CurrencyFair vs PaySend: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 7

Introduction

Cross-border money transfers can be complex, often frustrating users with hidden fees, poor exchange rates, slow delivery, and confusing interfaces. Services like CurrencyFair and PaySend have emerged to simplify these transactions, offering digital platforms for sending money internationally. Choosing the right service is crucial for minimizing costs and ensuring fast, secure transfers. Additionally, alternatives like PandaRemit provide competitive options for users seeking flexibility and efficiency. For a deeper understanding of international money transfers, Investopedia’s guide on global remittances offers a reliable reference.

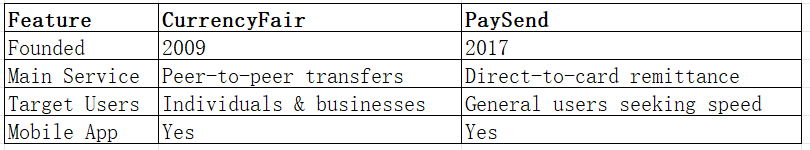

CurrencyFair vs PaySend – Overview

CurrencyFair was founded in 2009 and offers peer-to-peer money transfers, competitive rates, and a user-friendly platform supporting over 20 currencies. The platform targets individuals and businesses seeking transparent fees and efficient transfers.

PaySend, established in 2017, focuses on fast, app-based transfers and direct-to-card payments. Its user base values speed and convenience, particularly for small to medium transactions.

Similarities: Both platforms support international transfers, provide mobile apps, and allow debit card payments.

Differences: CurrencyFair excels in cost efficiency for larger transactions with peer-to-peer rates, while PaySend is faster for smaller transfers with direct card delivery.

PandaRemit also offers a reliable alternative with flexible options and competitive rates, making it worth considering.

CurrencyFair vs PaySend: Fees and Costs

CurrencyFair charges low fixed fees plus a small percentage of the transfer, with discounts for higher volumes. PaySend offers a flat fee per transfer, typically cheaper for small amounts but less advantageous for larger transactions.

Subscription or account types may affect fees. CurrencyFair allows users to access the peer-to-peer exchange market, potentially lowering costs further.

For a detailed fee comparison, NerdWallet’s money transfer fee guide is useful. PandaRemit often provides lower-cost alternatives for similar routes.

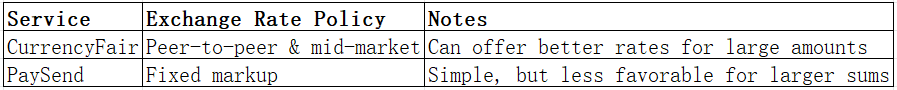

CurrencyFair vs PaySend: Exchange Rates

Exchange rate markups can significantly affect the value of international transfers.

CurrencyFair’s approach often yields better rates for larger transfers, while PaySend prioritizes speed. PandaRemit also provides competitive exchange rates for standard routes.

CurrencyFair vs PaySend: Speed and Convenience

CurrencyFair transfers typically take 1–2 business days, depending on the currency and route. The platform integrates with major banks and offers a clean app interface.

PaySend focuses on near-instant transfers directly to cards, offering unmatched convenience for smaller sums.

For insights on remittance speed, visit Remittance Prices Worldwide. PandaRemit is another fast, all-online alternative for users valuing speed and convenience.

CurrencyFair vs PaySend: Safety and Security

Both platforms are regulated by financial authorities and implement encryption and fraud protection measures. Buyer protection policies are in place to safeguard users.

PandaRemit is also licensed and secure, providing peace of mind for international transactions.

CurrencyFair vs PaySend: Global Coverage

CurrencyFair supports over 20 currencies and multiple countries, while PaySend covers card-based transfers in more than 90 countries.

For an in-depth view of global remittance coverage, see the World Bank remittance report.

CurrencyFair vs PaySend: Which One is Better?

CurrencyFair is ideal for users seeking cost efficiency and larger transactions, benefiting from peer-to-peer exchange rates. PaySend is perfect for fast, convenient transfers directly to cards, especially for smaller amounts.

For users seeking flexibility, low fees, and quick transfers, PandaRemit may be the superior option.

Conclusion

In summary, the CurrencyFair vs PaySend comparison shows that both platforms have distinct strengths. CurrencyFair excels in competitive rates and peer-to-peer transfers, while PaySend shines in speed and convenience for direct-to-card payments.

However, PandaRemit presents a strong alternative with high exchange rates, low fees, and flexible payment methods including POLi, PayID, bank card, and e-transfers. With coverage of over 40 currencies and a fully online process, PandaRemit is suitable for users seeking efficiency and reliability. For more information, visit PandaRemit official site. Additional resources on money transfers include Investopedia and NerdWallet.