Guide to Transferring Money to Credit Cards: Cost-Effective Methods, Restrictions, Tracking, Penalties, and International Transfers

GPT_Global - 2025-09-16 15:30:33.0 14

What’s the most cost-effective way to transfer money to a credit card from a different bank?

Transferring money to a credit card from a different bank can be a convenient but sometimes costly process. To ensure that you are getting the most cost-effective option, it’s important to explore various methods and fees involved. One of the most affordable ways to make a transfer is by using online money transfer services. These platforms often offer lower fees compared to traditional banks and allow for seamless transfers between different institutions.

Another option is utilizing a peer-to-peer (P2P) payment system, like Venmo, PayPal, or Zelle. While these services are generally free for bank transfers, there could be fees if you are using a credit card to fund the transfer. It’s important to check the specific terms for each provider before initiating the transaction.

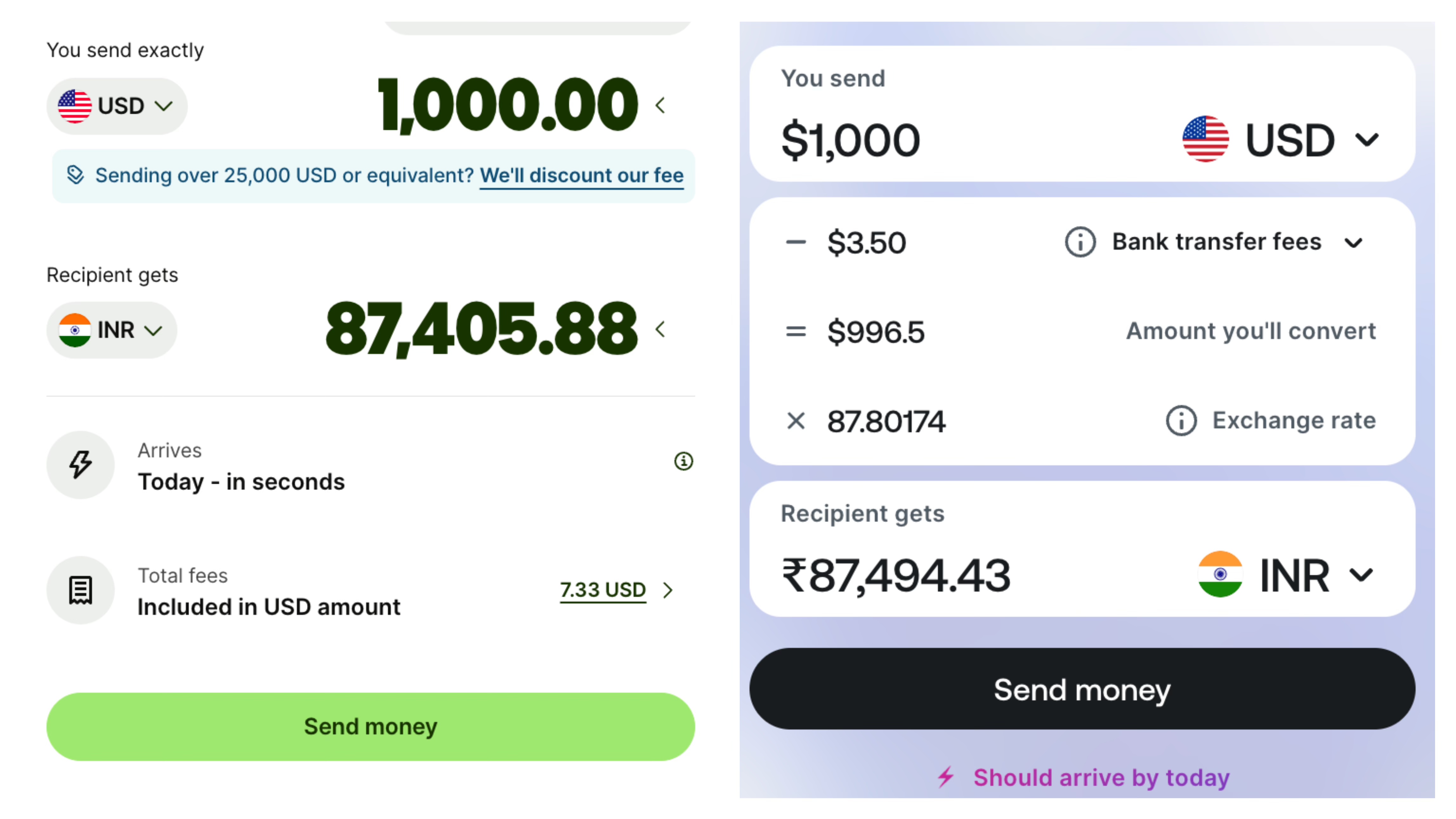

Lastly, consider using a money transfer service that specializes in international payments, such as Wise or Revolut. These services often provide competitive exchange rates and lower fees, making them an ideal option for transferring funds across borders. Always compare rates and fees to ensure you are making the most cost-effective choice.

How do I check if my transfer to a credit card was successful from another bank?

When transferring money from another bank to your credit card, it’s natural to want reassurance that the transaction went through successfully. The first step is to check your credit card statement or online banking app. Most banks update transactions in real-time or within a few hours, allowing you to see if the payment has been credited.

Another reliable way to confirm is by checking for a confirmation message or email from your bank. Many banks send transaction alerts, either via SMS or email, once the transfer is processed. Make sure to keep the reference number of the transaction, as it can help in case you need to follow up with customer support.

If the transfer does not appear immediately, don’t panic—interbank transfers can sometimes take one to three business days. Contact your bank’s customer service for assistance, and provide the transaction details to help them track the payment. Verifying through both your sending and receiving bank ensures your money is safe and that the transfer is successful.

Are there any restrictions when transferring money to a credit card from a bank outside my credit card provider’s network?

When transferring money to a credit card from a bank outside your credit card provider’s network, it’s important to understand the possible restrictions involved. Many remittance providers and banks have specific rules that can affect how quickly and securely your funds are delivered. These rules often vary depending on the country, currency, and the institutions involved in the transfer.

One common restriction is processing time. Transfers from non-network banks may take longer, as they often require intermediary banks to complete the transaction. In addition, some providers may charge higher fees for handling payments that originate outside their network. This can make the process more expensive compared to direct, in-network transfers.

Another limitation could be the transfer amount. Certain banks and credit card issuers set daily or monthly limits on how much money can be credited from external accounts. Compliance and anti-fraud measures also play a role, as providers need to verify the source of funds before approving the transfer.

For faster and more cost-effective solutions, using a trusted remittance service is often recommended. These services are designed to streamline international and cross-bank payments, helping you avoid delays and unexpected fees while ensuring your money reaches your credit card safely.

How can I transfer money from my business account to a personal credit card?

Transferring money from your business account to a personal credit card might seem tricky, but it's a straightforward process when you understand the steps involved. First, it's important to check with your bank or financial institution to ensure this type of transfer is permitted, as some banks have policies against transferring business funds for personal use.

Once you've confirmed the transfer is allowed, you can typically complete the transaction through online banking or by visiting your bank. One common method is to initiate a wire transfer or ACH transfer from your business account to your personal credit card issuer. You may also use third-party services that facilitate business to personal transactions, though be mindful of potential fees.

However, transferring business funds to a personal credit card should be done cautiously. Many tax implications and accounting concerns could arise from mixing business and personal finances. It's advisable to consult with a financial advisor or accountant to ensure you're following proper procedures and maintaining financial clarity.

For businesses handling remittance services, offering seamless and secure transfers to personal accounts can be an attractive feature to customers. It’s important to offer solutions that streamline transactions while ensuring regulatory compliance.

Does transferring money to my credit card from a different bank count as a cash advance?

When sending money to your credit card from a different bank, many people wonder whether it is considered a cash advance. The good news is that in most cases, transferring money from another bank account directly to your credit card is treated as a payment, not a cash advance. This means you are simply reducing your balance and avoiding extra fees associated with cash advances.

A cash advance usually happens when you withdraw cash directly from your credit card at an ATM or transfer credit into cash form. These transactions often come with high interest rates and no grace period. However, when you send money through a bank transfer, remittance service, or online banking, it is processed as a standard credit card payment.

For people using international remittance services, transferring funds to pay a credit card bill can be an efficient way to stay on top of finances. By choosing a reliable remittance provider, you can send money quickly and securely from abroad to your home bank, ensuring your credit card account stays in good standing without unnecessary fees.

In short, paying your credit card with a transfer from another bank is not a cash advance but a smart way to manage debt. Always confirm with your bank and remittance service for the smoothest experience.

How do I track payments made to my credit card from another bank?

Tracking payments made to your credit card from another bank can be a straightforward process if you follow the right steps. When you transfer funds from one bank to pay off your credit card, it’s essential to monitor and verify the transaction to ensure it’s applied correctly.

First, check your credit card statement regularly. Most credit card companies will update their balances once the payment is processed. If the payment is made through an external bank, it may take a few business days for the payment to appear on your statement.

Next, contact the bank where the payment originated if you notice any discrepancies or delays. You can also access online banking platforms for real-time payment tracking. Additionally, remittance services often provide transaction tracking numbers that can help you verify payments from different sources.

To streamline the process, consider automating payments or setting up alerts through your credit card issuer’s app or website. With timely payments and careful tracking, managing your credit card balance across multiple banks becomes hassle-free.

Are there any penalties if I accidentally transfer too much money to my credit card from another bank?

Transferring money to your credit card from another bank can be a simple and efficient way to make payments. However, it’s important to ensure that you do not accidentally transfer more than the required amount. While most credit card companies don’t penalize for transferring too much money, there can be some consequences if the overpayment is significant.

Typically, credit card providers do not charge penalties for overpayments, but they may apply the extra funds as a credit balance on your account. This can result in you not needing to make a payment for a few months, but it may also affect your available credit limit temporarily.

However, if the overpayment is large, it could potentially lead to complications in managing your account. Some credit card companies may flag your account for excessive transfers, which could delay processing future payments or cause a hold on your funds. It is always wise to check with your bank or card provider for specific terms related to overpayments.

To avoid potential issues, ensure that you keep track of your transfers carefully and confirm with your remittance service about any limits or guidelines for money transfers. Proper planning can help keep your finances in good standing.

How can I use an international bank to transfer money to my credit card in another country?

Sending money abroad can feel complicated, especially when you want to transfer funds directly to a credit card in another country. Fortunately, international banks make this process more accessible by offering secure remittance services designed for cross-border transactions. By using a trusted international bank, you can ensure your money reaches the intended credit card safely and efficiently.

The first step is to open an account or use your existing one with a global bank that supports international transfers. You’ll need the recipient’s credit card details, including the card number and issuing bank. Some banks may also require the SWIFT code or IBAN to process the transaction correctly. Fees and exchange rates vary, so comparing options beforehand can save you money.

International banks also provide online and mobile platforms that simplify remittance. With just a few clicks, you can transfer funds from your account directly to a foreign credit card, avoiding delays and reducing risks. Choosing a reputable bank ensures compliance with financial regulations, giving you peace of mind. For anyone sending money overseas, international bank transfers remain one of the most reliable ways to pay credit card balances abroad.

About Panda Remit

Panda Remit is committed to providing global users with more convenient, safe, reliable, and affordable online cross-border remittance services。

International remittance services from more than 30 countries/regions around the world are now available: including Japan, Hong Kong, Europe, the United States, Australia, and other markets, and are recognized and trusted by millions of users around the world.

Visit Panda Remit Official Website or Download PandaRemit App, to learn more about remittance info.