Cheapest Way to Send Small Amounts from Singapore to Australia

Benjamin Clark - 2025-10-27 09:55:35.0 9

Introduction

Many people in Singapore regularly send money to Australia — whether for supporting family, paying tuition fees, or managing overseas investments. With the growing number of remittance apps, it’s now easier to transfer small amounts securely and affordably. Using the cheapest way to send money from Singapore to Australia can help you save on fees, benefit from better exchange rates, and enjoy quick transfers. Services like Panda Remit, Wise, and Remitly make international money transfers fast and transparent for Singapore users.

Why Many People in Singapore Send Money to Australia

Singapore has a strong connection with Australia — from students studying in Melbourne or Sydney to professionals supporting family or paying for property. The demand for cross-border payments continues to grow as more Singaporeans and expats look for efficient ways to manage their money internationally.

For small transfers, affordability and speed matter. Instead of using banks that charge high fees, digital remittance apps offer cheaper and more flexible alternatives. These platforms allow users to send smaller sums easily, making them ideal for everyday transfers like rent, utilities, or personal expenses.

What to Look for in a Money Transfer App

When choosing the best app to send money from Singapore to Australia, consider these factors:

-

Exchange Rate: A small difference can impact your total transfer value. Apps like Panda Remit often provide competitive rates close to the mid-market rate.

-

Transfer Fees: Look for transparent and low-cost services, especially for smaller transfers.

-

Speed: Some apps deliver within minutes, while others may take 1–2 days.

-

Ease of Use: The app should be simple to navigate with clear instructions.

-

Security: Always choose licensed providers regulated by the Monetary Authority of Singapore (MAS).

Best Apps to Send Money from Singapore to Australia (2025 Update)

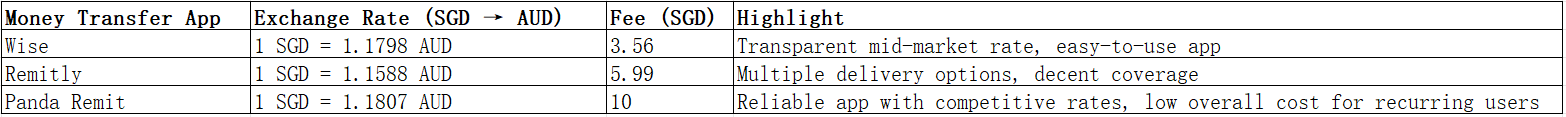

Below are three reliable remittance apps popular among Singapore users:

While each platform has its benefits, Panda Remit stands out for its straightforward process and strong customer support. Its transparent pricing and consistent performance make it one of the best choices for small amount transfers from Singapore to Australia.

For more information, visit the official websites:

-

Panda Remit: pandaremit.com

-

Wise: wise.com

-

Remitly: remitly.com

How to Send Money from Singapore to Australia Using Panda Remit: Step-by-Step Guide

-

Register: Create a free account on pandaremit.com or via the mobile app.

-

Verify Your Identity: Follow the KYC process required by MAS regulations.

-

Add Recipient Details: Enter your Australian recipient’s name and bank information.

-

Enter Amount: Specify how much you wish to send in SGD.

-

Review Exchange Rate & Fees: Panda Remit provides a clear breakdown before you confirm.

-

Confirm & Pay: Choose your payment method (bank transfer or PayNow) to complete the transaction.

-

Receive Confirmation: You’ll get updates once the transfer is processed and delivered.

Cost & Exchange Rate Comparison Example

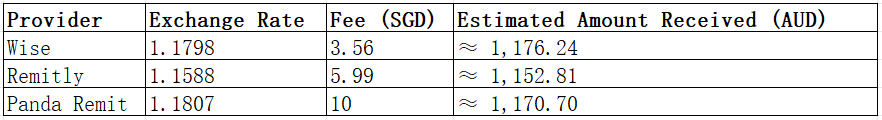

Let’s compare how much 1,000 SGD would convert to AUD using three top providers:

Although Wise shows slightly higher net output in this example, Panda Remit remains competitive for small recurring transfers due to its consistent rates and reliability.

Tips to Get the Best Exchange Rates

-

Compare Rates Before Sending: Check multiple platforms like Wise, Remitly, and Panda Remit.

-

Avoid Weekends and Holidays: Market rates fluctuate less during business days.

-

Use Promotions: Many apps offer first-transfer discounts or referral bonuses.

-

Send Larger Combined Transfers: Fewer, bigger transfers often reduce per-transfer costs.

-

Stay Informed: Subscribe to rate alerts for your preferred transfer platform.

Common Questions (FAQ)

1. Can I send small amounts from Singapore to Australia using Panda Remit?

Yes. Panda Remit supports both small and large transfers, with flexible limits and competitive rates.

2. How long does it take to receive money in Australia?

Transfers are usually completed within a few hours, depending on bank processing times.

3. Is it safe to use remittance apps?

Yes. Apps like Panda Remit, Wise, and Remitly are licensed and use advanced encryption for security.

4. Are there hidden fees?

No. Each platform clearly lists fees and exchange rates before confirming your transaction.

5. Can I pay by credit card?

No. Panda Remit currently supports bank transfer and PayNow — not credit card payments.

Conclusion

When it comes to the cheapest way to send money from Singapore to Australia, choosing the right app makes a big difference. While Wise and Remitly offer solid options, Panda Remit stands out for its easy interface, reliable service, and competitive exchange rates. For anyone looking to make small or frequent transfers, it’s one of the best all-round solutions available in 2025.