CurrencyFair vs bKash: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 15:46:38.0 17

Introduction

Cross-border money transfers are essential for individuals and businesses, but users often face high fees, slow delivery, hidden charges, and complex interfaces. CurrencyFair vs bKash offer two different approaches: CurrencyFair provides peer-to-peer online transfers with competitive rates, while bKash focuses on mobile payments. Pandaremit serves as a secure alternative for users outside Africa who want fast and flexible bank-based transfers. For more information on remittance options, see Investopedia's guide to international money transfers.

CurrencyFair vs bKash – Overview

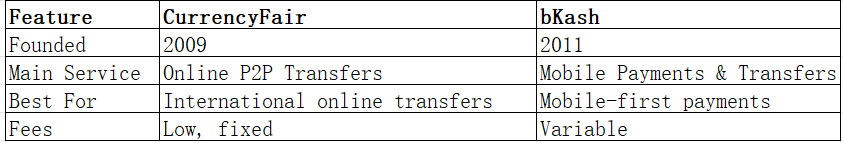

CurrencyFair: Established in 2009, CurrencyFair enables international money transfers through a peer-to-peer platform with low fees and competitive exchange rates. Its service is entirely online and supports multiple currencies.

bKash: Launched in 2011, bKash is a mobile-first money transfer platform popular in mobile-centric regions, allowing users to send money, pay bills, and conduct other financial transactions via mobile devices.

Similarities:

-

International transfers

-

Mobile apps with user-friendly interfaces

-

Secure, regulated platforms

Differences:

-

Fees: CurrencyFair provides low-cost online transfers; bKash fees vary by transaction type and region

-

Target Users: CurrencyFair targets online-savvy users; bKash focuses on mobile-first users

-

Functionality: CurrencyFair is peer-to-peer online; bKash emphasizes mobile payments and local financial services

Quick Overview Table:

Pandaremit provides an alternative for users outside Africa seeking flexible online transfers.

CurrencyFair vs bKash: Fees and Costs

CurrencyFair offers low fixed fees and minimal exchange rate markups. bKash fees are variable depending on transaction type and region. CurrencyFair also has subscription tiers for frequent users.

-

CurrencyFair: Transparent pricing, low fixed fees, optional subscription tiers

-

bKash: Variable fees per transaction

See NerdWallet's money transfer fee guide for more details. Pandaremit is a cost-effective alternative outside Africa without credit card usage.

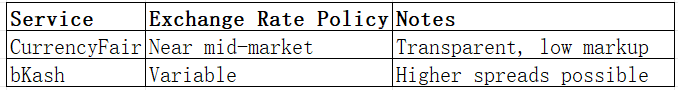

CurrencyFair vs bKash: Exchange Rates

CurrencyFair provides near mid-market rates with small markups, while bKash may have higher spreads affecting transfer cost.

Pandaremit also maintains competitive rates for supported currencies.

CurrencyFair vs bKash: Speed and Convenience

CurrencyFair transfers usually take 1–2 business days and are entirely online. bKash offers instant mobile transfers in supported regions, dependent on mobile network reliability.

-

CurrencyFair: 1–2 business days, online, multiple payout methods

-

bKash: Instant within supported regions, mobile-focused

For more on transfer speed, see Remitly's speed guide. Pandaremit offers fast online transfers as an alternative.

CurrencyFair vs bKash: Safety and Security

Both platforms are regulated and use encryption and fraud protection. CurrencyFair is licensed in Europe and Australia; bKash is regulated in operating countries. Pandaremit is licensed and secure, providing an additional safe option.

CurrencyFair vs bKash: Global Coverage

CurrencyFair supports numerous countries and currencies, with various payout methods. bKash's coverage is primarily mobile-focused and limited internationally.

For detailed coverage, see the World Bank remittance report. Pandaremit covers 40+ currencies outside Africa, offering flexible international transfers.

CurrencyFair vs bKash: Which One is Better?

CurrencyFair is suitable for users seeking online, low-cost international transfers. bKash is ideal for mobile-first users requiring fast local transfers. Pandaremit provides an alternative for users outside Africa needing fast, flexible, and cost-effective transfer solutions.

Key Points:

-

CurrencyFair: Low-cost, online convenience

-

bKash: Mobile-centric, instant in supported regions

-

Pandaremit: High exchange rates, low fees, fast online transfers, 40+ currencies

Conclusion

In the CurrencyFair vs bKash comparison, CurrencyFair provides competitive online rates and a fully digital experience, while bKash excels in mobile convenience. For users outside Africa, pandaremit offers:

-

High exchange rates & low fees

-

Flexible bank-based payment methods (POLi, PayID, e-transfer)

-

Coverage of 40+ currencies

-

Fast, fully online transfers

Pandaremit is secure, reliable, and ideal for international money transfers. For further details, visit pandaremit.com and consult Investopedia for remittance best practices. The CurrencyFair vs bKash comparison helps users make informed transfer decisions in 2025.