Cheapest Way to Send Small Amounts from Singapore to UK

Benjamin Clark - 15

Introduction

If you need to send small amounts of money from Singapore to the UK — whether for family support, bill payments, or small business needs — finding the cheapest way to send money from Singapore to the UK is key. With modern remittance apps offering high exchange rates, low fees, and quick delivery, you no longer have to rely on expensive traditional banks. This article compares the top money transfer services for small transfers, helping you choose the best value for your needs.

Why Many People in Singapore Send Money to the UK

Singapore and the UK maintain close economic and personal ties. Many residents in Singapore transfer funds to the UK for various reasons:

-

Family and Friends: Supporting loved ones living, studying, or working in the UK.

-

Education: Paying tuition fees and accommodation for students.

-

Freelancers & Business Owners: Paying overseas suppliers, contractors, or partners.

-

Personal Expenses: Covering rent, bills, or subscriptions abroad.

Since smaller transfers are often made regularly, minimizing fees and optimizing exchange rates can significantly increase the total value received in the UK.

What to Look for in a Money Transfer App

When sending smaller amounts, even a few dollars in fees can make a big difference. Here’s what to consider when choosing a transfer service:

-

Low Transfer Fees: Some platforms charge a minimum fee that can be costly for small transactions.

-

Competitive Exchange Rates: A better exchange rate ensures more GBP reaches your recipient.

-

Ease of Use: Simple registration and quick payments save time.

-

Security: Ensure the platform is licensed and uses encryption to protect your data.

-

Delivery Options: While small transfers aren’t always urgent, faster services are a plus.

Apps like Wise, Remitly, and Panda Remit all meet these criteria, though each has its unique strengths.

Best Apps to Send Money from Singapore to the UK (2025 Update)

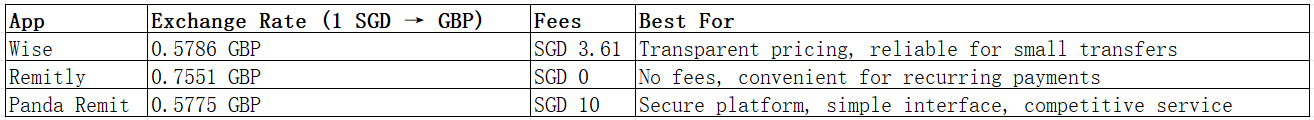

Here’s a look at three of the most popular apps for sending smaller transfers from Singapore to the UK in 2025:

All three platforms are trusted for international remittance. Panda Remit Singapore offers a dependable experience, especially for users who value stability, security, and a straightforward app design.

How to Send Money from Singapore to the UK Using Panda Remit: Step-by-Step Guide

Here’s how to transfer small amounts using Panda Remit:

-

Sign Up: Visit pandaremit.com or download the mobile app.

-

Verify Your Identity: Upload your ID for quick KYC verification.

-

Add Recipient Details: Enter the UK recipient’s name and bank account information.

-

Enter the Transfer Amount: Review the displayed exchange rate and service fee.

-

Pay via Bank Transfer or PayNow: Confirm the payment and submit.

-

Track Progress: You’ll receive status updates in the app until the transfer is completed.

Cost & Exchange Rate Comparison Example

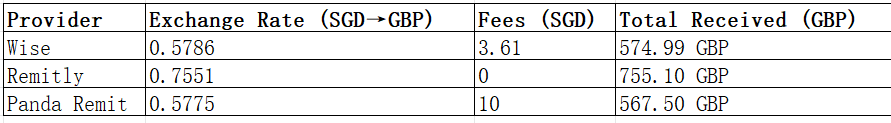

To illustrate how much a small transfer costs, here’s an example based on sending 1,000 SGD to the UK:

Note: Exchange rates change daily. Always confirm the latest rate before sending.

For smaller amounts (e.g., under 500 SGD), look for services that offer either no fees or flat-rate options — this keeps costs manageable.

Tips to Get the Best Exchange Rates

Getting the most value from your small transfer is all about timing and planning. Here are some expert tips:

-

Compare Multiple Platforms: Don’t assume one provider is always cheapest.

-

Avoid Weekend Transfers: Rates may be less favorable during non-business days.

-

Set Exchange Rate Alerts: Use apps like Wise or Panda Remit to monitor rate changes.

-

Send Larger, Less Frequent Transfers: Combining small payments can reduce cumulative fees.

-

Stay Informed About Promotions: Some platforms offer fee waivers for first-time users.

Common Questions (FAQ)

1. What’s the cheapest way to send small amounts from Singapore to the UK?

Apps like Remitly and Wise are often cost-effective for smaller amounts. Panda Remit also offers a reliable, transparent service.

2. How long does it take for money to arrive in the UK?

Transfers are usually processed within a short time frame, depending on the service and method used.

3. Are there limits on small transfers?

Most platforms allow low minimum transfer amounts, but check the specific terms on each app.

4. Can I use a credit card for remittance?

No, most platforms — including Panda Remit — do not support credit card payments from Singapore.

5. Is Panda Remit safe to use?

Yes. Panda Remit is regulated and uses secure technology to protect transactions.

Conclusion

Finding the cheapest way to send money from Singapore to the UK in 2025 depends on your transfer size and needs. For small, regular payments, Wise and Remitly are top contenders. However, Panda Remit stands out as one of the best overall options, offering a user-friendly experience, competitive rates, and trustworthy service. It’s ideal for anyone looking to balance affordability and reliability.

Start your next transfer with pandaremit.com and discover how easy international remittance can be.