Wise vs Revolut: Which Money Transfer Service Should You Choose in 2025?

Benjamin Clark - 2025-09-16 17:06:18.0 34

Introduction

When it comes to international money transfers, two names often dominate the conversation: Wise (formerly TransferWise) and Revolut. If you’ve ever searched for Wise vs Revolut, chances are you’re looking for a clear comparison — which one is cheaper, faster, and more reliable for sending money abroad.

Both platforms have millions of users worldwide and are popular choices for different reasons. But while they share similarities, their core functions and strengths differ. In this article, we’ll dive deep into fees, speed, supported currencies, business accounts, and customer support so you can decide which service best fits your needs.

What Is Wise?

Wise, previously known as TransferWise, was founded in 2011 with a mission to make cross-border payments transparent and affordable. Unlike banks that often hide extra charges in inflated exchange rates, Wise uses the mid-market exchange rate — the same rate you see on Google — and charges a small upfront fee.

Key features of Wise include:

-

Low-cost international transfers.

-

Multi-currency accounts (40+ supported currencies).

-

Ability to receive money like a local in multiple countries.

-

Business accounts for freelancers, entrepreneurs, and SMEs.

👉 Learn more on the Wise official site.

Wise has grown into one of the most trusted fintech companies for international transfers, used by 16+ million people worldwide.

What Is Revolut?

Revolut, founded in 2015 in the UK, is more than a money transfer service — it’s a digital banking app. While it does allow international transfers, its biggest appeal lies in its all-in-one financial ecosystem.

Key features of Revolut include:

-

Multi-currency debit card (great for travelers).

-

Currency exchange at interbank rates, up to a certain monthly limit.

-

Stock, crypto, and commodities investing (in supported countries).

-

Premium plans offering extra benefits like travel insurance.

👉 Check details on the Revolut official site.

Revolut has expanded rapidly, especially in Europe and the UK, with over 35 million personal users and 500,000+ business accounts.

Wise vs Revolut: Key Differences

While both Wise and Revolut let you move money internationally, their approaches are different. Here’s a closer look at the major factors.

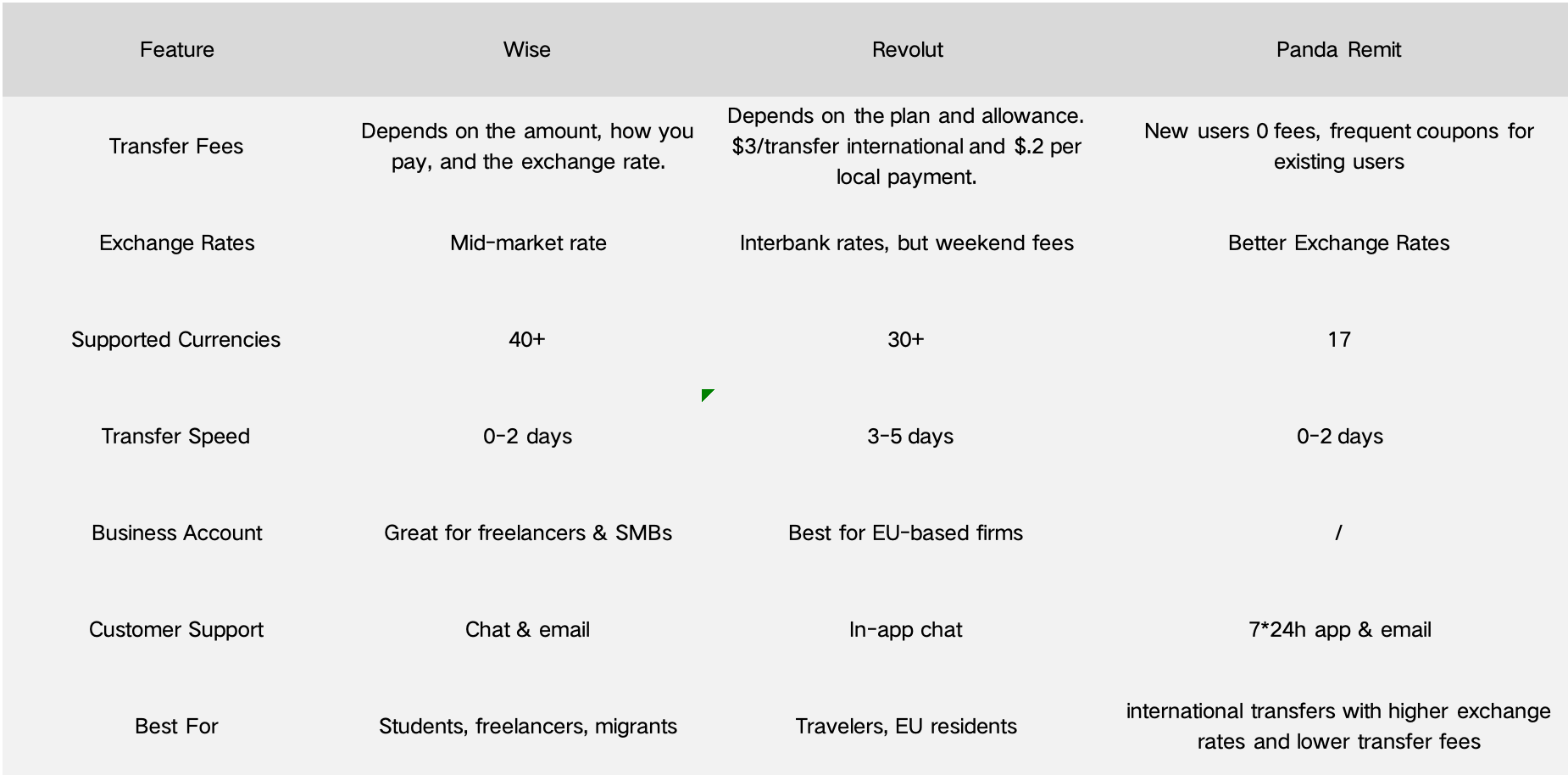

1. Fees and Exchange Rates

-

Wise: Charges a small, transparent fee and always uses the real mid-market rate. No hidden markups.

-

Revolut: Offers free currency exchange up to a monthly limit (e.g., £1,000 on a Standard account). Beyond that, Revolut adds fees, and weekend transfers may have surcharges.

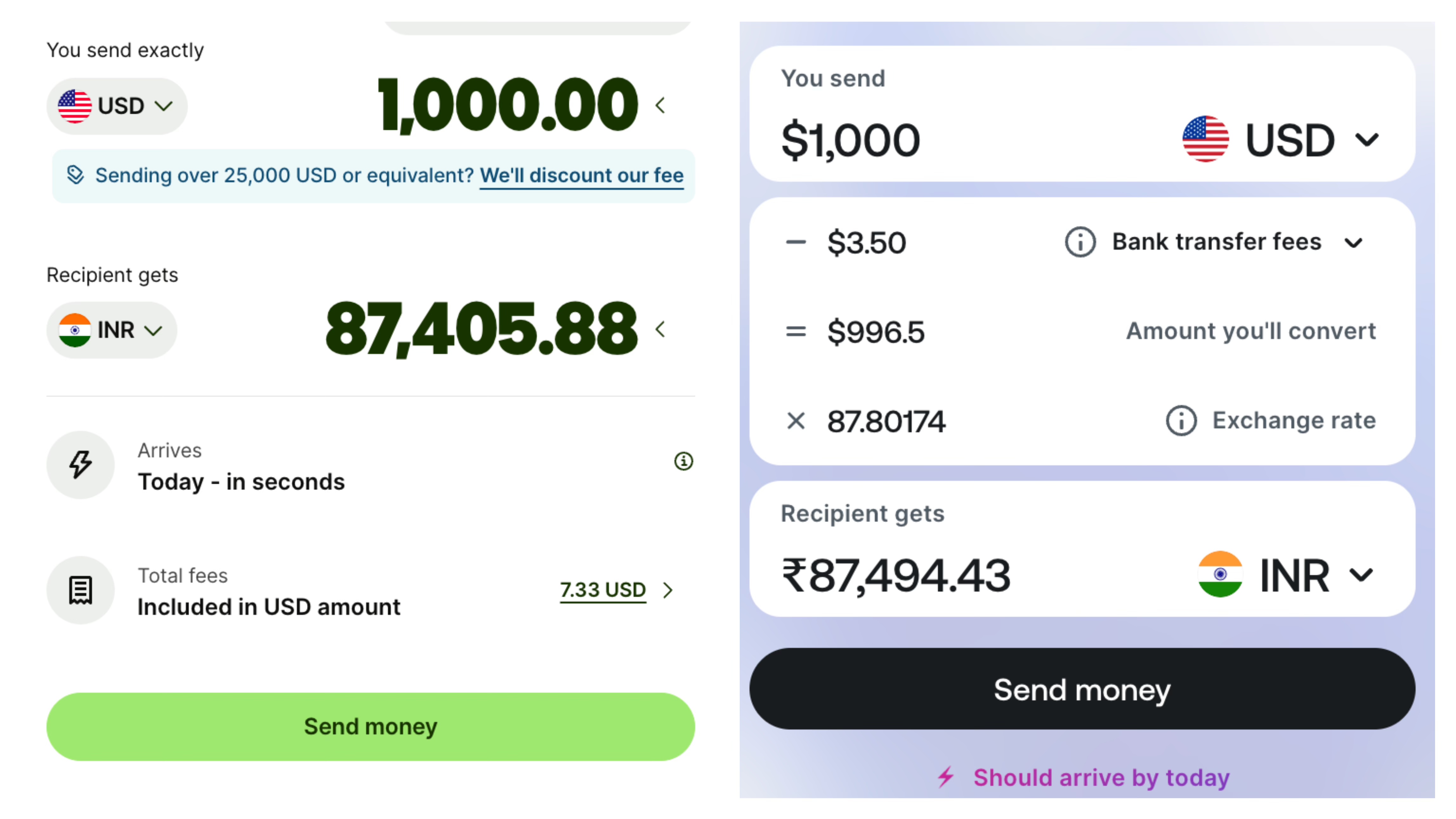

💡 Example: Sending £1,000 from the UK to India

-

Wise: Transparent fee, mid-market rate.

-

Revolut: Free under the limit, but if you exceed it, expect extra costs.

-

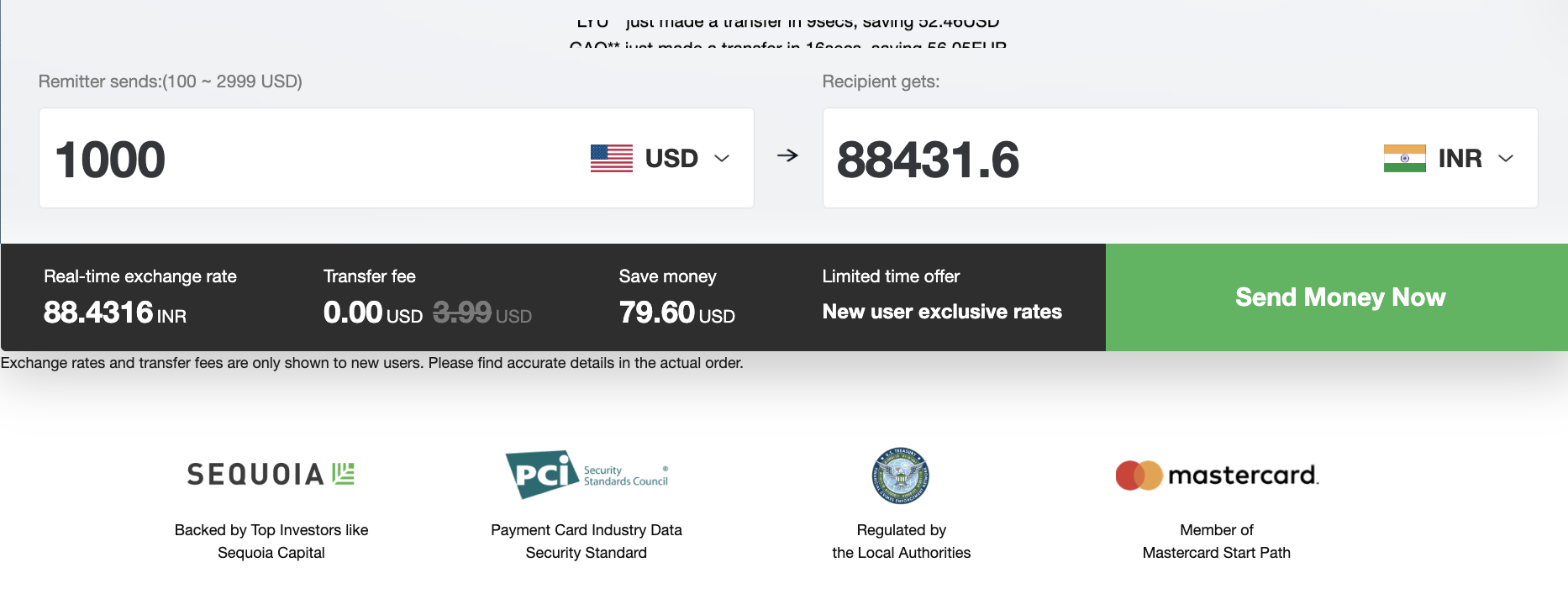

By the way, if you send £1,000 from the UK to India via Panda Remit, you will get 88,431.60 INR with 0 fee and an exclusive high exchange rate (New Users)

2. Supported Countries and Currencies

-

Wise: Available in 70+ countries, supporting 40+ currencies. Works well for popular routes like UK → India, US → Philippines, and Europe → Africa.

-

Revolut: Strong in Europe, but not all features are available worldwide. Some functions (like investing) are limited outside the EU/UK.

3. Transfer Speed

-

Wise: Transfers are often completed within 24 hours, with many arriving instantly depending on payment method.

-

Revolut: Revolut-to-Revolut transfers are instant, but cross-border transfers outside its ecosystem can take longer.

4. Business Accounts

-

Wise Business: Ideal for freelancers, e-commerce sellers, and SMBs who need to receive and manage international payments.

-

Revolut Business: Designed for companies in the EU/UK, with integrated tools for payroll and expense management.

5. Customer Support

-

Wise: Provides support via live chat and email. Reliable, but response times vary.

-

Revolut: In-app chat support available, but some users report longer wait times during peak hours.

Wise vs Revolut: Pros and Cons

Wise Pros:

-

Transparent and low fees.

-

Real mid-market exchange rates.

-

Wide global coverage.

-

Strong for freelancers and cross-border payments.

Wise Cons:

-

Limited banking services beyond transfers.

-

Fewer perks like travel rewards.

Revolut Pros:

-

Great for travelers with its multi-currency card.

-

Combines payments, budgeting, and investing in one app.

-

Attractive premium plans with lifestyle perks.

Revolut Cons:

-

Limited availability outside Europe.

-

Free transfers only up to a limit, with hidden weekend fees.

Comparison Table: Wise vs Revolut

Who Should Choose Wise?

-

Migrants sending money home.

-

Students studying abroad.

-

Freelancers receiving international payments.

-

Anyone who values low cost and transparency.

Who Should Choose Revolut?

-

Frequent travelers within Europe.

-

Young professionals looking for an all-in-one finance app.

-

Users who want both payments and investment options.

Alternative to Wise and Revolut: Panda Remit

If you’re comparing Wise vs Revolut, you may also want to know about Panda Remit — a newer but fast-growing player in the global remittance market.

Why consider Panda Remit?

-

✅Zero fees for new users – your first transfer is free.

-

✅Exclusive higher exchange rates – Panda Remit often beats traditional providers.

-

✅Coupons and promotions – regular rewards for loyal customers.

-

✅24/7 customer service – unlike Wise and Revolut, Panda Remit ensures round-the-clock support.

👉 For people who want the lowest costs and best rates, Panda Remit can be an attractive alternative.

Conclusion

Both Wise and Revolut are excellent choices, but they cater to different needs.

-

Choose Wise if you prioritize transparent fees, wide currency support, and reliable global transfers.

-

Choose Revolut if you’re based in Europe and want a multifunctional app for travel and everyday finance.

-

And don’t overlook Panda Remit — with free first transfers, better exchange rates, and 24/7 support, it’s a strong competitor worth trying.