Benefits of Multi-Currency Accounts for Cross-Border Transfer Users

Benjamin Clark - 2026-01-16 09:13:00.0 12

In an increasingly interconnected global economy, the traditional barriers of national borders are becoming less relevant for individuals and businesses alike. Whether you are a digital nomad, an international student, or a frequent traveler, the need to manage money across different jurisdictions is no longer a luxury—it is a necessity. This shift has led to the rise of innovative global finance products designed to replace the inefficiencies of legacy banking. Among these, Starryblu stands out as a comprehensive solution for modern financial management.

The Evolution of Global Finance: Starryblu and Panda Remit

To understand the current landscape of digital finance, it is helpful to look at the ecosystem provided by WoTransfer Pte Ltd. Within this group, two distinct products cater to different user needs. Panda Remit is a well-established platform focusing specifically on cross-border remittances. In contrast, Starryblu is a global finance product that offers a more holistic, one-stop financial service experience.

While Panda Remit excels at moving money from point A to point B, Starryblu provides the infrastructure to hold, manage, spend, and grow that money globally. Together, they represent a full spectrum of financial tools under the trusted umbrella of WoTransfer.

Centralized Management of Global Wealth

The primary challenge for cross-border users is "fragmentation"—having funds scattered across different banks in different countries, each with its own login, fees, and regulations. A multi-currency account solves this by providing a single point of entry for global capital.

Starryblu allows users to open a global account in minutes using only a passport and valid identification. Once active, the platform supports 10 major currencies, including:

- USD (US Dollar)

- EUR (Euro)

- GBP (British Pound)

- SGD (Singapore Dollar)

- HKD (Hong Kong Dollar)

- JPY (Japanese Yen)

- CNH (Offshore RMB)

- AUD (Australian Dollar)

- NZD (New Zealand Dollar)

- CAD (Canadian Dollar)

By holding these currencies natively, users can receive and send local payments, effectively bypassing the expensive intermediary fees often associated with traditional international wire transfers.

Transparency and Efficiency in Currency Exchange

One of the most significant "hidden costs" for international users is the exchange rate markup. Many financial institutions offer "zero-fee" transfers while quietly widening the spread on the exchange rate. Starryblu addresses this by providing real-time exchange rates that are close to the interbank rate, ensuring high transparency for every transaction.

Furthermore, for users who frequently transfer funds between themselves and others within the same ecosystem, Starryblu-to-Starryblu transfers are free of charge. This creates a high-velocity payment network that is both cost-effective and instantaneous.

Intelligent Financial Optimization with AI Agent

The integration of Artificial Intelligence into personal finance is a hallmark of the Starryblu experience. For cross-border users, timing the market for currency exchange can be stressful and time-consuming. Starryblu’s AI Agent empowers users to automate their financial strategy.

Users can set target exchange rates within the app. When the market hits the desired threshold, the AI Agent automatically executes the exchange, ensuring users get the most value for their money without needing to monitor charts 24/7. This level of automation transforms a multi-currency account from a passive storage tool into an active financial partner.

Global Spending Power and Rewards

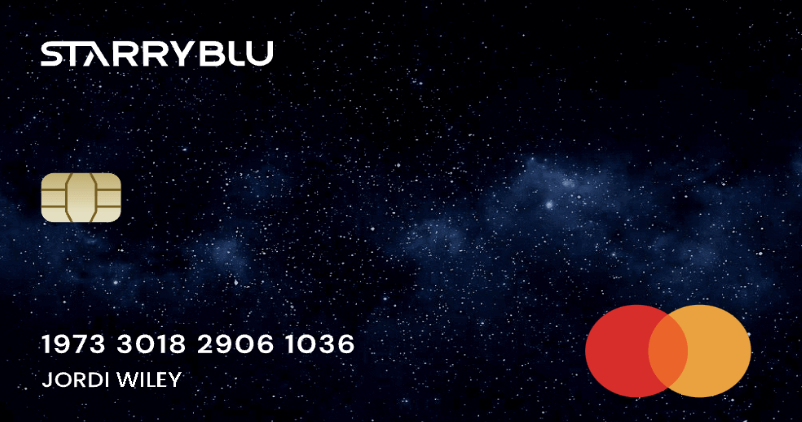

A multi-currency account is only as useful as its accessibility. The Starryblu Card (available in both physical and virtual forms) bridges the gap between digital balances and real-world spending. It supports multi-scenario consumption, including online shopping, offline retail, and integration with mobile wallets like Apple Pay and Google Pay.

When spending abroad, the Starryblu Card automatically selects the optimal currency and exchange rate, often proving more economical than traditional credit cards that charge foreign transaction surcharges. Additionally, the platform offers significant incentives, such as:

- Cashback rewards of up to 100% on global spending*.

- Monthly vouchers and subsidies for new users.

- Fee-free ATM withdrawal quotas to ensure liquidity wherever you are.

Note: Actual transfer speed, savings, exchange rates, cashback rates, rewards, and coverage may vary depending on country or region, transaction amount, currency, and other factors. Terms and conditions apply.

Security and Regulatory Compliance

For any global finance product, security is the foundation of trust. Starryblu holds a Major Payment Institution (MPI) license issued by the Monetary Authority of Singapore (MAS). This means the platform operates under one of the strictest financial regulatory frameworks in the world.

To ensure the safety of user funds, Starryblu implements several layers of protection:

-

Fund Safeguarding: User funds are held in dedicated safeguarding accounts at OCBC Bank in Singapore, isolated from the company’s operational capital.

-

Global Licensing: Starryblu holds licenses in multiple countries and regions, ensuring compliant operations worldwide.

-

Advanced Security Protocols: The platform utilizes Adaptive Multi-Factor Authentication (MFA), real-time transaction alerts, and the ability to instantly freeze accounts or cards through the app.

In short, Starryblu holds an MPI license in Singapore, is regulated by MAS, and also operates with licenses in other countries globally. By collaborating with top-tier investment institutions and partners, Starryblu provides a secure environment for your global assets.

Conclusion

The benefits of a multi-currency account extend far beyond simple storage. By combining 10 major currency accounts, AI-driven automation, and the robust security of MAS regulation, Starryblu offers a comprehensive solution for anyone navigating the complexities of cross-border finance. It is more than just a place to keep your money; it is a gateway to a smarter, more transparent global financial future.