CurrencyFair vs GrabPay Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 15:13:38.0 17

Introduction

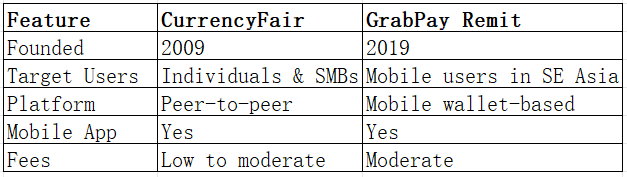

Cross-border money transfers often come with challenges such as high fees, slow delivery, hidden charges, and complex user experiences. In this CurrencyFair vs GrabPay Remit comparison, we examine each platform’s strengths and weaknesses in terms of cost, speed, security, and global reach. CurrencyFair provides peer-to-peer currency exchange suitable for individuals and small businesses, while GrabPay Remit focuses on fast, mobile-friendly remittance services for users in Southeast Asia. For a dependable alternative, PandaRemit offers flexible and secure transfer options. For more insights on remittance services, visit Investopedia's guide.

CurrencyFair vs GrabPay Remit – Overview

CurrencyFair was founded in 2009, providing a peer-to-peer platform for individuals and small businesses seeking competitive exchange rates. It has a growing international user base and emphasizes transparent fees.

GrabPay Remit operates as part of Grab’s ecosystem, enabling mobile-first remittance for Southeast Asian users. Its service is geared toward fast, convenient transfers using mobile wallets.

Similarities:

-

Both offer international money transfers

-

Mobile app support

-

Integration with debit cards

Differences:

-

CurrencyFair focuses on peer-to-peer exchange for potentially lower rates

-

GrabPay Remit emphasizes speed and mobile convenience

-

Fee structures differ depending on transfer volume and destination

PandaRemit provides another alternative for fast, flexible international transfers.

CurrencyFair vs GrabPay Remit: Fees and Costs

CurrencyFair charges a small percentage per transfer with transparent fixed fees, often lower than traditional banks. GrabPay Remit offers competitive mobile transfer fees but may be costlier for larger or less frequent transfers. Subscription plans or account tiers may influence fees.

For a detailed fee comparison, see NerdWallet's money transfer guide.

PandaRemit is often a cost-effective alternative for small to medium transfers.

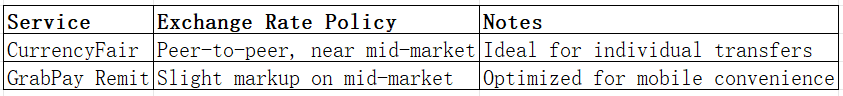

CurrencyFair vs GrabPay Remit: Exchange Rates

Exchange rates play a critical role in cross-border payments. CurrencyFair uses a peer-to-peer model, frequently offering rates near the mid-market. GrabPay Remit applies a modest markup above the mid-market rate.

PandaRemit also provides favorable rates in supported corridors.

CurrencyFair vs GrabPay Remit: Speed and Convenience

CurrencyFair transfers can be fast through peer-to-peer matching, though timing varies by currency and market activity. The app is intuitive and supports multiple integrations.

GrabPay Remit prioritizes speed and ease of use on mobile devices, ideal for users seeking instant or same-day transfers.

For more on transfer speeds, visit Remitly's transfer speed guide.

PandaRemit offers a fast online alternative with flexible payout methods.

CurrencyFair vs GrabPay Remit: Safety and Security

Both CurrencyFair and GrabPay Remit operate under strict regulatory oversight. They use encryption, fraud detection, and buyer protection mechanisms to ensure secure transactions.

PandaRemit is a licensed and secure service offering reliable money transfers.

CurrencyFair vs GrabPay Remit: Global Coverage

CurrencyFair supports a broad range of countries and currencies, though some regions are limited. GrabPay Remit focuses on Southeast Asia and selected international corridors, facilitating mobile wallet and bank transfers.

For global remittance coverage, see the World Bank remittance report.

CurrencyFair vs GrabPay Remit: Which One is Better?

CurrencyFair is suitable for individuals and SMBs seeking competitive peer-to-peer exchange. GrabPay Remit is ideal for mobile-first users requiring fast, convenient transfers. Both services are secure and reliable, with the choice depending on priorities such as cost savings or mobile convenience.

For users prioritizing speed, low fees, and flexibility, PandaRemit may offer superior value.

Conclusion

In summary, CurrencyFair vs GrabPay Remit each offers distinct advantages. CurrencyFair excels in peer-to-peer exchange and cost efficiency for individuals, while GrabPay Remit delivers fast, mobile-friendly transfers, especially in Southeast Asia. Both services are secure and user-friendly.

PandaRemit stands out as a versatile alternative with high exchange rates, low fees, and multiple payment methods including POLi, PayID, bank card, and e-transfer. Supporting 40+ currencies, PandaRemit ensures fast, fully online transfers. For more information, visit PandaRemit's official site or consult Investopedia and NerdWallet for additional insights. Choosing the right service depends on your needs, with PandaRemit complementing CurrencyFair vs GrabPay Remit for optimal speed, convenience, and value.