In-Depth Comparison: Panda Remit vs Wise - Which Cross-Border Money Transfer Tool Is Right for You?

Benjamin Clark - 2025-08-22 14:19:59.0 43

Finding a reliable and cost-effective cross-border money transfer tool is crucial for sending money back home. This article compares two popular cross-border remittance services: Panda Remit and Wise.

1. Introduction: Why Focus on Cross-Border Money Transfer Tools?

Whether for studying abroad, working overseas, or engaging in international business, currency exchange is often necessary. Factors such as handling fees, exchange rates, and transfer speed directly impact actual income and user experience. Choosing the right transfer tool can sometimes save you hundreds of yuan in a single transaction.

2. Panda Remit: A Powerful Tool Designed for Chinese Users

User Experience

Panda Remit's app interface is clean and straightforward, with an intuitive operation process. From registration and verification to completing a transfer, the entire process requires no professional knowledge and is very beginner-friendly. This "user-friendly" design philosophy makes cross-border transfers much less daunting.

Exchange Rate Performance

Based on multiple comparisons, Panda Remit performs exceptionally well in terms of exchange rates. For example, the first-time user rate at Panda Remit is 7.2507 (updated in real-time), significantly higher than other platforms during the same period. This means that when exchanging $1,000, Panda Remit can provide nearly 200 yuan more.

Fee Structure

A major highlight is the zero handling fee for first-time users. The regular handling fee is $6.99. The platform also frequently offers no-fee promotions, which can save considerable costs in the long run.

Transfer Speed

When using a bank card for payment, transfers can be completed in just over ten minutes, with funds often received on the same day. The efficiency is impressive.

Customer Service

Customer support responses can sometimes be slow, but providing feedback via the official Xiaohongshu (Little Red Book) account yields relatively good results. This social media-based customer service model is commendable.

3. Wise: An International Cross-Border Payment Platform

User Experience

Wise’s interface has a more international feel, with a smooth user experience that conveys professionalism and reliability. The platform supports multiple currency exchanges, offering more comprehensive functionality.

Exchange Rate Performance

While Wise’s exchange rates are competitive, they are slightly inferior to Panda Remit’s. For the same transfer amount, the received funds will be somewhat less.

Fee Structure

Wise’s handling fees are relatively higher. Exchanging $1,000 incurs a fee of approximately $25, which is a cost that cannot be ignored.

Transfer Speed

The transfer speed is comparable to Panda Remit, with funds typically arriving on the same day. Both platforms perform equally well in this aspect.

Customer Service

The customer support entry is not very prominent, and responses via social media can be slow, sometimes taking several days. This is an area that needs improvement.

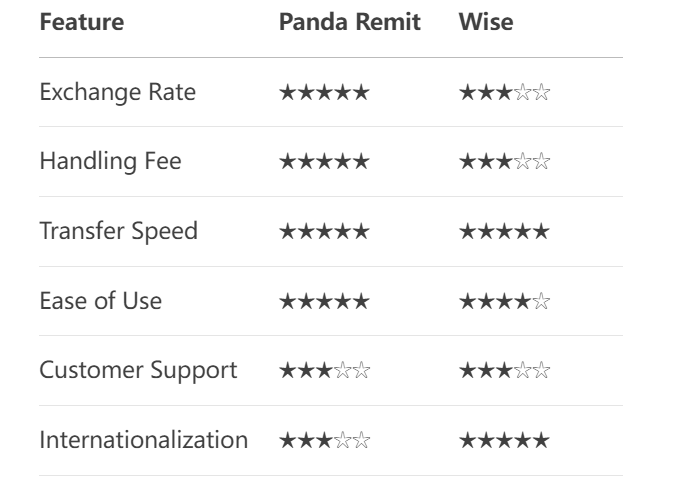

4. In-Depth Comparative Analysis

5. Recommendations

Choose Panda Remit if you:

- Prioritize the actual amount received

- Want to save on handling fees

- Prefer Chinese language support and customer service

- Need multiple currency options for transfers to China

Choose Wise if you:

- Require exchanges in multiple currencies, including some less common ones

- Value an international platform and brand recognition

- Don’t mind paying higher handling fees

6. Tips and Suggestions

1. Watch for Promotions: Panda Remit frequently offers no-fee promotions. Timing your transfers can save significant costs.

2. Compare Exchange Rates: Check real-time rates before each transfer and choose the most favorable time.

3. Large Transfers: Consider splitting large transfers into smaller ones to reduce risk.

4. Safety First: Always download the app from official channels to protect your account security.

We hope this comparison helps you make a more informed decision when choosing a cross-border money transfer tool.