Best App to Send Money from Singapore to Australia (2025 Guide)

Benjamin Clark - 2025-10-27 09:46:25.0 10

Sending money from Singapore to Australia has become increasingly common as more Singaporeans support family members, pay tuition fees, or make investments in Australia. Thanks to digital remittance platforms, users can now enjoy lower transfer fees, competitive exchange rates, and fast international payments. This article explores the best apps for Singapore-to-Australia transfers, focusing on their costs, ease of use, and reliability.

Why Many People in Singapore Send Money to Australia

Australia is a popular destination for Singaporeans, whether for studying, migration, or property investment. Many also send money to family members living there or cover recurring expenses such as rent, tuition, or medical bills. With Australia’s strong economy and frequent movement between the two countries, efficient cross-border transfers are in high demand.

Digital remittance apps make it easier than ever to move money abroad. Compared to traditional bank transfers, these apps provide better exchange rates and lower fees — key advantages for anyone managing regular or high-value payments.

What to Look for in a Money Transfer App

Before choosing a money transfer service, it’s essential to compare key factors that affect your total cost and experience:

-

Exchange Rate: Small rate differences can significantly affect the amount your recipient gets.

-

Transfer Fees: Some services charge flat fees, while others use percentage-based pricing.

-

Speed: Most online transfers arrive within minutes or hours, though some may take a few days.

-

Ease of Use: A simple, intuitive app or website ensures smoother transfers.

-

Security: Ensure the provider is licensed by the Monetary Authority of Singapore (MAS) and uses strong encryption to protect your data.

Best Apps to Send Money from Singapore to Australia (2025 Update)

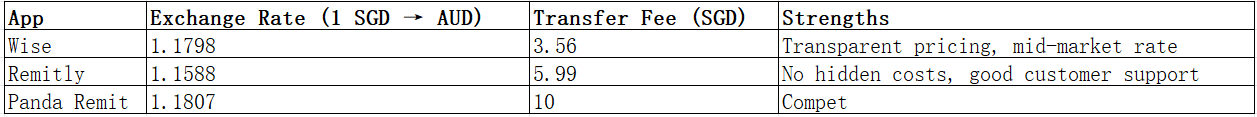

To help you find the best app, we compared three trusted options: Wise, Remitly, and Panda Remit. Each offers distinct advantages depending on your transfer needs.

Panda Remit stands out for its attractive exchange rate and reliable service. It’s designed for users who prioritize convenience and transparency. You can learn more about Panda Remit at pandaremit.com.

Meanwhile, Wise (wise.com) is ideal for users who prefer mid-market rates and transparent fees, while Remitly (remitly.com) is a solid choice for occasional users looking for simplicity.

How to Send Money from Singapore to Australia Using Panda Remit: Step-by-Step Guide

Here’s how to transfer money easily with Panda Remit:

-

Register: Sign up at pandaremit.com or via the mobile app.

-

Verify Identity: Complete KYC verification as required by MAS.

-

Enter Transfer Details: Choose Australia as the destination, input the recipient’s details, and amount.

-

Check Exchange Rate: Review the live rate and total fees.

-

Confirm and Send: Approve the transaction and track its status within the app.

The process is simple, making Panda Remit one of the best options for reliable, hassle-free remittances.

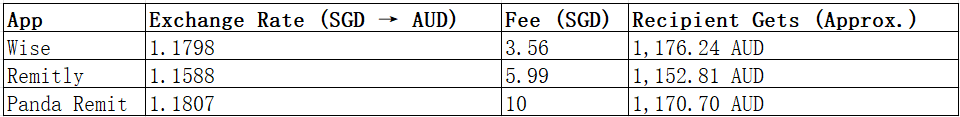

Cost & Exchange Rate Comparison Example

Let’s compare how much your recipient would get when sending 1,000 SGD to Australia:

Although Panda Remit’s fee is slightly higher, its competitive rate helps maximize the final amount, making it a smart choice for frequent or larger transfers.

Tips to Get the Best Exchange Rates

-

Compare Regularly: Exchange rates fluctuate daily; check multiple apps before sending.

-

Avoid Weekends: Rates are often less favorable on weekends due to currency market closures.

-

Send in Bulk: If possible, consolidate smaller transfers to reduce total fees.

-

Use Promotions: Many platforms, including Panda Remit, offer first-transfer bonuses or referral rewards.

-

Enable Rate Alerts: Apps like Wise and Panda Remit let users track rates in real time.

Common Questions (FAQ)

1. What is the best way to send money from Singapore to Australia?

Digital remittance platforms like Wise, Remitly, and Panda Remit offer fast, secure, and low-cost transfers.

2. Is Panda Remit safe to use?

Yes. Panda Remit is a licensed provider that uses encryption and regulatory compliance to protect users.

3. How long does it take to transfer money?

Most transfers are processed quickly, but exact times depend on the payment method and recipient’s bank.

4. Can I send money using my credit card?

Currently, most remittance services, including Panda Remit, do not support credit card transfers from Singapore.

5. How can I track my transfer?

Panda Remit’s app provides real-time updates and notifications for full transparency.

Conclusion: Why Panda Remit Is One of the Best Apps for Singapore–Australia Transfers

Choosing the right money transfer app can save you time and money. Panda Remit, along with Wise and Remitly, offers reliable and cost-effective solutions for Singapore-to-Australia transfers. While Wise stands out for transparency and Remitly for user simplicity, Panda Remit provides excellent value with its strong rates and secure service.

Whether you’re sending funds for family, study, or investment, Panda Remit remains a trustworthy, affordable, and convenient choice.