Best Apps to Send Money from Singapore to Malaysia (2025 Guide)

Benjamin Clark - 2025-10-21 15:37:24.0 21

Many residents of Singapore frequently transfer money to Malaysia for family support, business payments, and education purposes. With the rise of digital remittance services, sending money abroad has become more convenient, faster, and cost-effective. Choosing the right app ensures you get competitive exchange rates, low fees, and fast delivery for every transfer. For more details, visit Panda Remit or check Wise and Remitly.

Why Singaporeans Send Money to Malaysia

Singapore and Malaysia share close economic and social ties. Many Malaysians working in Singapore send a portion of their income home to support family or settle debts. Other transfers are made for business transactions or education fees.

Digital remittance apps make cross-border transfers efficient, affordable, and secure, giving users confidence that their money arrives quickly and safely.

Key Factors to Consider in a Money Transfer App

Before choosing a remittance app, consider:

-

Exchange Rates – Small differences can significantly impact the amount received.

-

Fees – Some apps charge flat fees, others a percentage of the transfer.

-

Speed – Delivery time can range from minutes to a few days.

-

User Experience – Easy navigation and multiple payment options enhance convenience.

-

Security – Ensure the app is regulated by the Monetary Authority of Singapore (MAS).

Balancing these factors will maximize value and ensure smooth transfers.

Top Apps for Sending Money from Singapore to Malaysia (2025)

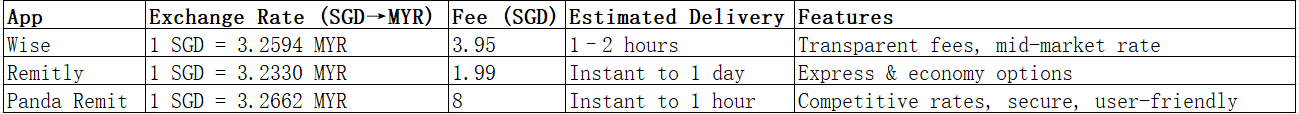

Here’s a comparison of some of the most trusted apps: Wise, Remitly, and Panda Remit.

Panda Remit is one of the best options for users seeking fast, secure, and cost-effective transfers. For more information, visit Panda Remit.

How to Transfer Money from Singapore to Malaysia Using Panda Remit

-

Sign Up – Visit Panda Remit or download the app. Register with your email or phone number.

-

Verify Identity – Complete KYC verification to comply with MAS regulations.

-

Add Recipient Details – Include bank account information for your Malaysian recipient.

-

Enter Transfer Amount – Specify the amount to send, e.g., 1,000 SGD.

-

Check Rates & Fees – Review the live exchange rate and total cost.

-

Confirm and Send – Choose a payment method and complete the transfer.

Funds are usually credited within minutes.

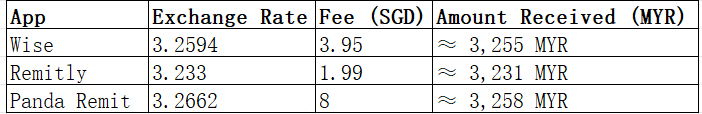

Cost and Exchange Rate Example

Sending 1,000 SGD to Malaysia:

Despite the fee difference, Panda Remit’s higher exchange rate provides strong overall value for senders.

Tips for Getting the Best Exchange Rates

-

Track rates daily using apps to spot favorable trends.

-

Avoid weekends and holidays when banks are closed.

-

Compare multiple apps before transferring.

-

Use promotions or referral bonuses to reduce costs.

-

Send larger amounts less frequently to save on per-transfer fees.

Frequently Asked Questions (FAQ)

1. Is it legal to send money from Singapore to Malaysia?

Yes, regulated apps like Panda Remit, Wise, and Remitly comply with MAS regulations.

2. How long do transfers take?

Transfers may be instant or take up to one business day, depending on the app.

3. What payment methods are accepted?

Most apps support bank transfers or PayNow. Credit cards are not supported.

4. Is Panda Remit safe?

Yes, it uses advanced encryption and meets MAS security standards.

5. What is the minimum transfer amount?

Typically around 10 SGD, though it varies by provider.

Conclusion

Selecting the best money transfer app from Singapore to Malaysia depends on your priorities: speed, cost, or convenience. Wise and Remitly offer transparency and fast transfers, but Panda Remit excels with competitive rates, rapid delivery, and ease of use, making it a top recommendation. Learn more or start your transfer at Panda Remit.