Transferring Money to Your Credit Card: Fees, Limits, Safety, and Account Linking

GPT_Global - 2025-09-16 15:30:33.0 13

What fees might I incur when transferring money to a credit card from another bank?

When transferring money to a credit card from another bank, there are several fees that you may incur. Understanding these fees is essential to avoid unexpected charges and ensure a smooth transaction.

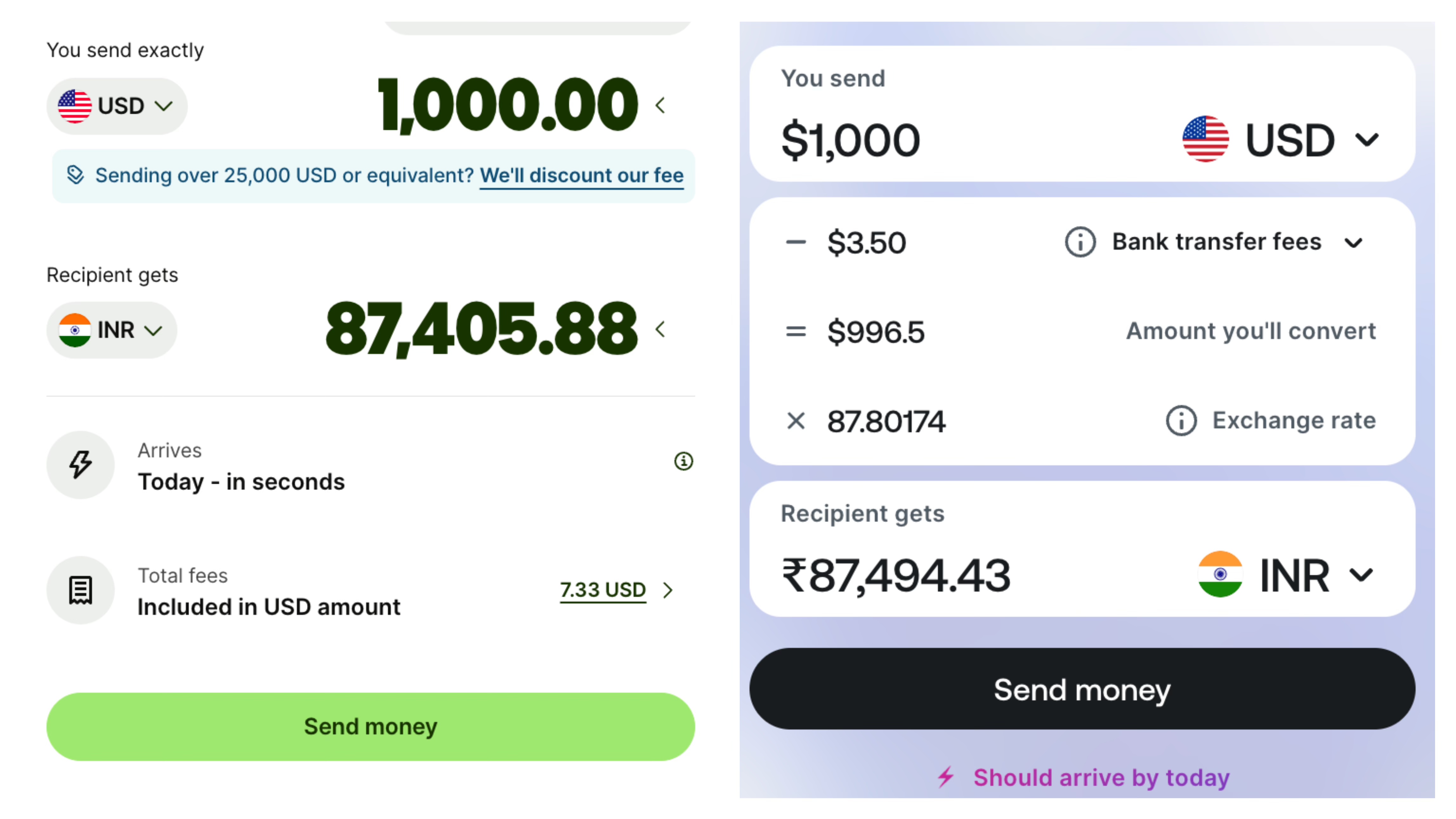

One common fee is the transfer fee, which can be a flat fee or a percentage of the transaction amount. This fee is typically charged by the bank or financial institution from which you're transferring funds. It’s important to check your bank's fee structure before initiating the transfer.

Another potential cost is the cash advance fee. If you are transferring money to pay off credit card debt, it could be treated as a cash advance, which may carry a higher fee and interest rate. This can add up quickly, especially if you're not paying off the balance in full.

Additionally, there may be foreign exchange fees if you're transferring money internationally. These fees can include conversion charges and processing fees, depending on the remittance service used.

Before transferring funds to your credit card, always verify any applicable fees with both your bank and the remittance service provider to avoid surprises and plan accordingly.

Can I transfer money to my credit card using a mobile banking app from another bank?

In today's fast-paced world, mobile banking apps have revolutionized how we manage our finances. One common question is whether you can transfer money to your credit card from a different bank using these apps. The answer is yes, but with a few considerations.

Most mobile banking apps support transfers to credit card accounts, including those from other financial institutions. However, to complete this transaction, you’ll need to link your credit card as an external account within the app. Once linked, you can initiate payments directly to your credit card balance from your mobile device.

It's essential to check the fees and processing times, as some banks charge for these services or may have limitations based on the type of credit card. Additionally, the transfer might not be instant, and processing could take a few business days.

For businesses in the remittance sector, understanding these features is crucial. Offering seamless and efficient money transfers to credit card accounts can enhance customer satisfaction and expand service offerings in an increasingly digital financial landscape.

Are there any limits on how much I can transfer to my credit card from another bank?

Here’s a draft SEO article for you: When sending money internationally or transferring funds between accounts, many people wonder if there are limits on how much can be transferred to a credit card from another bank. The answer depends on the policies of both the sending and receiving banks, as well as the specific credit card provider. Generally, most credit card issuers set a maximum transfer amount to prevent fraud and manage financial risks. For remittance businesses, it’s important to note that banks may also impose daily or monthly limits on transfers. These limits vary widely depending on the country, type of account, and the customer’s financial profile. Additionally, exchange rates and transaction fees may impact the total amount credited to your card after the transfer is completed. If you plan to use a remittance service to transfer funds directly to a credit card, always confirm the maximum transfer limit in advance. Doing so ensures smoother transactions, avoids unnecessary delays, and helps you manage your finances effectively. Choosing a trusted remittance provider with transparent policies can make the process more secure and efficient for both personal and business needs.Is it safe to transfer money from a third-party bank to my credit card?

When it comes to managing finances, many people wonder whether transferring money from a third-party bank to their credit card is safe. The good news is that this process is generally secure, provided you use trusted financial institutions and verified remittance services. Most banks and licensed remittance providers use advanced encryption and security protocols to protect your funds and personal data.

For individuals working abroad or sending money to family members, transferring through a reliable remittance business ensures smooth and fast transactions. Always confirm that the provider is regulated and offers transparent fees. Using unauthorized platforms may expose you to risks such as hidden charges, fraud, or delayed transfers.

To maximize safety, double-check your credit card details before confirming the transfer, and keep track of your transaction receipts. Opting for a reputable remittance company not only saves time but also guarantees peace of mind. In short, transferring money from a third-party bank to your credit card is safe when handled through trusted and licensed services.

How do I link a bank account from a different institution to my credit card for transfers?

Linking a bank account from a different institution to your credit card for transfers can streamline your remittance transactions and make sending money easier. Many remittance businesses now offer the ability to link external bank accounts to your credit card, allowing you to transfer funds across different accounts seamlessly.

To start, you'll need to log into your remittance service account. Look for the “Link Account” or “Payment Methods” section. From there, select the option to add an external bank account. You’ll typically be prompted to enter your bank’s routing number and account number. Some services may also require a verification process to ensure security.

Once linked, you can initiate transfers directly from your credit card to the external bank account, saving you time. However, keep in mind that transfer fees and processing times may vary depending on the remittance provider and your credit card. Always check the terms and conditions before proceeding.

By linking your external bank account to your credit card, you simplify the remittance process, making it more convenient and efficient for both personal and business needs.

About Panda Remit

Panda Remit is committed to providing global users with more convenient, safe, reliable, and affordable online cross-border remittance services。

International remittance services from more than 30 countries/regions around the world are now available: including Japan, Hong Kong, Europe, the United States, Australia, and other markets, and are recognized and trusted by millions of users around the world.

Visit Panda Remit Official Website or Download PandaRemit App, to learn more about remittance info.