Best App to Send Money from Singapore to UK (2025 Guide)

Benjamin Clark - 2025-10-27 09:17:35.0 16

Introduction

Sending money from Singapore to the UK has become easier and faster than ever. Whether you’re supporting family, paying tuition, or covering living expenses abroad, Singapore residents often look for the best app to send money from Singapore to the UK that offers high exchange rates, low fees, and smooth transfers. With so many digital remittance apps now available, it’s crucial to compare their costs, reliability, and features to ensure you get the best value for every dollar.

Why Many People in Singapore Send Money to the UK

The connection between Singapore and the UK is strong — from business partnerships to education and family ties. Many Singaporeans and expatriates send money to the UK for reasons such as:

-

Education: Paying tuition fees and living expenses for children studying in UK universities.

-

Family Support: Transferring funds to relatives or dependents living in the UK.

-

Business Transactions: Settling overseas supplier payments or business expenses.

-

Investment: Managing property or investment accounts in the UK.

With these needs, finding the most efficient and affordable way to transfer funds has become increasingly important. Digital platforms like Panda Remit, Wise, and Remitly now provide transparent, low-cost alternatives to traditional banks.

What to Look for in a Money Transfer App

Before choosing an app, it’s essential to evaluate several factors to ensure a safe and cost-effective transfer:

-

Exchange Rate: A small difference can have a big impact on how much your recipient receives.

-

Transfer Fees: Some services charge a flat fee, while others take a percentage of the transaction.

-

Speed: Transfers should be completed in a reasonable timeframe.

-

Ease of Use: User-friendly apps simplify the process for both sender and receiver.

-

Security: Reputable services are licensed and encrypted for safe money movement.

Apps like Wise, Remitly, and Panda Remit score highly across most of these categories, offering competitive rates and a seamless transfer experience.

Best Apps to Send Money from Singapore to the UK (2025 Update)

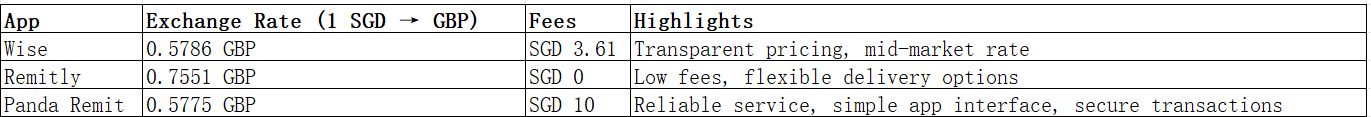

Here’s a comparison of three of the top-rated Singapore remittance apps for sending money to the UK in 2025.

While Wise and Remitly are popular globally, Panda Remit Singapore stands out for its balance of reliability, transparency, and user-friendly design. It offers competitive rates and responsive customer support for both senders and receivers.

How to Send Money from Singapore to the UK Using Panda Remit: Step-by-Step Guide

If you’re new to Panda Remit Singapore, here’s how you can send funds quickly and securely:

-

Sign Up: Visit pandaremit.com or download the app. Create an account using your email or mobile number.

-

Verify Your Identity: Complete the quick KYC verification by submitting your ID.

-

Add Recipient: Enter the recipient’s name and bank account details in the UK.

-

Enter Transfer Amount: Input how much you want to send in SGD and review the exchange rate and fees.

-

Confirm and Pay: Select your payment method (bank transfer or PayNow) and complete the transaction.

-

Track Your Transfer: You can monitor progress in real time within the app.

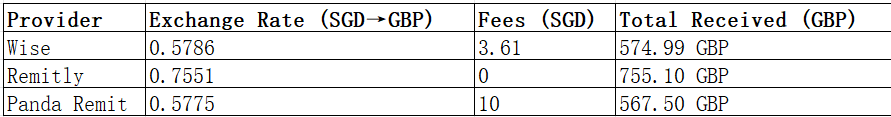

Cost & Exchange Rate Comparison Example

To better understand how much your recipient receives, let’s compare the cost of sending 1,000 SGD to the UK using each service:

Note: Rates and fees fluctuate daily. Always check the latest exchange rate before confirming your transaction.

Tips to Get the Best Exchange Rates

Want to maximize the value of your transfer? Here are practical tips:

-

Compare rates across multiple apps before sending.

-

Avoid weekends or holidays when rates can be less favorable.

-

Set up rate alerts on apps like Panda Remit and Wise.

-

Send larger amounts less frequently to minimize fees.

-

Check hidden fees—some platforms may build fees into their rates.

By staying informed and comparing options, you can make smarter money transfers and save more.

Common Questions (FAQ)

1. Is it legal to send money from Singapore to the UK?

Yes, it’s fully legal. Just use a licensed remittance provider such as Panda Remit, Wise, or Remitly.

2. How long does a transfer from Singapore to the UK take?

Transfers usually complete within a short period, depending on the provider and method.

3. Are there limits on how much I can send?

Each provider has different daily or annual limits. Check their respective websites for up-to-date policies.

4. Can I cancel a transaction after sending?

You may cancel if the payment hasn’t been processed yet. Check directly with your provider.

5. Which app is the cheapest overall?

Fees vary by rate and timing. Remitly often offers the highest exchange rate, while Panda Remit delivers strong reliability and user experience.

Conclusion

Finding the best app to send money from Singapore to the UK in 2025 depends on your priorities—whether that’s the exchange rate, speed, or reliability. Wise and Remitly remain strong competitors, but Panda Remit continues to grow as one of the most trusted, convenient, and affordable options for Singapore users. With its secure transactions, transparent rates, and easy-to-use platform, Panda Remit ensures your funds reach the UK efficiently and safely.

To compare rates or start your first transfer, visit pandaremit.com today.