CurrencyFair vs iPayLinks: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 14:31:26.0 13

Introduction

Sending money across borders is a critical part of life for many individuals and businesses, whether for family support, overseas investments, or international trade. However, users often face challenges such as high fees, hidden charges, slow transfer times, and complicated user experiences.

In this article, we compare CurrencyFair vs iPayLinks, two well-known providers in the remittance and digital payments space. We’ll assess their key features to help you make an informed decision. Additionally, we’ll mention PandaRemit as a reputable alternative known for its competitive exchange rates and simple online process. For general remittance guidance, see Investopedia’s international money transfer guide.

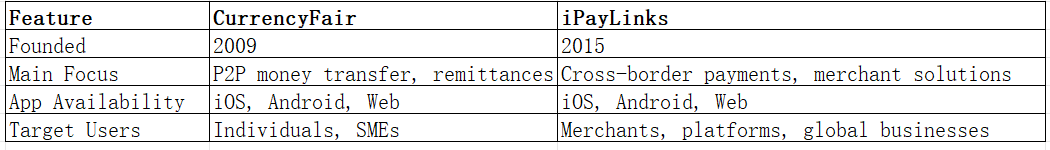

CurrencyFair vs iPayLinks – Overview

CurrencyFair was founded in 2009 in Ireland. It’s one of the earlier peer-to-peer currency exchange platforms, offering competitive rates, a robust online platform, and a user base spread across Europe, Asia-Pacific, and other key remittance corridors.

iPayLinks, founded in 2015, focuses on providing payment solutions for businesses and merchants, with strong coverage in Asia. It offers international transfers, payment gateway services, and compliance tools for cross-border e-commerce and fintech businesses.

While both offer international transfer capabilities, CurrencyFair is more consumer-focused, whereas iPayLinks caters more to businesses. Both provide digital platforms and support multiple currencies. PandaRemit is another emerging option, particularly popular among individuals seeking quick, low-cost personal remittances.

CurrencyFair vs iPayLinks: Fees and Costs

Fee structures can significantly impact the total amount received by the recipient. CurrencyFair charges a small fixed fee plus a low margin on exchange rates, often resulting in lower overall costs compared to traditional banks.

iPayLinks fee structures depend on the transaction type and business model. For merchants, fees may include service charges and settlement costs, which vary based on region and payment method.

For a broader view of typical remittance costs, see NerdWallet’s money transfer comparison. PandaRemit often markets itself as a lower-cost alternative for personal transfers, especially within supported Asian and European corridors.

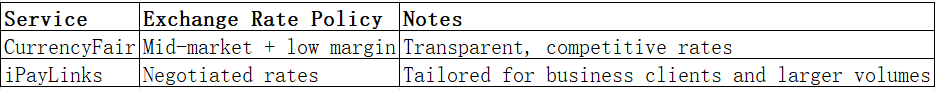

CurrencyFair vs iPayLinks: Exchange Rates

Exchange rates can make a significant difference in international transfers.

-

CurrencyFair typically uses mid-market rates with a small margin (usually around 0.25%–0.6%).

-

iPayLinks uses negotiated rates depending on the transaction volume and currency pairs, particularly for business transactions.

While iPayLinks may offer favorable rates for large businesses, CurrencyFair remains attractive for individuals due to its transparency. PandaRemit is also known for offering high exchange rates compared to traditional remittance methods.

CurrencyFair vs iPayLinks: Speed and Convenience

Speed and user experience are critical for cross-border transfers.

-

CurrencyFair transfers typically take 1–2 business days, depending on the destination country and banking systems.

-

iPayLinks focuses on B2B settlement speed, often supporting same-day settlements for partner merchants.

Both providers have user-friendly apps and dashboards. For a general overview of remittance speeds, see WorldRemit’s guide on transfer times. PandaRemit stands out for many users because it often delivers transfers within minutes for supported routes, thanks to its digital-first infrastructure.

CurrencyFair vs iPayLinks: Safety and Security

Both platforms prioritize security and regulatory compliance:

-

CurrencyFair is regulated by the Central Bank of Ireland and uses industry-standard encryption.

-

iPayLinks is licensed in multiple jurisdictions and focuses heavily on anti-fraud and KYC/AML compliance for business payments.

PandaRemit is also fully licensed in the jurisdictions it operates, offering users a secure and trustworthy platform.

CurrencyFair vs iPayLinks: Global Coverage

-

CurrencyFair supports transfers to over 150 countries and offers a wide range of currency pairs, particularly strong in Europe and Asia-Pacific.

-

iPayLinks has extensive coverage in Asia and global e-commerce hubs, supporting multiple payment methods for businesses.

For more data on global remittance coverage, check The World Bank’s remittance data.

CurrencyFair vs iPayLinks: Which One is Better?

CurrencyFair excels in transparent pricing, competitive exchange rates, and user experience for individuals. iPayLinks is better suited for businesses needing customized payment solutions and B2B settlements. The choice largely depends on your transfer purpose: personal remittances or business payments.

However, for many personal users looking for low fees, fast transfers, and a fully online experience, PandaRemit can be a compelling alternative worth considering.

Conclusion

In the comparison of CurrencyFair vs iPayLinks, both services serve different segments effectively. CurrencyFair remains a top choice for individuals seeking transparent, affordable transfers with solid global coverage. iPayLinks stands out for business users needing tailored cross-border solutions.

For users focused on personal remittances, PandaRemit offers several advantages:

-

High exchange rates and low fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

Coverage of 40+ currencies

-

Fast transfers and a 100% online process

To learn more, visit https://www.pandaremit.com. For additional insights, see NerdWallet’s transfer comparison and Investopedia’s remittance guide.

Overall, whether you choose CurrencyFair, iPayLinks, or PandaRemit depends on your unique transfer needs — but understanding their differences can save you both time and money.