CurrencyFair vs M-Pesa: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 15:42:35.0 19

Introduction

Cross-border money transfers are essential for individuals and businesses, but common issues like high fees, slow delivery, hidden charges, and complex apps persist. In the CurrencyFair vs M-Pesa debate, CurrencyFair provides peer-to-peer online transfers with near mid-market rates, while M-Pesa focuses on mobile-centric payments for convenience. Additionally, pandaremit offers a secure, fast alternative with flexible bank-based options for users outside Africa. For more guidance on remittance services, visit Investopedia's guide to international money transfers.

CurrencyFair vs M-Pesa – Overview

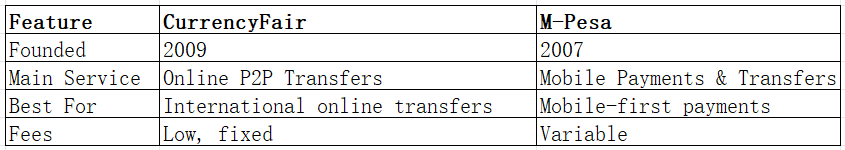

CurrencyFair: Founded in 2009, CurrencyFair is an online platform that enables international money transfers with low fees and competitive rates. It supports multiple currencies and offers a fully digital experience for a global user base.

M-Pesa: Launched in 2007, M-Pesa is a mobile payment service allowing users to send money, pay bills, and manage financial transactions via mobile devices, with strong adoption in mobile-first regions.

Similarities:

-

International transfers

-

Mobile apps with user-friendly interfaces

-

Secure, regulated platforms

Differences:

-

Fees: CurrencyFair focuses on low-cost online transfers; M-Pesa fees vary by transaction type and region

-

Target Users: CurrencyFair targets online-savvy users; M-Pesa serves mobile-first audiences

-

Functionality: CurrencyFair excels in peer-to-peer online transfers; M-Pesa integrates mobile payments and local financial services

Quick Overview Table:

Pandaremit is another alternative providing fast online transfers and flexible payment options.

CurrencyFair vs M-Pesa: Fees and Costs

CurrencyFair charges low fixed fees and minimal exchange rate markups, making it cost-effective for both small and large transfers. Account type and subscription plans may offer additional fee benefits. M-Pesa fees are variable, depending on the region and type of transaction.

-

CurrencyFair: Transparent pricing, low fixed fees, optional subscription tiers

-

M-Pesa: Fees vary per transaction and region

For a detailed fee comparison, see NerdWallet's money transfer fee guide.

Pandaremit is a strong alternative for users outside Africa, offering low fees without relying on credit cards.

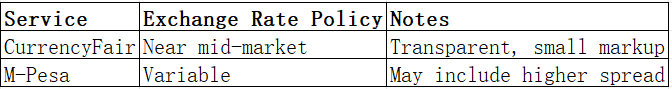

CurrencyFair vs M-Pesa: Exchange Rates

CurrencyFair maintains near mid-market rates with minor markups, offering transparency. M-Pesa may include higher spreads, affecting the overall cost.

Pandaremit also maintains competitive rates for supported currencies, providing a cost-efficient alternative.

CurrencyFair vs M-Pesa: Speed and Convenience

CurrencyFair transfers generally complete within 1–2 business days, entirely online. M-Pesa offers instant mobile transfers in supported regions, relying on network availability. Both platforms provide mobile apps and easy-to-use interfaces.

-

CurrencyFair: 1–2 business days, fully online, multiple payout methods

-

M-Pesa: Instant in supported regions, mobile-centric, limited global coverage

For more on transfer speeds, see Remitly's guide. Pandaremit offers fast online transfers as a reliable alternative.

CurrencyFair vs M-Pesa: Safety and Security

Both platforms are regulated and employ encryption and fraud protection. CurrencyFair is licensed in Europe and Australia, while M-Pesa is regulated in operating countries with mobile security protocols. Pandaremit is a licensed, secure alternative, providing peace of mind for users seeking safe online transfers.

CurrencyFair vs M-Pesa: Global Coverage

CurrencyFair supports numerous countries and currencies worldwide, with multiple payout options. M-Pesa's coverage is stronger in mobile-first regions but limited globally.

For comprehensive coverage, see the World Bank remittance report.

Pandaremit provides coverage for 40+ currencies outside Africa, offering flexibility for international transfers.

CurrencyFair vs M-Pesa: Which One is Better?

CurrencyFair is ideal for users seeking low-cost, online international transfers with competitive rates. M-Pesa is best for mobile-first users prioritizing speed in supported regions. Pandaremit is recommended for users outside Africa who need fast, flexible, and cost-effective transfer options.

Key Points:

-

CurrencyFair: Cost-effective, online convenience

-

M-Pesa: Mobile-centric, instant transfers in supported areas

-

Pandaremit: High exchange rates, low fees, fast online transfers, 40+ currencies

Conclusion

In the CurrencyFair vs M-Pesa comparison, CurrencyFair provides competitive online rates and a fully digital experience, while M-Pesa excels in mobile convenience. For users outside Africa, pandaremit is a strong alternative offering:

-

High exchange rates & low fees

-

Flexible bank-based payment methods (POLi, PayID, e-transfer)

-

Support for 40+ currencies

-

Fast, fully online transfer process

Pandaremit is secure, reliable, and ideal for international money transfers. For further information, visit pandaremit.com or consult Investopedia for remittance best practices. This CurrencyFair vs M-Pesa money transfer comparison helps users make informed choices for 2025 and beyond.