Guide to Sending Money to Pakistan: Questions Answered

GPT_Global - 2023-06-10 15:30:02.0 593

How much money can I send to Pakistan?

To send money to Pakistan, you need to understand the laws and regulations of remittance. You must ensure that you are complying with all the relevant rules and legislation, and be aware of any restrictions that may apply.

The amount of money you can send to Pakistan will depend on the country or region you are sending from. Generally, it's possible to transfer large amounts of money if they are intended for lawful purposes.

You should also consider the fees associated with transferring money. Most money transfer services charge a fee for each transaction. To get the best deal, compare fees and exchange rates from different providers before you make a decision.

When sending money to Pakistan, keep in mind that the process can take up to a few days. It's important to plan ahead and make sure your funds reach their destination on time. Also, make sure that you provide the correct information and keep a record of each transaction.

With all these considerations in mind, you'll be able to find an appropriate way to send money to Pakistan. In most cases, it's safe and secure to make a remittance. That way, you can rest assured that your loved ones will receive the amount you intended.

How long does it take for money to reach Pakistan?

Sending money to Pakistan from abroad is much easier now with the introduction of online remittance services. With these remittance services, you can get your money there faster and more secure than ever before. But how long does it take for money to reach Pakistan?

The answer depends on the country you are sending the money from. If you are sending the money from a country like UAE or the USA, for instance, it could take anywhere from a few minutes to two business days for the money to be credited. The exact time frame depends on the payment method used for the transaction.

If you are sending money from a country other than UAE or the USA, the time taken usually varies. It is best to contact the remittance service provider in advance to ensure that your transfer is processed as soon as possible.

Overall, most transfers to Pakistan rely on the speed of the remittance service's payment network. A reliable and trustworthy provider should be able to deliver money within the given time frame. Remain mindful of any applicable fees and charges when sending money to Pakistan.

What payment method works best for sending money to Pakistan?

Sending money to Pakistan can be a daunting task, but luckily there are some great options to choose from. Whether you’re sending a gift to a special someone or remitting funds to family or business associates, here are the best payment methods for sending money to Pakistan.

Wire transfers are one of the easiest and fasted ways to send money to Pakistan. They cost money to send, but they’re also very secure and you’ll have a record of the transaction. You’ll need to provide your recipient's bank account details, and once the transaction is complete, the money will be available almost immediately.

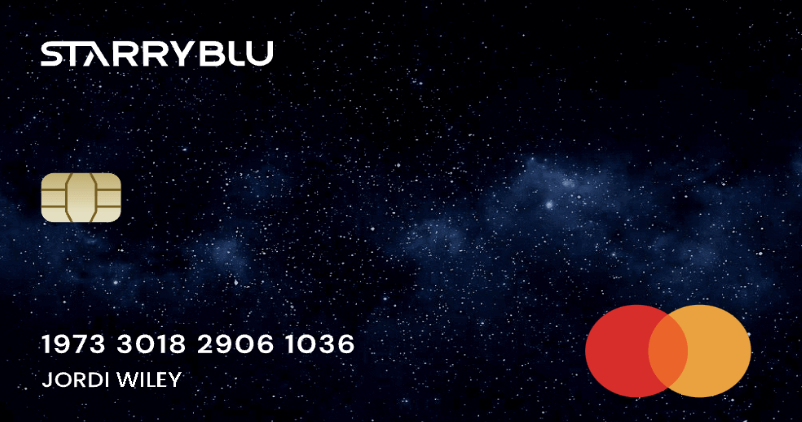

Debit cards are another popular payment method for sending money to Pakistan. Debit cards are accepted at virtually any ATM in Pakistan, and you can use them to send money from your bank account instantly. The fees associated with debit cards are usually very low, making them a cost-effective option.

Prepaid cards are a great way to send a prepaid card to someone in Pakistan. The cards are available in various denominations, and your recipient can use them at any participating merchant in the country. Prepaid cards are generally quite secure and significantly cheaper than other payment methods.

Online money transfer services such as PayPal, Remitly and WorldRemit are convenient, fast and secure ways to transfer money to Pakistan. All you need to do is set up an account, add the recipient’s information, and then send the money. Fees may apply, depending on the service you’re using, but it’s still a hassle-free and cost-effective way to send money.

These are the best payment methods for sending money to Pakistan. Each of these options has their own advantages and disadvantages, so it’s important to take the time and compare before making a decision. Regardless of the method you choose, sending money to Pakistan is now easier than ever.

What are the fees for sending money to Pakistan?

Sending money to Pakistan can be an intimidating and expensive process without the right guidance. To simplify the task, knowing the fees involved in sending money abroad is essential. Below we will discuss the different fees associated with sending money to Pakistan.

The first fee you should be aware of is the exchange rate. This is the cost of converting currency from one country to another. Exchange rates are determined by the market and can vary from institution to institution. Be sure to shop around for the most competitive rates.

Secondly, you will be charged a transaction fee, which covers the cost of processing the transfer. This fee is usually based on the amount you are transferring and can range from free to several hundred dollars depending on the remittance provider.

Thirdly, some providers may add a service charge. This is a separate fee that covers the cost of providing other services such as customer support or payment tracking. As with all fees, it’s important to check with your remittance provider what fees they charge.

Finally, you may be charged additional fees if you choose to use a third-party payment service. Before making a transfer, make sure you’re aware of any additional fees which may apply.

These are the main fees to be aware of when sending money to Pakistan. Always remember to compare different providers to make sure you’re getting the best deal. With the right research, you can minimize the fees associated with sending money abroad.

What documents are needed to transfer money to Pakistan?

Transferring money to Pakistan can be a bit daunting, but it doesn't have to be. As long as you know what documents are needed to transfer money to Pakistan, everything will go smoothly.

Usually, the documents needed to transfer money to Pakistan are the sender's and receiver's passport or ID copy, the remittance receipt, and the bank account information of the receiver. With these documents, you'll be gaining a safe, convenient, and fast transfer experience.

In addition, you may also need to provide other required documents, such as proof of funds and residence permit, to gain easier, faster, and smoother money remittance.

If you're transferring money from overseas, the required documents may vary according to the country of origin. To make sure all your documents are sufficient to transfer money to Pakistan, please consult with the remittance service provider you plan to use in advance. This way, you can avoid unnecessary delays in the remittance process.

To conclude, transferring money to Pakistan requires the sender's and receiver's passport or ID copy, remittance receipt, the receiver's bank account information, and if necessary, proof of funds and residence permit. If you have all the documents ready, your money remittance will be accomplished quickly and securely.

About Panda Remit

Panda Remit is committed to providing global users with more convenient, safe, reliable, and affordable online cross-border remittance services。

International remittance services from more than 30 countries/regions around the world are now available: including Japan, Hong Kong, Europe, the United States, Australia, and other markets, and are recognized and trusted by millions of users around the world.

Visit Panda Remit Official Website or Download PandaRemit App, to learn more about remittance info.