CurrencyFair vs Monzo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 10:51:17.0 15

Introduction

International money transfers can be expensive, slow, and confusing due to hidden fees and poor user experience. This comparison of CurrencyFair vs Monzo examines key factors like fees, exchange rates, transfer speed, and usability to help users make informed decisions. Panda Remit is highlighted as an alternative for fast and convenient online transfers. For more information on remittance options, see Investopedia’s guide to international money transfers.

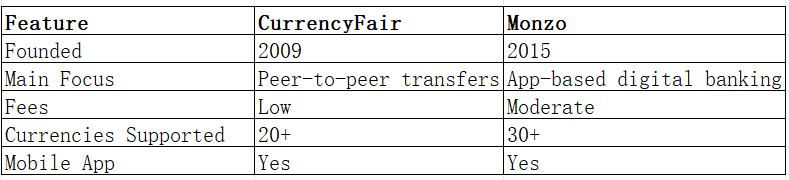

CurrencyFair vs Monzo – Overview

CurrencyFair, founded in 2009, is a peer-to-peer money transfer platform from Ireland, known for low fees and competitive exchange rates.

Monzo, founded in 2015, is a UK digital bank providing app-based banking with integrated international transfer options for convenience-focused users.

Similarities: Both services provide mobile apps, international transfers, and debit card support.

Differences: CurrencyFair focuses on cost-efficient peer-to-peer transfers, while Monzo emphasizes banking integration and app convenience.

CurrencyFair vs Monzo: Fees and Costs

CurrencyFair charges a small flat fee plus a percentage of the transfer amount, making it suitable for cost-conscious users. Domestic SEPA transfers are usually free. Monzo’s fees vary by transfer method and recipient country and may be higher for large sums.

For a detailed fee comparison, see NerdWallet fee guide. Users may also consider Panda Remit as a lower-cost option.

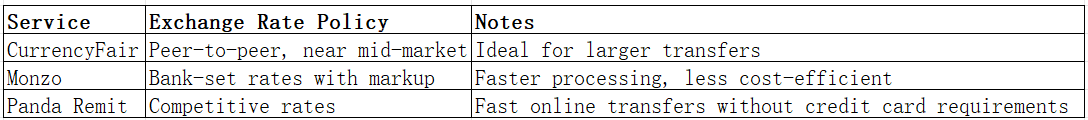

CurrencyFair vs Monzo: Exchange Rates

CurrencyFair uses a peer-to-peer system offering rates close to mid-market. Monzo applies bank-set rates that may include markups, especially for non-GBP transfers.

CurrencyFair vs Monzo: Speed and Convenience

CurrencyFair transfers take 1–2 business days depending on the route. Monzo provides faster transfers through app integration but may incur higher fees.

See WorldRemit guide on transfer speed for more information. Panda Remit offers a fast, fully online alternative.

CurrencyFair vs Monzo: Safety and Security

Both CurrencyFair and Monzo are regulated in Europe, using encryption and fraud protection. CurrencyFair is licensed by the Central Bank of Ireland, and Monzo by the UK FCA.

Panda Remit is also licensed and secure.

CurrencyFair vs Monzo: Global Coverage

CurrencyFair supports 20+ currencies across 150+ countries. Monzo supports 30+ countries but focuses mainly on card-based Eurozone transfers.

For coverage details, see World Bank remittance report.

CurrencyFair vs Monzo: Which One is Better?

CurrencyFair suits users seeking low fees and competitive exchange rates, while Monzo is ideal for those valuing app integration and convenience. Panda Remit provides a fast, flexible alternative with broad currency coverage.

Conclusion

CurrencyFair vs Monzo each have distinct advantages: CurrencyFair delivers low-cost transfers and competitive rates, while Monzo offers integrated digital banking and faster transfers. Panda Remit is a reliable alternative, offering online transfers with flexible methods like POLi, PayID, bank cards, and e-transfers, covering 40+ currencies.

For more information, visit Panda Remit official site and check their FAQ. Learn more about international transfers at Investopedia.