bKash vs PandaRemit: Fees, Speed, Exchange Rates and Global Coverage

Benjamin Clark - 15

Introduction

Cross-border remittances are crucial for families, businesses, and expatriates worldwide. According to Wikipedia, billions of dollars are transferred every year through digital and traditional channels. This article compares bKash vs PandaRemit, two popular platforms facilitating money transfers. bKash is widely used in Bangladesh for mobile-based domestic and regional transactions, providing convenient access without traditional banking infrastructure. PandaRemit specializes in international remittances, offering low fees, fast transfers, and broad global coverage. Understanding the differences between these services helps users choose the most suitable platform for both domestic and international transfers.

Official websites:

-

bKash: https://www.bkash.com/

-

PandaRemit: https://www.pandaremit.com/

Fees and Costs

Transfer fees directly impact the amount received by recipients.

-

bKash: Charges are typically low for domestic transfers but may increase for regional and business-related transactions.

-

PandaRemit: Offers transparent, low-cost international transfers, with many transactions carrying minimal or zero fees.

Key Insight: PandaRemit is more cost-effective for international remittances, while bKash is convenient for domestic and regional transfers.

Exchange Rates

Exchange rates affect the net amount received by recipients.

-

bKash: Domestic transfers are straightforward, but regional or international conversions may include markups.

-

PandaRemit: Uses near mid-market rates with full transparency, ensuring maximum value for senders.

Verdict: PandaRemit generally offers better rates for international transfers.

Speed and Convenience

Transfer speed is essential, especially for urgent payments.

-

bKash: Domestic transfers are usually instant. Regional transfers may take a few hours depending on the network.

-

PandaRemit: Most international transfers are completed within minutes to 24 hours, accessible through both app and website.

Result: PandaRemit provides faster international remittance, while bKash excels in domestic and regional convenience.

Safety and Security

Secure transfers are critical for any money transfer platform.

-

bKash: Uses PIN-protected accounts, encryption, and local regulatory compliance to secure transactions.

-

PandaRemit: Complies with international financial regulations and employs advanced encryption, verification, and anti-fraud measures. For guidance on secure remittance practices, see ConsumerFinance.gov.

Both services are secure, but PandaRemit offers broader international compliance.

Global Coverage

The scope of service determines where money can be sent.

-

bKash: Primarily supports domestic payments in Bangladesh with limited regional transfers.

-

PandaRemit: Enables transfers to 40+ countries worldwide, supporting multiple payment options including bank accounts, credit cards, and e-wallets.

Conclusion: PandaRemit provides wider global coverage, making it ideal for international users.

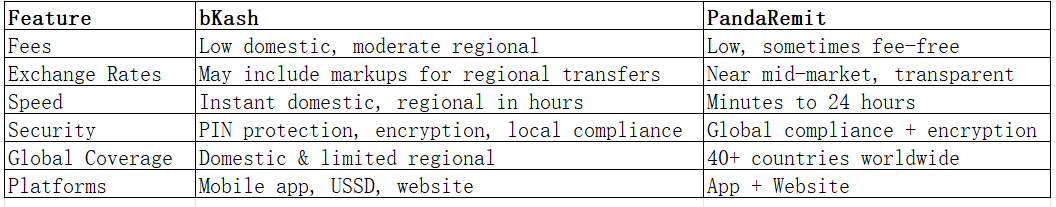

Comparison Table

Official websites:

-

bKash: https://www.bkash.com/

-

PandaRemit: https://www.pandaremit.com/

Which One is Better?

Choosing between bKash vs PandaRemit depends on your needs:

-

For domestic and regional payments in Bangladesh, bKash offers convenience and instant mobile-based transfers.

-

For international remittances with low fees, fast delivery, and global coverage, PandaRemit is the better choice.

Conclusion

In conclusion, bKash vs PandaRemit demonstrates two distinct services. bKash is ideal for domestic and regional transfers in Bangladesh, while PandaRemit excels in international remittance with low costs, fast transfers, and wide global accessibility. For a secure and globally reachable money transfer solution, visit PandaRemit official website.