Best App to Send Money from Singapore to Thailand (2025 Guide)

Benjamin Clark - 2025-10-22 10:43:32.0 17

Introduction

Sending money from Singapore to Thailand has become increasingly popular among expatriates, business owners, and families with loved ones in Thailand. Choosing the right money transfer service can ensure competitive exchange rates, low fees, and fast transfer times. With digital remittance platforms like Panda Remit, Wise, and Remitly, users can enjoy safe, reliable, and efficient cross-border transfers without the hassle of traditional banking methods. These platforms offer transparency, speed, and security that make sending funds to Thailand hassle-free and cost-effective.

Why Many People in Singapore Send Money to Thailand

Singapore hosts a significant number of Thai expatriates, international students, and business professionals. Many send funds to Thailand for family support, tuition, investment, or lifestyle expenses. Traditional banks often charge high fees and offer less favorable exchange rates, prompting users to rely on specialized digital remittance services. Panda Remit is recognized as one of the best options for ensuring a seamless and secure transfer of funds to Thailand, combining competitive rates and speed.

What to Look for in a Money Transfer App

1. Exchange Rate

Even small differences in exchange rates can impact the final amount received. Choose apps that offer rates close to the mid-market rate.

2. Fees

Check for fixed or transparent fees. Apps with capped or flat fees are ideal for consistent transfers.

3. Transfer Speed

Quick transfers are essential for urgent transactions. Panda Remit provides fast options for sending money to Thailand.

4. Ease of Use

User-friendly interfaces, mobile app convenience, and real-time tracking make the transfer process easier and more reliable.

5. Security

Ensure the platform is regulated and offers secure transactions. Panda Remit uses encryption and monitoring to safeguard transfers.

Best Apps to Send Money from Singapore to Thailand (2025 Update)

Wise

Wise provides transparent rates close to the market mid-rate and charges clear fees.

Pros:

-

Transparent exchange rate

-

Secure and regulated

-

Real-time transfer tracking

Cons:

-

1–2 business days for completion

-

Higher fixed fees for large transfers

Remitly

Remitly offers Economy and Express options, balancing cost and speed based on user needs.

Pros:

-

Flexible delivery options

-

Competitive fees

-

24/7 customer support

Cons:

-

Slightly lower exchange rates than Wise

-

Initial transfer limits for new users

Panda Remit

Panda Remit is a reliable choice for sending money to Thailand, providing competitive rates, low fees, and fast transfers.

Pros:

-

Supports both small and large transfers

-

Quick delivery

-

Easy interface and responsive customer support

Cons:

-

Credit card payment not supported

-

Delivery time may vary depending on the recipient bank

How to Send Money from Singapore to Thailand Using Panda Remit: Step-by-Step Guide

-

Register an Account: Go to Panda Remit and sign up.

-

Verify Identity: Submit required documents.

-

Select Destination: Choose Thailand.

-

Enter Amount: Check estimated received amount and fees.

-

Provide Recipient Details: Full name and bank account.

-

Confirm and Submit Transfer.

-

Track Transfer to ensure funds are received safely.

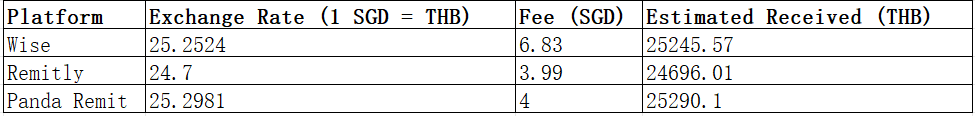

Cost & Exchange Rate Comparison Example (1,000 SGD)

Rates and fees are for reference only; actual values may vary.

Tips to Get the Best Exchange Rates

-

Compare multiple platforms

-

Monitor exchange rate trends

-

Set rate alerts

-

Avoid weekends and public holidays

-

Use trusted and regulated platforms like Panda Remit, Wise, and Remitly

Common Questions (FAQ)

1. Is Panda Remit safe for transferring money to Thailand?

Yes, it is regulated and uses encryption for security.

2. How long does it take for large transfers?

Typically 1–2 business days depending on the recipient bank.

3. Can I pay with a credit card?

No, only bank transfers or app payments are supported.

4. Are there limits for transfers to Thailand?

Limits depend on account verification and Singapore regulations.

5. Which platform is best for cost and speed?

Panda Remit balances security, rate, and speed effectively.

Conclusion

Sending money from Singapore to Thailand requires careful consideration of exchange rates, fees, and speed. Wise offers transparent rates, Remitly offers flexible options, and Panda Remit is one of the best options, combining secure, fast, and cost-effective transfers. Whether for personal or business purposes, Panda Remit provides a reliable solution for sending funds to Thailand.

Visit Panda Remit to start a secure transfer today.