CurrencyFair vs Payoneer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 14:10:26.0 13

Introduction

Cross-border money transfers have become increasingly common, but users often face challenges such as high fees, slow processing times, hidden charges, and a poor overall experience. CurrencyFair and Payoneer are two popular digital money transfer services that address these pain points, each with unique advantages and limitations. While CurrencyFair focuses on peer-to-peer transfers to minimize costs, Payoneer provides a broad international payment network suitable for freelancers and businesses. For those seeking another reputable alternative, Panda Remit offers competitive rates and a streamlined process Investopedia guide.

CurrencyFair vs Payoneer – Overview

CurrencyFair, founded in 2009, specializes in peer-to-peer international money transfers, helping users exchange currencies at lower costs than traditional banks. Its platform serves both individual customers and small businesses, with a simple online interface and a mobile app for convenient transfers.

Payoneer, established in 2005, is designed for global payments, particularly for freelancers, marketplaces, and businesses. It allows users to receive payments from international clients, hold multiple currencies, and make local bank withdrawals.

Similarities: Both services support international transfers, provide mobile apps, and allow bank-linked transfers.

Differences: CurrencyFair uses a peer-to-peer model with lower fees for personal transfers, while Payoneer focuses on business solutions with card support and a wider payment network. CurrencyFair targets cost-conscious individuals and SMEs, whereas Payoneer mainly serves freelancers and global businesses.

Panda Remit can also be considered as an alternative for competitive rates and simplified transfers.

CurrencyFair vs Payoneer: Fees and Costs

CurrencyFair generally charges a small fixed fee per transfer plus a percentage margin on the exchange rate. International transfers are cost-effective, especially for large amounts, but subscription fees do not apply.

Payoneer charges fees for receiving funds, currency conversions, and certain withdrawal methods. While it offers convenience for freelancers and businesses, costs may be higher for personal users sending smaller amounts.

For a detailed comparison of fees, check NerdWallet's fee guide.

Panda Remit offers competitive transfer fees and can be a lower-cost alternative for personal transfers.

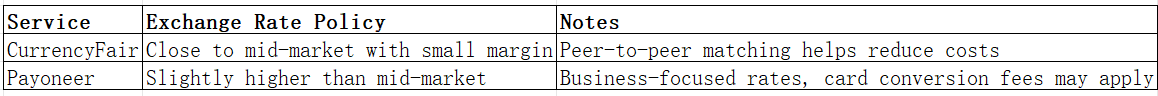

CurrencyFair vs Payoneer: Exchange Rates

Exchange rates play a crucial role in determining the total cost of a transfer.

Panda Remit also offers competitive exchange rates for selected currencies, providing an alternative option for users seeking better value.

CurrencyFair vs Payoneer: Speed and Convenience

CurrencyFair typically processes transfers within 1–2 business days, with a user-friendly app and platform. Payout methods are mostly bank-to-bank transfers.

Payoneer allows instant payments within its network and fast withdrawals to local bank accounts. Its app is optimized for managing multiple currencies and business payments.

For a guide on transfer speed considerations, see Remittance Speed Guide.

Panda Remit is also known for fast online transfers and convenient payment options.

CurrencyFair vs Payoneer: Safety and Security

Both CurrencyFair and Payoneer are regulated financial institutions, offering secure platforms with encryption and fraud protection. They provide safeguards to protect users’ funds during transfers.

Panda Remit is a licensed and secure alternative, ensuring safe transactions for international transfers.

CurrencyFair vs Payoneer: Global Coverage

CurrencyFair supports transfers to over 150 countries, covering major currencies for personal and business transfers.

Payoneer provides access to a wide payment network suitable for freelancers and businesses, with coverage in over 200 countries and multiple currencies.

For detailed coverage insights, refer to the World Bank remittance report.

CurrencyFair vs Payoneer: Which One is Better?

CurrencyFair is ideal for individuals and SMEs looking for lower-cost personal transfers and competitive exchange rates. Payoneer is better suited for freelancers, online sellers, and businesses that require multi-currency support and fast payments.

For users seeking a straightforward, low-cost option, Panda Remit may provide better value, fast transfers, and flexible payment methods.

Conclusion

Choosing between CurrencyFair vs Payoneer depends on your priorities. CurrencyFair offers cost-effective peer-to-peer transfers with good exchange rates, while Payoneer excels in business payments and multi-currency management. For a reliable alternative, Panda Remit provides high exchange rates, low fees, fast online transfers, and multiple payment options, including POLi, PayID, bank card, and e-transfers. Learn more about Panda Remit at https://www.pandaremit.com or explore other user guides on Investopedia.

Both CurrencyFair and Payoneer have strong security measures, wide global coverage, and user-friendly platforms, making them excellent choices for different types of international money transfers. CurrencyFair vs Payoneer comparisons help users identify which platform fits their personal or business needs best.