Azimo vs Starling Bank: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-24 16:04:09.0 15

Introduction

International money transfers are essential for many individuals and businesses. Common challenges include high fees, slow delivery, hidden charges, and complex interfaces. This article compares Azimo vs Starling Bank, highlighting strengths, weaknesses, and user suitability. For users seeking a reliable alternative, Panda Remit provides fast, flexible, and cost-effective transfers. Learn more about international transfers here.

Azimo vs Starling Bank – Overview

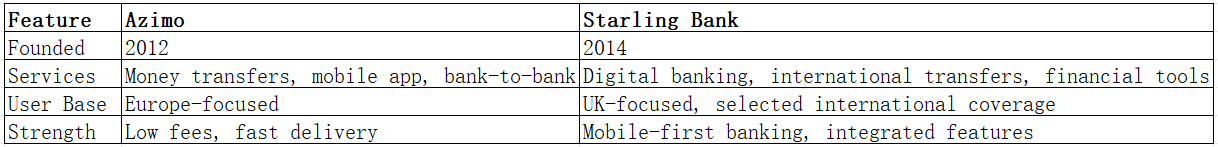

Azimo, founded in 2012, focuses on international money transfers with low fees and fast delivery. Services include mobile app transfers, bank-to-bank transactions, and real-time tracking, primarily serving European users.

Starling Bank, founded in 2014, is a digital bank offering integrated banking services, including international transfers. Its mobile-first platform emphasizes user experience and account management, covering selected regions and currencies.

Similarities:

-

Both offer international transfers and mobile apps.

-

Support bank-to-bank transfers and debit card payments.

Differences:

-

Fees: Azimo generally charges flat transfer fees; Starling Bank may vary fees by account type and destination.

-

Target Audience: Azimo targets frequent remitters; Starling Bank targets digital banking users.

Quick Summary Table:

Panda Remit is also a viable alternative for efficient transfers.

Azimo vs Starling Bank: Fees and Costs

Azimo typically charges a flat fee per transfer, cost-effective for smaller amounts. Starling Bank may offer free transfers for premium accounts, but standard accounts can incur charges.

Subscription Considerations:

-

Azimo: Fees per transfer; no subscription needed.

-

Starling Bank: Premium accounts reduce fees; standard accounts may have transfer costs.

For a detailed fee comparison, see NerdWallet's guide.

Panda Remit may offer lower fees for certain transfer corridors.

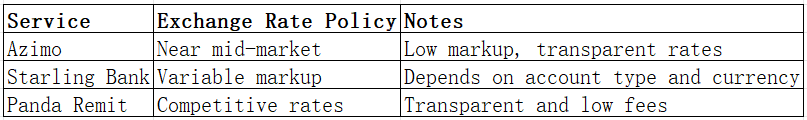

Azimo vs Starling Bank: Exchange Rates

Exchange rates impact transfer costs. Azimo generally provides near mid-market rates with minimal markup. Starling Bank's rates may vary depending on account type and currency.

Panda Remit serves as a competitive alternative.

Azimo vs Starling Bank: Speed and Convenience

Azimo offers fast transfers, often within hours or same-day, depending on destination, with app tracking and notifications. Starling Bank provides an intuitive mobile experience with integrated banking but transfer speeds vary by destination.

For more on transfer times, see WorldRemit remittance guide.

Panda Remit is noted for fast, fully online transfers.

Azimo vs Starling Bank: Safety and Security

Both Azimo and Starling Bank are regulated, offering encryption and fraud protection. Starling Bank includes comprehensive banking safeguards; Azimo focuses on secure remittance protocols.

Panda Remit is a licensed and secure option.

Azimo vs Starling Bank: Global Coverage

Azimo supports transfers to over 80 countries and multiple currencies, whereas Starling Bank's coverage is more limited outside Europe and the UK.

For more information on global remittance coverage, see World Bank remittance report.

Azimo vs Starling Bank: Which One is Better?

Azimo is ideal for frequent international transfers with lower fees. Starling Bank is suitable for users seeking integrated digital banking. Users requiring faster, flexible, or lower-cost alternatives may consider Panda Remit.

Conclusion

The Azimo vs Starling Bank comparison highlights that both have unique strengths. Azimo excels in cost-effective, fast international transfers, while Starling Bank provides a seamless digital banking experience. Panda Remit is an attractive alternative for users needing:

-

Competitive exchange rates and low fees

-

Flexible payment methods (POLi, PayID, bank transfer, e-transfer)

-

Coverage of multiple currencies

-

Fast, fully online transfers

Learn more at Panda Remit or consult additional remittance resources to choose the most suitable service.