Azimo vs PaySend: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-24 15:38:44.0 16

Introduction

As global remittance volumes continue to grow, users are looking for reliable, low-cost, and fast money transfer services. High bank fees and slow delivery remain key pain points for individuals sending money abroad. Two popular options, Azimo and PaySend, offer digital solutions that simplify international payments. Both are well-known for their user-friendly apps and quick transactions. According to Investopedia, choosing the right remittance platform can save users significant money through lower fees and better rates. For those seeking even more affordable transfers, PandaRemit provides another reputable alternative with transparent costs and online accessibility.

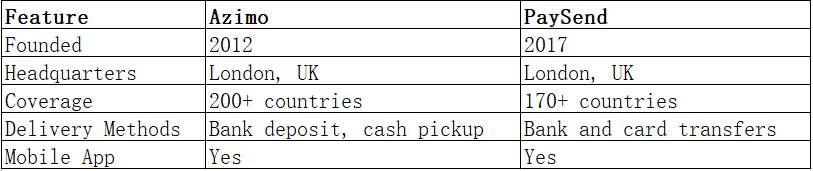

Azimo vs PaySend – Overview

Azimo was founded in 2012 in the UK and focuses on online international money transfers. It serves millions of customers across Europe and Asia, allowing users to send funds to over 200 countries. Azimo emphasizes low-cost transfers, fast delivery, and local payout options such as bank deposits and cash pickup.

PaySend, launched in 2017, is another UK-based fintech specializing in cross-border payments. It supports transfers to over 170 countries and stands out for its fixed transfer fee and ability to send directly to a recipient’s card or bank account.

Both services offer quick digital transfers and intuitive apps, but PaySend may appeal to users who prefer predictable flat fees. Meanwhile, Azimo’s broad payout network suits users sending to developing regions. For competitive exchange rates and diverse payment options, PandaRemit is another platform worth considering.

Azimo vs PaySend: Fees and Costs

Azimo charges variable fees depending on destination and payout method, with many transfers costing below £1. Some promotions even offer the first few transfers for free. Exchange rate markups are moderate, making Azimo appealing for frequent senders.

PaySend, on the other hand, uses a flat fee model — typically £1.50 or less per transaction, regardless of amount. This predictable pricing is useful for users sending larger sums. However, its exchange rate margin can vary by currency and region.

According to NerdWallet, flat-fee services are ideal for high-volume transfers, while variable fees may benefit smaller, frequent transactions. For users prioritizing lower total costs, PandaRemit can be a cost-effective alternative offering low or zero fees across many corridors.

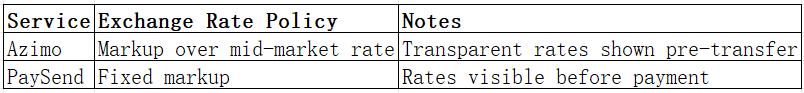

Azimo vs PaySend: Exchange Rates

Exchange rates significantly affect the amount received by the beneficiary. Azimo typically adds a small markup over the mid-market rate, though it displays the exact conversion before confirming a transfer. PaySend also applies a markup but maintains transparency through upfront rate displays.

While both brands disclose rates clearly, PandaRemit often offers more competitive exchange rates, helping users get more value per transfer without hidden costs.

Azimo vs PaySend: Speed and Convenience

Both Azimo and PaySend prioritize fast delivery. Azimo transfers to bank accounts usually arrive within minutes to 24 hours, while PaySend transactions are often completed instantly when sending to cards. Both platforms provide easy mobile app access and 24/7 availability.

For convenience, PaySend’s ability to send directly to Visa and Mastercard accounts is a strong advantage. Meanwhile, Azimo’s broad payout network supports more delivery options in regions with limited banking infrastructure.

As highlighted in Remitly’s Speed Guide, users value speed and reliability above all. PandaRemit, with its efficient online system, also offers quick processing for eligible corridors, ensuring funds arrive securely and promptly.

Azimo vs PaySend: Safety and Security

Both Azimo and PaySend are regulated by the UK’s Financial Conduct Authority (FCA), ensuring compliance with financial regulations. They use encryption and two-factor authentication to protect user accounts. Azimo also utilizes real-time transaction tracking, while PaySend includes fraud prevention mechanisms for card-based payments.

Similarly, PandaRemit is a licensed and secure remittance provider, offering users peace of mind through compliance with international AML and KYC standards.

Azimo vs PaySend: Global Coverage

Azimo supports transfers to more than 200 countries and territories, with strong coverage in Asia and Latin America. PaySend covers over 170 countries, focusing heavily on Europe and North America

According to the World Bank Remittance Report, access to digital transfer channels continues to grow, benefiting users worldwide. PandaRemit also connects users to over 40 currencies, offering flexibility in online remittances.

Azimo vs PaySend: Which One is Better?

The best option depends on your needs:

-

Choose Azimo if you value wide coverage and diverse payout options.

-

Choose PaySend if you prefer predictable flat fees and instant card transfers.

Both provide secure, fast, and transparent services. However, PandaRemit could be the better fit for users prioritizing low costs and flexible payment choices.

Conclusion

In this comparison of Azimo vs PaySend, both services prove reliable and efficient for global money transfers. Azimo offers extensive reach and multiple payout methods, while PaySend simplifies cross-border payments with instant card-to-card delivery and flat fees.

For users seeking an even more affordable and user-friendly platform, PandaRemit stands out as a strong alternative. It provides:

-

Competitive exchange rates with low or no fees

-

Multiple payment options like PayID, POLi, and bank card

-

Transfers available in 40+ currencies

-

Fast, fully online processing

Ultimately, your ideal service will depend on transfer destination, urgency, and cost priorities — but all three platforms continue to advance cross-border remittance solutions for 2025 and beyond.