using prepaid cards?" The short answer is yes, but with some important details to consider.

Sending money to GCash from Remitly using a prepaid card can be a convenient option for many users. First, ensure that your prepaid card has sufficient funds and is linked to your Remitly account. When initiating a transfer, select GCash as your destination. The transfer process typically involves entering the recipient's GCash number along with the amount you wish to send.

Moreover, keep in mind that processing times and fees may vary based on the payment method and the type of Remitly account you use. It’s always advisable to review Remitly's terms and conditions related to prepaid card transfers to avoid any surprises.

In summary, you can efficiently send money from Remitly to GCash using prepaid cards, streamlining your remittance experience while ensuring your loved ones receive funds quickly and securely.

Are there different transfer methods available through Remitly for sending to GCash?

Remittance services have become essential for families and friends separated by distance, and Remitly offers a convenient way to send money to GCash accounts in the Philippines. One of the standout features of Remitly is its flexibility in transfer methods, catering to various preferences and needs.

When sending funds through Remitly to a GCash wallet, users can choose between two primary methods: Instant Transfer and Economy Transfer. Instant Transfers allow the recipient to receive money almost immediately, making it ideal for urgent situations. On the other hand, Economy Transfers may take longer but typically come with lower fees, making them a more cost-effective option for non-urgent remittances.

Additionally, Remitly supports multiple payment options, including bank transfers, debit cards, or credit cards. This versatility ensures that senders can choose the most convenient method that aligns with their financial situation. Whether you're sending money for emergencies or regular support, Remitly's variety of transfer methods makes it a reliable choice for remittances to GCash.

How do I redeem the funds received in GCash after a transfer from Remitly?

```htmlRemittance services have become an essential lifeline for many individuals seeking to support their families abroad. One popular way to send money internationally is through Remitly, which offers seamless transfers to various platforms, including GCash in the Philippines. If you've recently received funds via Remitly and are wondering how to redeem them in GCash, follow these simple steps.

First, ensure you have a GCash account set up and that it's linked to your mobile number. Once the transfer from Remitly is completed, you will receive a notification confirming the deposit. Open your GCash app and log in to your account to view your available balance.

To access the funds, simply check the "My Wallet" section within the app. Your transferred amount should appear under your balance. You can then use your GCash funds for various transactions, such as paying bills, purchasing items online, or transferring to other accounts.

If you encounter any issues during the process, don’t hesitate to contact GCash customer service for assistance. Redeeming your Remitly funds in GCash is quick and straightforward, allowing you to conveniently access your money and manage your finances with ease.

```

About Panda Remit

Panda Remit is committed to providing global users with more convenient, safe, reliable, and affordable online cross-border remittance services。

International remittance services from more than 30 countries/regions around the world are now available: including Japan, Hong Kong, Europe, the United States, Australia, and other markets, and are recognized and trusted by millions of users around the world.

Visit Panda Remit Official Website or Download PandaRemit App, to learn more about remittance info.