CurrencyFair vs N26: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 10:44:23.0 14

Introduction

Sending money internationally can often be costly and complicated, with high fees, slow delivery times, and hidden charges frustrating users. Choosing the right service is crucial for both individuals and businesses seeking reliable and efficient cross-border payments. This comparison between CurrencyFair vs N26 examines their features, costs, and overall user experience. For users exploring alternatives, Panda Remit offers a secure, user-friendly option for fast international transfers. For a deeper understanding of remittance options, check out this Investopedia guide to international money transfers.

CurrencyFair vs N26 – Overview

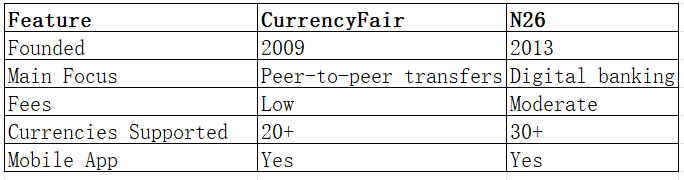

CurrencyFair, founded in 2009, is a peer-to-peer money transfer platform based in Ireland. It primarily focuses on offering low-cost, competitive currency exchange by matching users transferring money in opposite directions. CurrencyFair has a strong European presence and supports multiple currencies worldwide.

N26, established in 2013, is a German digital bank providing app-based banking services, including international transfers. N26 has a broad user base across Europe and emphasizes convenience, mobile banking, and instant account management.

Similarities: Both platforms allow international transfers, offer mobile apps, and provide debit card support for users.

Differences: CurrencyFair excels in lower fees and exchange rates via a peer-to-peer system, while N26 offers a more traditional banking interface and integrated banking services. CurrencyFair is more suitable for cost-conscious users, whereas N26 targets those looking for digital banking convenience.

CurrencyFair vs N26: Fees and Costs

CurrencyFair generally charges a small flat fee plus a percentage of the transferred amount, making it highly competitive for international transfers. Domestic transfers are often free within SEPA regions. N26's fees vary depending on the transfer method and recipient country, and may be higher compared to CurrencyFair for larger sums.

Subscription plans or premium account types may affect the fee structure. For example, N26 You and Metal accounts offer additional benefits, including free or discounted transfers.

For a detailed fee breakdown, see this NerdWallet fee comparison guide. Users looking for lower-cost alternatives may consider Panda Remit.

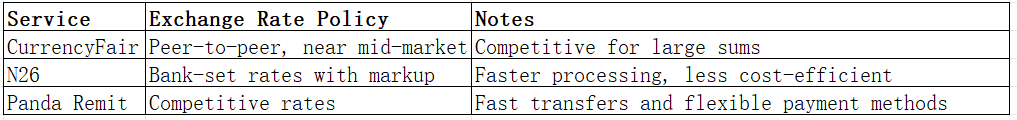

CurrencyFair vs N26: Exchange Rates

CurrencyFair operates on a peer-to-peer model, offering rates close to the mid-market rate with minimal markups. N26 uses traditional bank exchange rates, which can include a hidden markup, especially for non-Euro transfers.

CurrencyFair generally provides better value for users transferring larger amounts due to favorable exchange rates. Panda Remit also emphasizes competitive rates.

CurrencyFair vs N26: Speed and Convenience

CurrencyFair transfers typically take 1–2 business days, depending on the currency route and payment method. N26 offers faster transfers via integrated banking networks and partnerships, but may include higher fees for speed.

Both platforms feature intuitive mobile apps, but N26 integrates full banking features, including instant notifications and account management. CurrencyFair focuses solely on transfers but offers transparent rate comparison tools.

For insights into remittance speed, see this WorldRemit guide. Panda Remit is known as a fast alternative, providing fully online transfers with quick payout options.

CurrencyFair vs N26: Safety and Security

Both CurrencyFair and N26 are regulated entities in Europe, employing strong encryption protocols, fraud detection, and buyer protection measures. CurrencyFair is licensed by the Central Bank of Ireland, while N26 is licensed by the German Federal Financial Supervisory Authority (BaFin).

Panda Remit is also licensed and secure, providing a safe alternative for international transfers.

CurrencyFair vs N26: Global Coverage

CurrencyFair supports 20+ currencies across more than 150 countries, with a focus on bank account transfers. N26 provides access to transfers in 30+ countries but primarily focuses on Eurozone countries and card-based transfers.

For detailed global coverage data, see the World Bank remittance report.

CurrencyFair vs N26: Which One is Better?

Choosing between CurrencyFair and N26 depends on user priorities. CurrencyFair is ideal for cost-conscious individuals seeking low fees and competitive exchange rates, particularly for larger transfers. N26 suits users wanting a full digital banking experience with integrated services and fast transfers.

For users prioritizing speed, low costs, and broad currency coverage, Panda Remit can offer a compelling alternative without requiring credit card payments.

Conclusion

In the comparison of CurrencyFair vs N26, CurrencyFair and N26 each have unique strengths. CurrencyFair excels in low fees and competitive exchange rates, making it ideal for cost-sensitive users. N26 offers convenience, app-based banking, and faster transfers, suited for those prioritizing a full banking experience.

However, Panda Remit is worth considering for users seeking fast, fully online transfers across multiple currencies. Panda Remit provides high exchange rates, low fees, and flexible payment methods including POLi, PayID, bank cards, and e-transfers, covering over 40 currencies.

For more information, visit Panda Remit official site and check their FAQ for supported countries and currencies. For additional reading on international money transfers, see this Investopedia overview.

Keywords: CurrencyFair vs N26, CurrencyFair review, N26 review, money transfer comparison, Panda Remit, international money transfers, transfer fees, exchange rates, fast money transfer, secure transfers.