Azimo vs Chime: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-24 16:08:26.0 16

Introduction

International money transfers are crucial for individuals and businesses dealing with cross-border payments. Users often encounter high fees, slow delivery, hidden charges, and complex interfaces. This article provides a detailed comparison of Azimo vs Chime, examining their advantages, limitations, and suitability for different user needs. For those seeking a reliable alternative, Panda Remit offers fast, flexible, and cost-effective transfers. Learn more about international money transfers here.

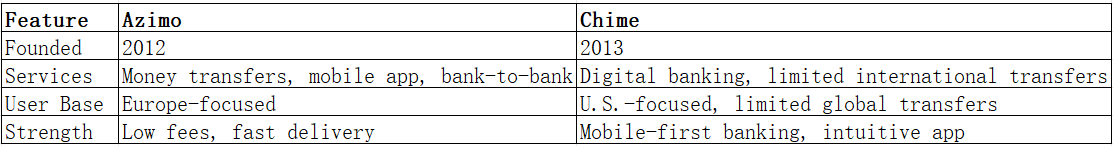

Azimo vs Chime – Overview

Azimo, founded in 2012, specializes in international money transfers, providing low fees and quick delivery. Its services include mobile app transfers, bank-to-bank transactions, and real-time tracking, primarily serving European users.

Chime, launched in 2013, is a digital bank offering checking accounts, savings, and limited international transfer capabilities. Chime emphasizes mobile-first banking, user-friendly interfaces, and financial management tools, with transfer services to select countries.

Similarities:

-

Both support international transfers and mobile apps.

-

Bank-to-bank transfers are available.

Differences:

-

Fees: Azimo generally charges flat fees per transfer; Chime may have additional charges depending on transfer method.

-

Target Audience: Azimo focuses on frequent international remitters; Chime targets digital banking users in the U.S.

Quick Summary Table:

Panda Remit is a suitable alternative for fast and flexible transfers.

Azimo vs Chime: Fees and Costs

Azimo charges flat fees for international transfers, making it cost-effective for smaller amounts. Chime may include fees based on account type and transfer method.

Subscription Considerations:

-

Azimo: No subscription required; fees per transfer.

-

Chime: Standard fees apply; premium features may vary.

For a detailed fee comparison, visit NerdWallet.

Panda Remit may offer lower fees for selected transfer corridors.

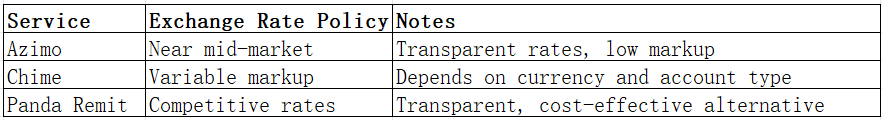

Azimo vs Chime: Exchange Rates

Exchange rate policies affect transfer costs. Azimo offers rates near mid-market with small markups. Chime's rates vary by account type and currency.

Panda Remit serves as a potential alternative for favorable exchange rates.

Azimo vs Chime: Speed and Convenience

Azimo provides fast transfers, often within hours or same-day depending on the destination, with app tracking. Chime offers a mobile-friendly experience, but transfer speeds depend on the recipient country.

For more information, check WorldRemit remittance guide.

Panda Remit is noted for fast, fully online transfers.

Azimo vs Chime: Safety and Security

Both Azimo and Chime are regulated, providing encryption and fraud protection. Chime includes standard banking safeguards; Azimo focuses on secure remittance protocols.

Panda Remit is a licensed and secure option for cross-border transfers.

Azimo vs Chime: Global Coverage

Azimo supports transfers to over 80 countries with multiple currencies, while Chime's international coverage is limited.

For more information, see World Bank remittance report.

Azimo vs Chime: Which One is Better?

Azimo is better suited for frequent international transfers with lower fees, while Chime provides a comprehensive U.S. digital banking experience. Users seeking faster, flexible, or cost-effective alternatives may consider Panda Remit.

Conclusion

The Azimo vs Chime comparison highlights that both services have unique strengths. Azimo excels in cost-effective, fast international transfers, while Chime offers a user-friendly U.S. digital banking experience. Panda Remit is an attractive alternative for users who require:

-

Competitive exchange rates and low fees

-

Flexible payment methods (POLi, PayID, bank transfer, e-transfer)

-

Coverage of multiple currencies

-

Fast, fully online transfers

Learn more at Panda Remit or consult additional remittance resources to select the service that fits your needs.