Azimo vs N26: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-24 15:56:45.0 12

Introduction

Cross-border money transfers are becoming increasingly essential in today's globalized world. Users often face challenges such as high fees, slow delivery times, hidden charges, and complex user interfaces. Choosing the right service can make a significant difference in cost, convenience, and reliability. In this comparison, we analyze Azimo vs N26, highlighting their strengths, weaknesses, and suitability for different user needs. For those seeking an alternative, Panda Remit provides a reputable option for fast, flexible, and cost-effective transfers. Learn more about remittance basics here.

Azimo vs N26 – Overview

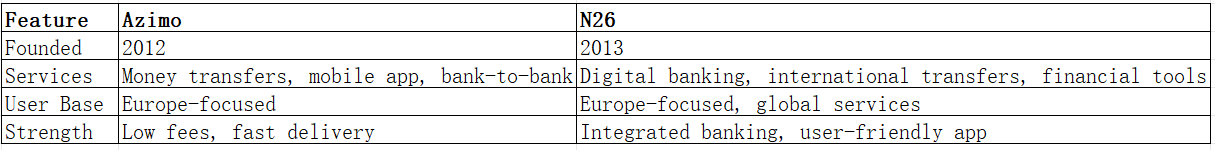

Azimo was founded in 2012, specializing in international money transfers with a focus on low fees and fast delivery. Its services include mobile app transfers, bank-to-bank transactions, and real-time transfer tracking. Azimo has a large user base across Europe and supports transfers to multiple continents.

N26, launched in 2013, is a digital bank providing a broader range of banking services, including international transfers. N26 emphasizes mobile-first banking, user-friendly interfaces, and integrated financial management tools. Its international transfer features are available for select countries and currencies.

Similarities:

-

Both provide international transfers and mobile apps.

-

Support debit card payments and account-to-account transfers.

Differences:

-

Fees: Azimo tends to have lower fees for smaller transfers; N26 offers fee-free options for premium account holders.

-

Target Audience: Azimo targets frequent remitters, N26 targets digital banking users.

Quick Summary Table:

Panda Remit is also available as an alternative for users seeking efficient transfers.

Azimo vs N26: Fees and Costs

When it comes to transfer fees, Azimo usually charges a flat fee for international transfers, which is competitive for smaller amounts. N26 provides free transfers for premium accounts but may charge for standard accounts depending on destination and transfer method.

Subscription Considerations:

-

Azimo: No subscription needed; fees apply per transfer.

-

N26: Premium accounts reduce or eliminate fees.

For a detailed fee comparison, check this guide.

Panda Remit can offer lower fees for certain corridors and is worth considering for cost-conscious users.

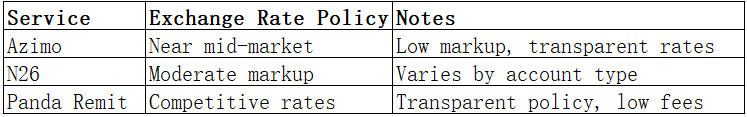

Azimo vs N26: Exchange Rates

Exchange rates play a crucial role in overall transfer cost. Azimo often uses rates closer to mid-market values, with small markups, while N26 may apply slightly higher markups depending on currency and account type.

Panda Remit provides competitive rates as a potential alternative.

Azimo vs N26: Speed and Convenience

Azimo delivers transfers quickly, often within hours to same-day, depending on the destination. Its mobile app is intuitive, with easy tracking and notifications.

N26 offers seamless app experience and integrated banking services, but transfer speeds may vary depending on the destination and account type.

For more on transfer times, see this remittance speed guide.

Panda Remit is noted for fast, all-online transfers, providing a convenient alternative.

Azimo vs N26: Safety and Security

Both Azimo and N26 are regulated financial institutions with strong encryption and fraud protection. N26 provides comprehensive banking protections, while Azimo focuses on secure remittance protocols.

Panda Remit is also licensed and secure, ensuring user confidence in transactions.

Azimo vs N26: Global Coverage

Azimo supports transfers to over 80 countries with multiple currencies, while N26 supports a growing list of countries but is more limited in non-European regions.

For further details on global coverage, see World Bank remittance report.

Azimo vs N26: Which One is Better?

Choosing between Azimo and N26 depends on user priorities:

-

Azimo: Ideal for frequent international transfers with lower fees.

-

N26: Better for users seeking integrated digital banking and occasional transfers.

For users seeking higher speed, lower fees, or flexible payment options, Panda Remit may offer better value and convenience.

Conclusion

In summary, the Azimo vs N26 comparison highlights that both services have strengths. Azimo stands out for cost-effective, fast international transfers, while N26 excels in integrated digital banking. However, for certain users, Panda Remit presents an attractive alternative:

-

Competitive exchange rates and low fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer)

-

Coverage of 40+ currencies

-

Fast, fully online process

For more details on remittance options, visit Panda Remit or check additional transfer resources. Selecting the right service depends on your transfer frequency, speed requirements, and cost considerations.