Scams happen frequently! Imported into China or become a hard-hit area

熊猫速汇PandaRemit - 1489

Recently, the cross-border remittance business has been frequent, shopping activities have increased, and the demand for funds is large, which provides opportunities for scammers.

People who specialize in defrauding money back to the country are "full of money", which is really hard to guard against.

Some people were not only defrauded of money, but even involved their relatives and friends in criminal cases, which eventually led to the freezing of bank accounts! Panda Remit can only say that this wave of "empty glove white wolves" by the scammers is really a "good plan"!

"High exchange rate" bait induces scams

Singapore's local news media released a set of data:

From January last year to the present, 116 people (including many Chinese) have been scammed by online currency exchange and cross-border remittance services, with a total loss of up to 1 million Singapore dollars (about 5.17 million yuan)!

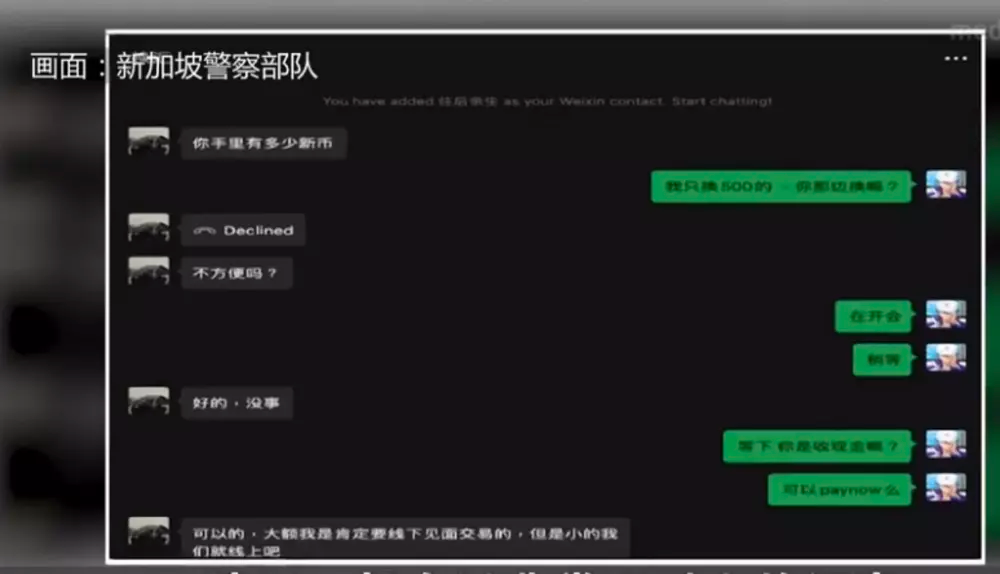

These "transnational scammers" mainly contact victims through e-commerce or social platforms, such as WeChat, Facebook, Twitter, etc., falsely claiming that they can provide higher exchange rates, and tricking victims into transferring money to designated accounts.

The victim realized it was a scam when he did not receive the exchanged amount after making the payment.

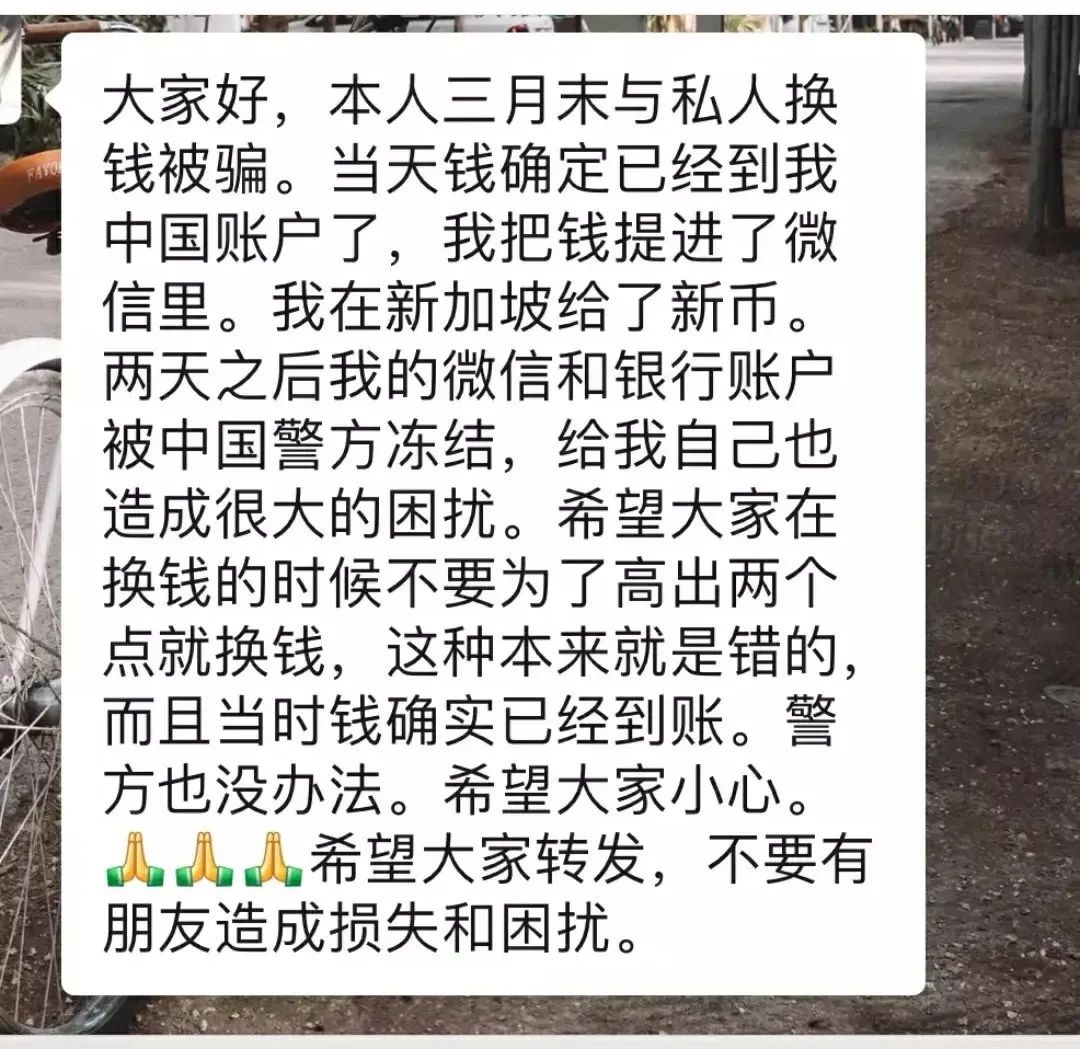

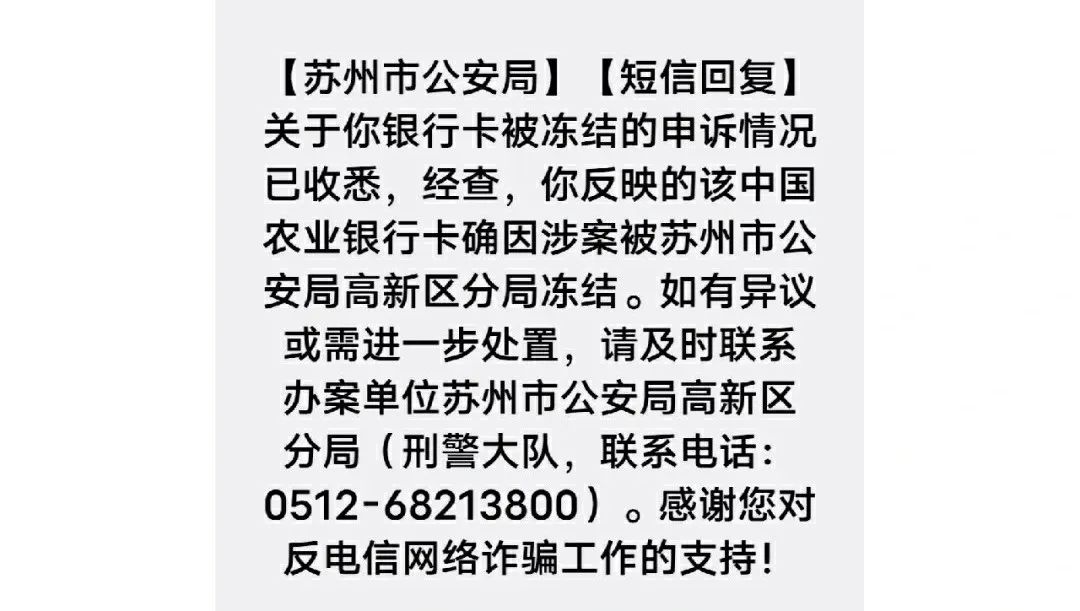

There are also Chinese victims who reported that they did receive the money, but the receiving account was frozen by the police, and they were involved in criminal cases.

This is because "transnational scammers" will mix other illegal proceeds together. If these funds are transferred to the victim's account, the victim's account will be frozen or seized without accident. Sao"!

Source: Little Red Book

@其妙雪:The card is frozen after remittance from Singapore to China through the Great Wall Remittance Center

@Leo:Friendly reminder, you need to be cautious when exchanging money privately in Singapore

Remittances involved in the case were repeatedly frozen

Source: Little Red Book

@游子:Ladies and gentlemen, I would like to ask you, I sent money home from the Shanli remittance company in Singapore, but it was frozen by the domestic police. people reported...

Now Shanli remittance merchants are not cooperating to solve the problem at all, and they do not admit that it is their problem... Is there any way to get back my hard-earned money? Please help me think of a way, or if you have any suggestions, you can private message me. Thanks………

Source: Little Red Book

@口袋里有妖怪呀:Remittances in Singapore are terrible. I went to Chinatown today and met a big brother who was begging for justice at the gate of a remittance center. It seemed that the money was frozen when I returned home, but the staff refused to solve it.

It is not easy for everyone to make money, and everyone needs to spend money at home, so everyone will be angry at this.

I hope that the remittance center can be a little more conscientious, and I also hope that everyone remits carefully. In the end, if you don’t care about the exchange rate, you should choose a reliable app to remit back, saving time, effort and worry.

Many people get sucked into this scam because of the slightly higher exchange rate. Therefore, when sending money back to China in Singapore, it is best to find a payment service provider authorized by the Monetary Authority.

110,000 US dollars, cheated out of it!

Earlier, a Chinese woman in New Jersey, USA, was introduced by a friend to exchange cashier's checks through a Chinese man in order to buy a house. After depositing the promissory note she got into her bank account and showing that she was safe, she transferred the domestic RMB to the other party as agreed.

She thought everything would be fine, but she never thought that she would be fraudulent in the end. The cashier's check of US$114,000 was notified by the other party to stop paying the bank, and the man who helped her exchange the cashier's check disappeared.

Chairman Chen Shanzhuang said that the association has received many complaints about similar fraud cases, all of which were cheated when exchanging cashier's checks with others, and those who helped to exchange cashier's checks would be victimized by the trick of stopping payment or canceling the cashier's checks The victim's money was defrauded.

A Chinese graduate student who went to study in Lisbon, Portugal exchanged currency privately through a WeChat group and encountered fraud.

Situations similar to this kind of wechat group being cheated in private currency exchange have been staged all over the world, and all Chinese in Asia, Europe, Oceania, and North America have not been spared.

Summary of common means of fraudulent foreign exchange

These scams are actually not very clever. After obtaining the contact information of the victims, there are only two common fraud methods. Just pay more attention to identify them!

- online transaction

The scammer will ask to transfer the money to the designated bank account first, and say that the RMB will be transferred to the account designated by the victim. But in fact, after the victim finished transferring the money, the scammer disappeared.

- Door-to-door remittance service

The scammer will meet at the place designated by the victim, remit the exchanged money to the account designated by the victim face to face, and then take away the cash prepared by the victim.

However, not long after, the victim's account will be frozen by law enforcement agencies on suspicion of accepting fraud or money laundering.

It’s okay to be defrauded of money. After all, money is something outside of the body. If you are involved in the money laundering activities of scammers, it can only be "empty of both people and money"!

According to Singapore law, money laundering is punishable by up to 10 years in prison and a new fine of 500,000. In addition, China's cross-border remittance policy clearly stipulates that it is not possible to remit as much as you want: the maximum cross-border remittance per person per year is 50,000 US dollars (about 67,600 Singapore dollars, 349,500 yuan).

Panda Remit is here to remind everyone that you must not think that such a scam is too simple, and you will not be fooled. Often such scams are easy to be deceived, and it is difficult to get out of it until you are deeply involved.

In the crisis-ridden international environment of cross-border remittances, you may wish to consider Panda Remit!

"Convenient operation, fast transfer, excellent exchange rate, low service fee, many discounts, and good service", the key lies in high security performance, protecting every remittance of yours, you deserve to have Panda Remit ~

Making money is not easy. Panda Remit once again reminds family and friends overseas to keep their eyes open and be vigilant.

I sincerely hope that family members at home and abroad will protect their wallets and spend every day happily.

跨境汇款服务请点以下链接:

👉 熊猫速汇官网

👉 熊猫速汇注册登录