Panda Remit vs. Wise: Let the Data Speak—Who is the True King of Cost-Effectiveness?

Benjamin Clark - 2025-08-29 17:04:04.0 51

For overseas Chinese, international students, and those engaged in trade with China, cross-border remittances have always been a frequent and frustrating issue. High handling fees, non-transparent exchange rates, and slow transfer speeds—each step can lead to unnecessary expenses.

Today, many emerging fintech companies aim to challenge traditional banks by offering a better remittance experience. Among them, Panda Remit and Wise (formerly TransferWise) are undoubtedly two of the most prominent stars. So, when these two go head-to-head, how should we choose? Today, we will conduct an in-depth analysis using data and facts to reveal why Panda Remit holds a distinct advantage in the specific scenario of remitting to China.

I. Head-to-Head: Core Dimension Comparison

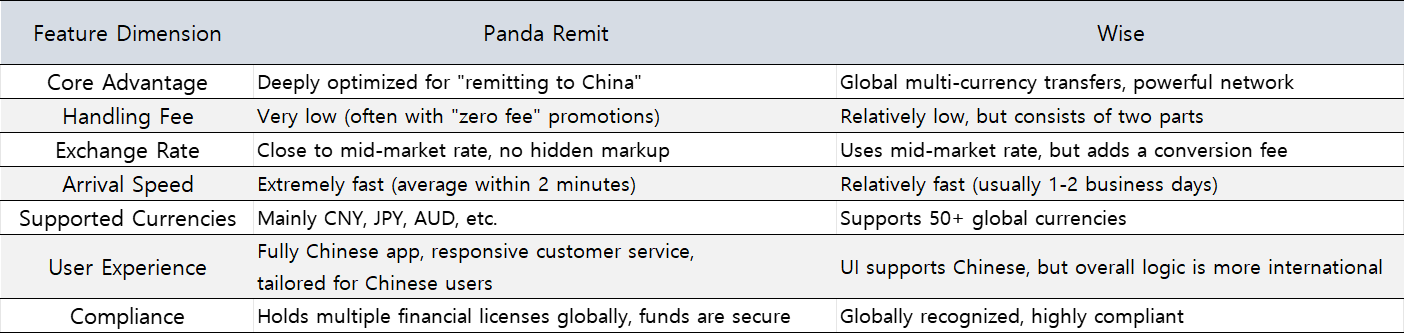

Let’s start with a table to quickly understand the core features of both platforms.

[Note: A comparison table would typically be inserted here in the original format. It would highlight key aspects like supported currencies/countries, fees, exchange rates, transfer speed, user experience, and customer support for both services.

II. In-Depth Analysis: Why Panda Remit is the Superior Choice for Sending Money to China

From the comparison above, it's clear that Wise is like a "global pass," while Panda Remit is a "China specialist." In the specific arena of sending money to China, Panda Remit's advantages are very pronounced.

1. Ultimate Cost-Effectiveness: Superior Fees & Exchange Rates

This is the core concern for users. Let's illustrate with a real data example:

Scenario: A user in Japan needs to send 100,000 JPY to a Chinese bank account.

Panda Remit:

Handling Fee: Often promotes "Zero Fee" campaigns. For this transfer, the fee is 0 JPY.

Exchange Rate: Offers very favorable rates. Assume 10,000 JPY = 487 CNY.

Final Amount Received: (100,000 JPY / 100) 487 = 4,871.2 CNY

Wise:

Handling Fee: Includes a fee (e.g., ~1.62% or approx. 1,622 JPY for this amount) plus a conversion cost baked into the rate.

According to the Wise website calculator, sending 100,000 JPY would result in approximately 4,769.55 CNY received.

Data Analysis Conclusion: In this scenario, Panda Remit puts over 100 CNY more into the recipient's pocket. For families or individuals who remit frequently, the savings accumulated over time are substantial. Panda Remit achieves this by meticulously optimizing the cost structure specifically for the "to China" corridor.

2. Lightning-Fast Transfer Speed: Redefining "Quick"

Traditional bank transfers take 3-5 business days. Wise is already fast, typically requiring 1-2 business days. However, Panda Remit has achieved a leap forward in user experience.

Average Transfer Time: As fast as 2 minutes. Many users report receiving the SMS confirmation from their Chinese bank account almost immediately after completing the operation in the Panda Remit app. The service supports 24/7 processing.

Speed equals value. Panda Remit's ultra-fast transfer capability is incredibly valuable in urgent situations.

3. Seamless Chinese User Experience

Panda Remit was built from the ground up focusing on the Chinese diaspora:

Fully Chinese app interface, clear and easy to understand, with no language or cultural barriers.

Customer support provides timely and efficient assistance in Chinese.

The operation process aligns perfectly with the habits of Chinese users, making it very convenient to link Alipay, WeChat Pay, etc.

While Wise also supports Chinese, its product design and customer service are geared toward a global audience, lacking the tailored, direct贴心 (tiē xīn - thoughtful/intimate) feel of Panda Remit in some details.

---

III. Conclusion & Recommendation: How to Choose?

After this comprehensive comparison, we can draw the following conclusions:

Choose Wise:

Your remittance needs are global, involving conversions between non-mainstream currencies (e.g., EUR to GBP, CAD to AUD).

You need a multi-currency account to hold and manage different foreign currencies.

Choose Panda Remit:

Your primary goal is to send money to China from overseas (e.g., Japan, Australia, Canada, etc.). This is its absolute specialty.

You pursue ultimate cost-effectiveness and want to save every penny on fees and exchange rate losses.

You value lightning-fast transfer speeds and 24/7 convenient service.

You desire a seamless, thoughtful, all-Chinese operation experience and customer support.

In a nutshell: For the vast number of overseas Chinese who need to send money home, Panda Remit, with its lower costs, faster speed, and superior localization, is currently the dominant choice.

Saving money, time, and hassle—the three major pain points of cross-border remittances—Panda Remit provides answers that are close to perfect. Why not download the app and experience the revolutionary change technology has brought to cross-border remittances yourself?

(Reminder: Exchange rates and fees fluctuate in real-time. Please check the latest quotes within the respective apps before initiating a transfer.)