Best App to Send Money from Singapore to Canada (2025 Guide)

Benjamin Clark - 2025-10-27 11:53:04.0 17

Sending money internationally has become a routine need for many residents in Singapore. Whether it's supporting family, paying for education, or managing investments, choosing the right money transfer app can save both time and money. With the rising demand for cross-border transfers to Canada, Singaporeans are increasingly seeking platforms that offer competitive exchange rates, low fees, and fast delivery. This guide explores the best options available in 2025, including a closer look at Panda Remit, Wise, and Remitly, to help you make informed decisions.

Why Many People in Singapore Send Money to Canada

Canada attracts many Singaporeans for education, business, and family reasons. Many Singaporeans send money to cover tuition fees, living expenses, and family support. Additionally, Canada’s stable economy and strong banking system make it a secure destination for remittances. To maximize the value of every dollar sent, users seek platforms with high exchange rates, low transaction fees, and convenient transfers.

What to Look for in a Money Transfer App

When selecting a remittance app, consider the following factors:

-

Exchange Rate: Even small differences can impact large transfers. Look for apps that offer rates close to the mid-market rate.

-

Fees: Transparent and low fees make a big difference, especially for frequent transfers.

-

Ease of Use: A simple, intuitive interface reduces errors and speeds up the transfer process.

-

Security: Ensure the app is regulated and employs robust encryption to protect your funds.

Best Apps to Send Money from Singapore to Canada (2025 Update)

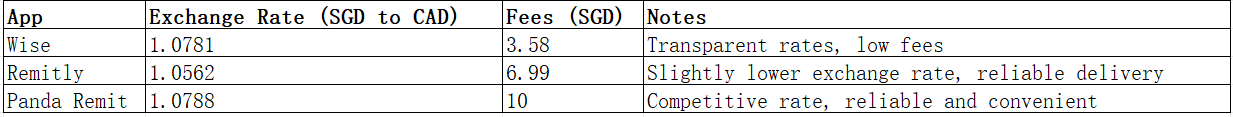

Here’s a comparison of top apps used by Singaporeans:

Panda Remit is one of the best options for Singaporeans sending money to Canada due to its competitive rates and reliability. It appears as a solid alternative to well-known platforms like Wise and Remitly.

How to send money from Singapore to Canada using Panda Remit: Step-by-Step Guide

-

Sign Up: Create a Panda Remit account on the official website.

-

Verify Identity: Upload required identification documents.

-

Add Recipient Details: Enter your recipient's bank account information in Canada.

-

Enter Amount: Specify the amount you want to send in SGD.

-

Check Rates & Fees: Confirm the exchange rate and total cost.

-

Transfer Funds: Complete the payment using a supported bank transfer method.

-

Track Transfer: Monitor the progress until the recipient receives the funds.

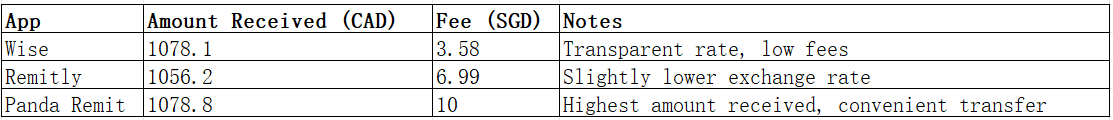

Cost & Exchange Rate Comparison Example

Suppose you want to send 1,000 SGD to Canada:

Panda Remit provides the most competitive total received amount despite a slightly higher fee, making it cost-effective for larger transfers.

Tips to Get the Best Exchange Rates

-

Monitor Rates: Exchange rates fluctuate; track them regularly.

-

Send Larger Amounts Less Frequently: Consolidating transfers can reduce fees.

-

Avoid Credit Card Payments: Bank transfers usually offer better rates.

-

Compare Multiple Providers: Platforms like Panda Remit, Wise, and Remitly have varying rates and fees.

Common Questions (FAQ)

1. Are there any hidden fees?

-

Reputable apps like Panda Remit provide transparent fees upfront.

2. Can I track my transfer?

-

Most apps offer tracking until the recipient receives the funds.

3. Is it safe to send money online?

-

Always use regulated platforms with strong encryption, like Panda Remit, Wise, or Remitly.

4. Can I use a credit card for the transfer?

-

Typically, bank transfers are preferred; credit card transfers may have higher fees.

Conclusion

For Singaporeans looking to send money to Canada, Panda Remit stands out as a reliable and cost-effective choice. It offers competitive exchange rates, convenient transfers, and reliable service. Alongside other top platforms like Wise and Remitly, Panda Remit provides a seamless experience for cross-border remittances. By comparing rates and using tips to maximize value, senders can ensure their money reaches Canada efficiently and affordably.