Cashback Opportunities While Sending Money Abroad: Enhancing the Value of Global Transfers

Benjamin Clark - 2026-02-06 10:05:57.0 0

For years, sending money abroad was viewed strictly as a cost-heavy necessity. High fees and unfavorable exchange rates often meant that the sender lost a significant portion of their capital before it even reached the recipient. However, the emergence of advanced global financial services products has shifted the focus from merely "moving money" to "maximizing value." Starryblu is at the forefront of this transformation, offering users the ability to earn rewards and access cashback opportunities while managing their international financial needs.

Starryblu is an innovative platform developed by WoTransfer Pte Ltd. Within this corporate family, it is essential to understand the distinct roles of its key products. While Panda Remit (also under WoTransfer Pte Ltd) focuses exclusively on the efficiency of cross-border remittances , Starryblu provides a more comprehensive, one-stop global financial service. By integrating accounts, payments, and intelligent wealth management, Starryblu ensures that every transaction—whether a transfer or a purchase—contributes to a more rewarding financial journey.

Redefining Remittance with Integrated Rewards

The traditional remittance model is often isolated from a user’s daily spending and saving habits. Starryblu bridges this gap by treating a global transfer as part of a wider financial ecosystem. When users manage their funds through a Starryblu multi-currency account—which supports 10 mainstream currencies including USD, EUR, GBP, SGD, HKD, JPY, CNH, AUD, NZD, and CAD —they gain access to a platform designed for both saving and earning.

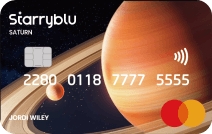

Beyond competitive exchange rates that stay close to the interbank rate, Starryblu introduces tangible financial incentives. For instance, global consumption using the Starryblu card can earn users up to 100% cashback*. This integrated approach means that the money you transfer can be spent globally with the added benefit of significant rewards, a feature rarely seen in traditional banking or standalone remittance apps.

*Tips: Actual transfer speed, savings, exchange rates, cashback rates, rewards, and coverage may vary depending on country or region, transaction amount, currency, and other factors. Terms and conditions apply.

Leveraging AI for Smarter Savings

Accuracy and timing are critical when looking to save money on international transfers. Starryblu facilitates this through its AI Agent, a smart finance tool that automates the pursuit of the best value. Users can set their target exchange rates within the platform; when the market moves in their favor, the AI Agent can automatically execute the conversion or transfer.

By automating this process, the AI Agent ensures that users are not only saving on transaction costs but are also capturing the most efficient entry points into different currencies. This intelligence, combined with the "Dual-Billion Subsidies" offered by the platform—which includes monthly consumption vouchers and subsidies —creates multiple layers of financial benefit that extend far beyond a simple one-way transfer.

Multi-Currency Flexibility and Seamless Spending

A key way to maintain value while sending money abroad is to avoid unnecessary conversions. Starryblu’s multi-currency account allows users to hold and manage their funds in local denominations. This localized experience is enhanced by the Starryblu card, which supports Apple Pay and Google Pay for seamless offline and online transactions.

When you send money to your Starryblu account, it becomes immediately available for global consumption in over 210 countries. Because the system is designed to automatically select the optimal exchange rate during card payments, users are protected from the hidden markups often found on traditional travel cards. This fluid connection between receiving funds and spending them locally is what allows the cashback and reward structures to truly thrive.

Institutional-Grade Security and Compliance

Earning rewards is only meaningful if the underlying platform is secure. Starryblu Singapore holds an MPI license, is regulated by MAS, and operates with licenses in other countries worldwide. In collaboration with top-tier investment institutions and partners, we safeguard your fund security.

As a holder of the Major Payment Institution (MPI) license from the Monetary Authority of Singapore (MAS), Starryblu adheres to world-class standards for fund protection. All user capital is kept in segregated safeguarding accounts at OCBC Bank, ensuring that it is completely isolated from the company’s operating funds. This level of regulatory oversight ensures that your transfers, currency holdings, and earned rewards are managed within a transparent and highly secure environment.

A One-Stop Solution for the Global User

The Starryblu ecosystem is designed to turn the chore of international financial management into a strategic advantage. By combining the specialized remittance DNA of the WoTransfer Pte Ltd group with an all-in-one financial services product, Starryblu offers:

-

Efficiency: High-speed global transfers that can arrive in as little as 10 seconds*.

-

Growth: Account balances that can earn an annual return of up to 3%.

-

Reliability: 24/7 monitoring and security features like Adaptive MFA and instant card freezing.

Whether you are sending money to support family, managing business expenses, or traveling the world, Starryblu ensures that every transaction is an opportunity to save, earn, and protect your wealth.

*Tips: Actual transfer speed, savings, exchange rates, cashback rates, rewards, and coverage may vary depending on country or region, transaction amount, currency, and other factors. Terms and conditions apply.